Pi Network Users Pay Attention: Key News on the Verification Front

Ever since its inception over half a decade ago, the Pi Network project has attracted millions of users, even before it officially launched, but also a fair share of controversy and criticism.

One of those has been the verification process, with countless users complaining online about having to wait weeks or even months only to be denied at the end. Now, though, the team behind the project has issued a new update, providing more detailed information on the KYC procedures, the number of successfully verified users, and what’s next.

Verified Pioneers

The new update from the Pi Network Core Team reads that over 3.36 million additional users (referred to as Pioneers) had successfully passed the complete Know-Your-Customer (KYC) procedures. This became possible after the recent release of a system process that conducts additional checks for Tentative KYC cases and enabled more than 4.76 million Tentative KYC’d users to become eligible for full KYC completion.

These new procedures allow the team to prevent “cheating accounts” from passing KYC, help uphold the project’s policy of one account per person, and “further protect the integrity of the network and fairness for honest, real Pioneers.”

It’s worth noting that not all of the 3.36 million noted above have migrated to the Mainnet blockchain – the number as of press time stands at 2.69 million. Those who have not made the move yet need to check if they have fully passed KYC and complete the Mainnet Checklist.

They might also need to conduct “liveness checks as soon as possible” to become eligible for the new system process to help get fully verified.

PI Price Update

Despite all the updates and news coming from the Core Team, Pi Network’s native token has been in a free-fall state for months. It has lost over 93% of its value since the ATH marked in late February.

Its correction continued this week with another slip below $0.20. However, it has defended that level as of press time and trades just inches above it.

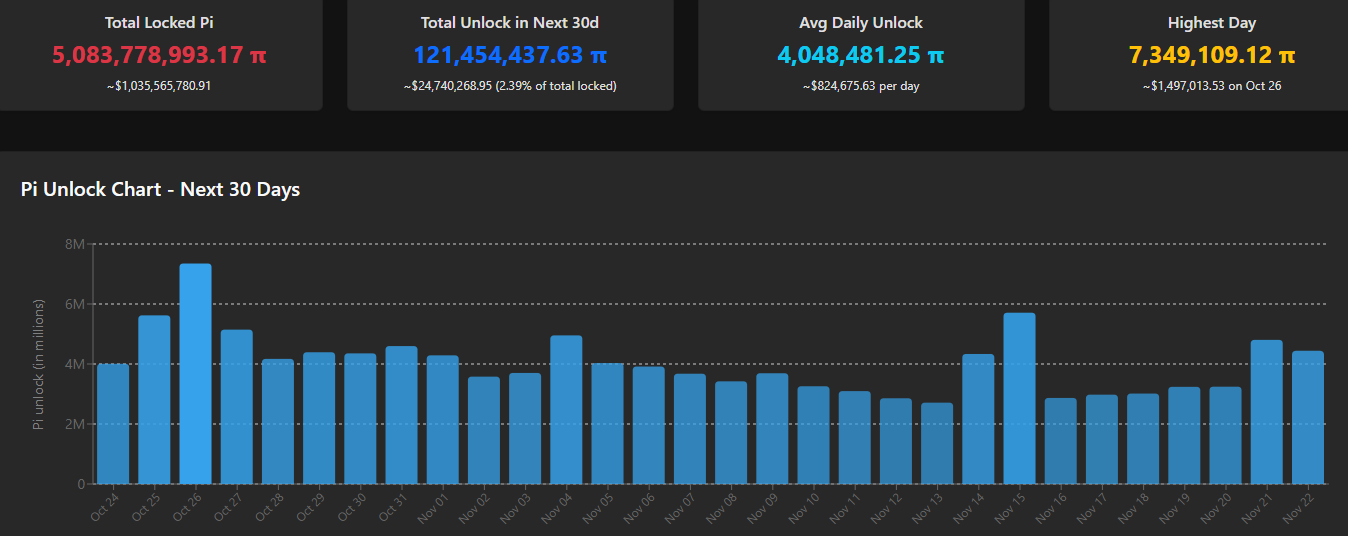

The token unlock schedule for the next month doesn’t appear too painful as the average number of coins to be released daily sits at just over four million, which is a lot less than the 8-9 million seen during the summer. This means that the immediate selling pressure could ease, especially from investors who receive their tokens now.

Pi Token Unlock Schedule. Source: PiScan

Pi Token Unlock Schedule. Source: PiScan

The post Pi Network Users Pay Attention: Key News on the Verification Front appeared first on CryptoPotato.

You May Also Like

Aave DAO to Shut Down 50% of L2s While Doubling Down on GHO

The "1011 Insider Whale" has added approximately 15,300 ETH to its long positions in the past 24 hours, bringing its total account holdings to $723 million.