SharpLink to Deploy $200M in ETH on Linea via ether.fi and EigenCloud for Higher DeFi Returns

Highlights:

- SharpLink has announced plans to deploy $200M in ETH on Linea via ether.fi and EigenCloud.

- The move is targeted towards generating higher DeFi returns for SharpLink Gaming.

- The deployment will happen gradually, mirroring a risk-managed multi-year strategy.

SharpLink Gaming, one of the world’s largest Ethereum (ETH) holders, has advanced its effort to boost Ethereum adoption and treasury productivity. According to a recent press release, the Ethereum holding firm plans to deploy $200 million worth of ETH from its corporate treasury onto Linea. Developed by Consensys, Linea is a Layer 2 network and a major Ethereum contributor, backed by top investors like Microsoft and Coinbase Ventures.

SharpLink stated that the ETH deployment will happen gradually under a risk-managed multi-year strategy. The company also plans to leverage the growing opportunities within Ethereum staking, restaking, and Decentralized Finance (DeFi) ecosystems for more yields.

SharpLink to Earn ETH-Based Yields

By moving funds to Linea, SharpLink hopes to earn secure and high ETH-based returns via three key sources. They include native Ethereum yield, restaking rewards from EigenCloud services, and incentives from Linea and ether.fi, its staking partner. Notably, SharpLink’s assets will remain under the custody of Anchorage Digital Bank, a regulated US custodian, to ensure security and compliance.

Joseph Chalom, SharpLink’s Co-CEO, reacted to the move, noting that it reflects the company’s professional approach to digital assets’ investments. The Co-CEO also stated that his company is proud to be one of the early institutional adopters of Linea.

Chalom added:

SharpLink Drives Ecosystem Collaboration

By integrating Consensys, either.fi, Eigen Labs, and Anchorage Digital, SharpLink has opened a new pathway for DeFi yields on Ethereum. Joseph Lublin, Consensys Founder and CEO, sees the partnership as a blueprint for institutional blockchain finance. He added that Ethereum has evolved into a programmable foundation for modern financial markets, enabling on-chain asset movement and expansion. The CEO also stated that Linea will make ETH more productive for adopters to earn greater on-chain returns.

Mike Silagadze, either.fi’s CEO expressed excitement about the partnership, reiterating his company’s commitment to bringing the best risk-adjusted returns to institutions. “At scale, ETH treasury managers need trusted, efficient venues to put their assets to work – and these companies are setting the standard for doing so with both trust and operational excellence,” Silagadze added.

Sreeram Kannan, Eigen Labs’ CEO and Founder, also spoke about the partnership. He said the move placed SharpLink at the center of Ethereum’s restaking ecosystem. He also noted that the integration will help EigenCloud to power a new wave of Ethereum-based services, spanning verifiable AI, insured DeFi, and decentralized infrastructure.

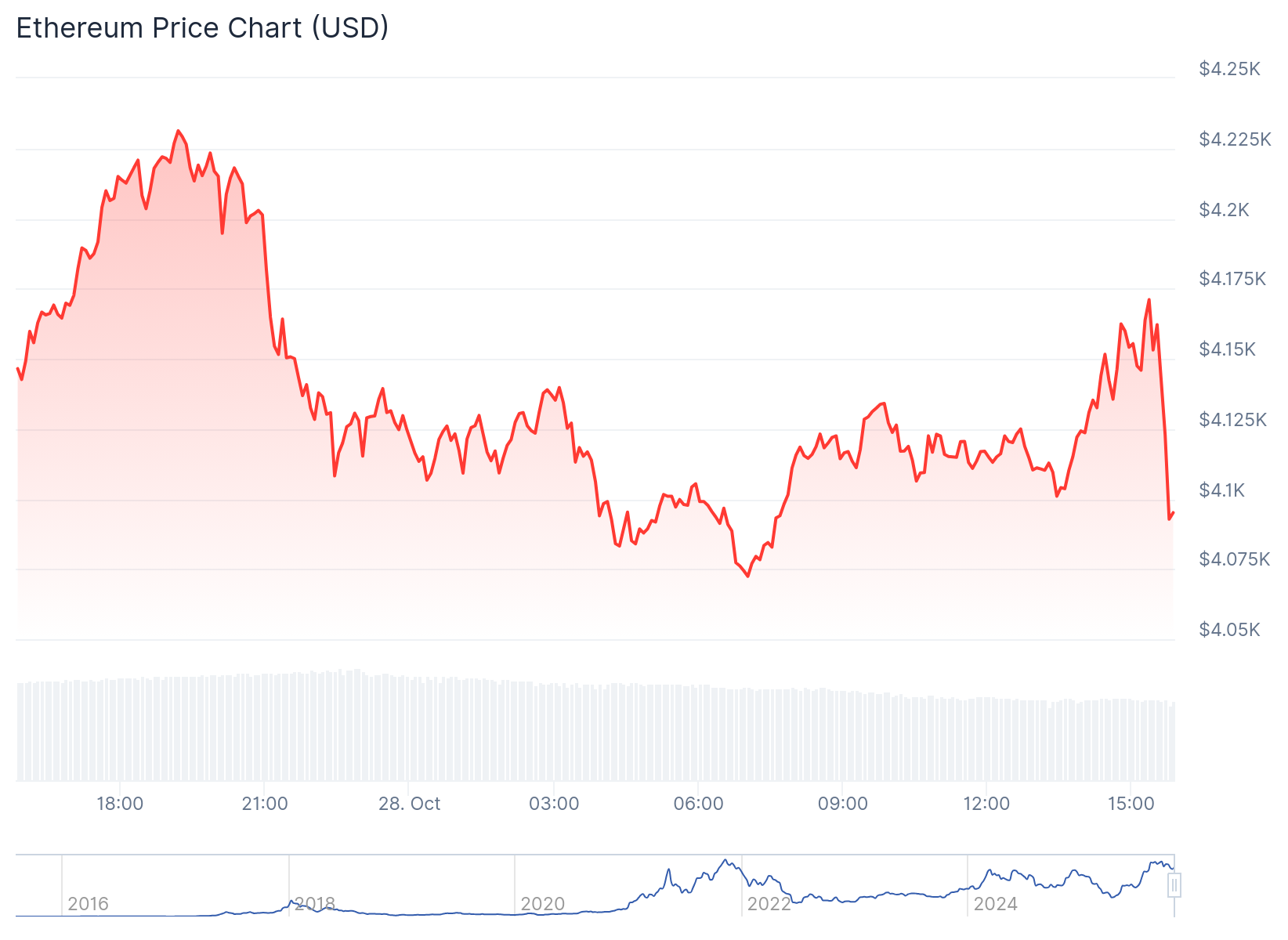

Ethereum’s Price Dips Slightly as SharpLink Deploys $200M in ETH

At the time of writing, Ethereum is trading at about $4,105, following a 1.2% decline in the past 24 hours. Within the same timeframe, ETH fluctuated between $4,072.42 and $4,231.28 with a trading volume of $26.82 billion. Other extended period price change data, including their 7-day-to-date and month-to-date variables, reflected increments of about 6.3% and 3%, respectively.

Meanwhile, SharpLink currently holds 860,299 ETH worth roughly $3.58 billion. The company paid an average of $3,609 per ETH token. It has also accumulated 6,116 ETH as proceeds from staking rewards.

Source: CoinGecko

Source: CoinGecko

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

The Channel Factories We’ve Been Waiting For

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight