Dogwifhat Price Softens as Open Interest Declines and Market Momentum Cools

The market remains in a controlled downtrend, and despite periodic stabilization attempts, neither buyers nor sellers have shown decisive dominance in recent sessions.

Open Interest Pulls Back as Price Slides Toward Lower Range

Open interest across WIF derivatives markets shows a clear downtrend over the past several sessions, aligning with the broader decline in spot price. After reaching peaks above 84M, open interest has gradually compressed toward the 69M range, reflecting reduced speculative participation and a shift toward caution among traders.

Source: Open Interest Chart

The hourly chart indicates repeated lower highs and sustained downside pressure, with price slipping from the mid-$0.40s toward the $0.40–$0.41 area. The decline in open interest alongside the falling price suggests that traders are closing positions rather than adding new exposure, a structure commonly associated with trend cooling rather than aggressive bearish expansion.

The combination of weakening price action and contracting open interest points to a market in de-risking mode, awaiting clearer directional signals before rebuilding momentum in either direction.

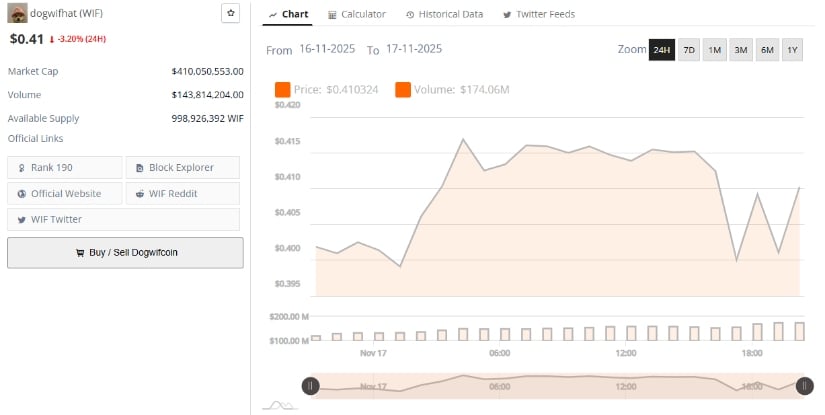

WIF Trades at $0.41 as Market Cap Holds Above $410M

BraveNewCoin data lists Dogwifhat trading at $0.41, marking a –3.20% decline over the past 24 hours. Market capitalization stands at $410,050,553, supported by $143,814,204 in trading volume during the same period. The circulating supply is recorded at 998,926,392 tokens, placing the token at Rank 190 by market cap.

Source: BraveNewCoin

Price activity across the latest session has remained muted, with intraday movement staying inside a narrow band as overall liquidity and trade flow exhibit moderation. While the decline is controlled rather than disorderly, no meaningful trend reversal has yet emerged from spot metrics.

Technical Indicators Show Persistent Downtrend and Tightening Volatility

The TradingView daily chart for the coin highlights continued downside structure, with the token currently trading near $0.407, close to the lower portion of its multi-week range. Price remains below the Bollinger Band at $0.463, reinforcing short-term bearish momentum. The upper and lower Bollinger Bands sit at $0.554 and $0.372, respectively, with the gradual tightening of the bands indicating reduced volatility and an extended consolidation phase.

Source: TradingView

MACD readings further reflect sluggish momentum. Both the MACD line (–0.040) and the signal line (–0.040) remain negative and nearly flattened, while the histogram prints marginally below zero. This alignment shows that bearish momentum has softened but not reversed, keeping WIF in a neutral-to-bearish structure without immediate signs of recovery.

You May Also Like

EarnForex – Helping Users Find Best Crypto Prop Firms and Crypto Forex Brokers

UXLINK Approves Token Buyback with 100% Community Support