Templeton’s XRP ETF Goes Live as Bitcoin Hyper Presale Picks Up Speed

Quick Facts:

Franklin Templeton’s EZRP and Bitwise’s XRP ETF arrive this week, signaling that institutional demand for major altcoins remains in place despite volatility.

Franklin Templeton’s EZRP and Bitwise’s XRP ETF arrive this week, signaling that institutional demand for major altcoins remains in place despite volatility. Nine XRP ETFs landing between November 18 and 25 could push XRP toward long-term allocation status rather than short-term speculation.

Nine XRP ETFs landing between November 18 and 25 could push XRP toward long-term allocation status rather than short-term speculation. With more than $27.78M raised and clear Layer 2 utility, Bitcoin Hyper offers higher-beta exposure to the same adoption trend that ETFs are reinforcing.

With more than $27.78M raised and clear Layer 2 utility, Bitcoin Hyper offers higher-beta exposure to the same adoption trend that ETFs are reinforcing.

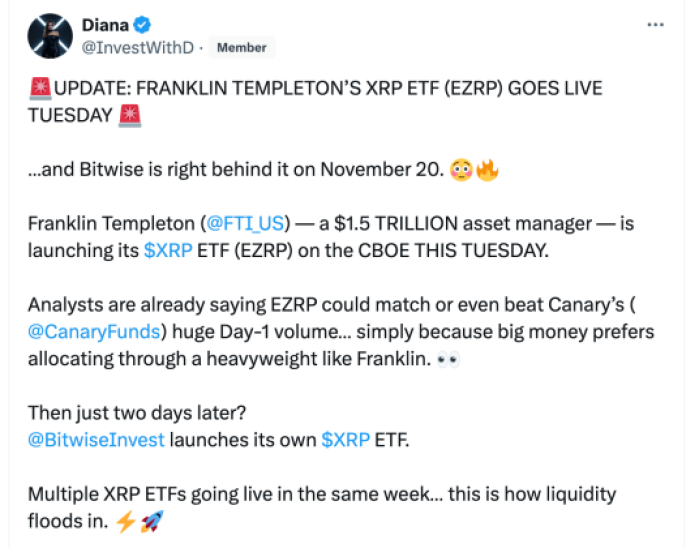

Franklin Templeton is launching its XRP ETF, EZRP, on November 18th on the CBOE.

It’s the first in a tight cluster of new XRP funds arriving on the market. Analysts expect Franklin Templeton’s EZRP to compete with Canary’s XRPC, which grabbed the early advantage but does not have Franklin Templeton’s reach or distribution power.

Bitwise will follow with its own XRP ETF on November 20, setting up a real-time check on institutional appetite for the asset.

This rollout is happening while crypto prices remain shaky. $BTC recently dropped from its $126K high to below $100K after heavy derivatives unwinding and security worries.

Yet major asset managers continue to broaden their lineups, from single-asset XRP products to multi-coin index funds. That split between falling prices and rising product launches sends a message:

Big firms still see long-term value in crypto, even when sentiment flips.

For XRP, nine spot ETFs are expected to be launched between November 18th and 25th, giving mainstream investors direct exposure for the first time. If the inflows come in as expected, these funds may create steady buy-side demand that could soften volatility over time.

EZRP, for example, benefits from Franklin Templeton’s large balance sheet and adviser network, a combination that may allow it to overtake smaller issuers.

Clearly, crypto infrastructure keeps moving forward even when markets look messy. The same pattern is playing out on the Bitcoin side.One of the most closely tracked projects in the niche is Bitcoin Hyper ($HYPER), a Bitcoin Layer 2 presale aiming to turn idle $BTC into something more usable.

With over $27.78M raised, a presale price near $0.013285, and staking rewards around 41% APY, $HYPER sits in a different risk bracket than ETFs but draws from the same adoption story.

Bitcoin Hyper Brings Speed, Scalability, and Programmability to the Bitcoin Network

As XRP gains its first wave of spot ETFs, the parallel for Bitcoin is not more wrappers. It is the infrastructure that upgrades what $BTC can actually do. For investors open to higher volatility, this is the category where Bitcoin Hyper stands out.

Bitcoin Hyper uses Solana’s Virtual Machine for execution, while settling and securing everything back to the Bitcoin base chain.

Users lock $BTC on-chain through a canonical bridge, receive a wrapped version on the Layer 2, and then move it quickly and cheaply through payments, DeFi, NFTs, and consumer apps.

Combining SVM throughput with Bitcoin security gives the native crypto $HYPER a clear functional purpose. That explains why the Bitcoin Hyper token presale has climbed above $27.78M, despite choppy conditions.

Clearly, crypto infrastructure keeps moving forward even when markets look messy. The same pattern is playing out on the Bitcoin side, making $HYPER one of the best cryptos to buy now.

The token currently sells for about $0.013285. The staged presale model increases the price over time, rewarding early buyers and providing the team with predictable funding for development and liquidity.

The Presale Frenzy Continues

Early participants can lock tokens for projected yields of 41% APY, helping secure the network once the mainnet is live and encouraging longer holding periods.

Our Bitcoin Hyper ($HYPER) projection places a possible 2025 high near $0.32 and a 2030 peak around $1.5, assuming strong exchange listings and dApp growth.

Nothing is assured, yet even the conservative side of that range would comfortably outpace what most ETF investors typically expect from high-cap crypto exposure.

That contrast explains the interest. The project continues to draw steady interest from whales, including a whale purchase worth $502K last Wednesday, even as the wider market cools. Read our How to Buy Bitcoin Hyper guide for detailed instructions on joining the presale.From the current presale level of $0.013285, the 2025 forecast range of $0.15 to $0.32 would translate to roughly 11.3x on the lower end and around 24.1x at the top.

XRP ETFs are structured for institutions seeking straightforward exposure.

Bitcoin Hyper gives retail and early-stage investors a chance to position themselves in the infrastructure layer that could make Bitcoin more useful in the next wave of adoption.

Join the Bitcoin Hyper ($HYPER) presale before it’s too late.

Disclaimer: This article is not financial advice. Crypto assets are volatile and risky. Always research independently before allocating capital.

Authored by Bogdan Patru for Bitcoinist – https://bitcoinist.com/xrp-etf-franklin-templeton-launch-bitcoin-hyper-presale

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Vitalik Buterin Warns Crypto Lost Its Way, But Ethereum Is Ready to Fix It