Game Theory in the Workplace: Using Bonuses to Ensure a Self-Enforcing Equilibrium

Table of Links

Abstract and 1. Introduction

-

A free and fair economy: definition, existence and uniqueness

2.1 A free economy

2.2 A free and fair economy

-

Equilibrium existence in a free and fair economy

3.1 A free and fair economy as a strategic form game

3.2 Existence of an equilibrium

-

Equilibrium efficiency in a free and fair economy

-

A free economy with social justice and inclusion

5.1 Equilibrium existence and efficiency in a free economy with social justice

5.2 Choosing a reference point to achieve equilibrium efficiency

-

Some applications

6.1 Teamwork: surplus distribution in a firm

6.2 Contagion and self-enforcing lockdown in a networked economy

6.3 Bias in academic publishing

6.4 Exchange economies

-

Contributions to the closely related literature

-

Conclusion and References

Appendix

6 Some applications

There a wide variety of applications of our theory. In this section, we provide applications to the distribution of surplus in a firm, exchange economies, self-enforcing lockdowns in a networked economy facing a pandemic, and publication bias in the academic peer-review system.

6.1 Teamwork: surplus distribution in a firm

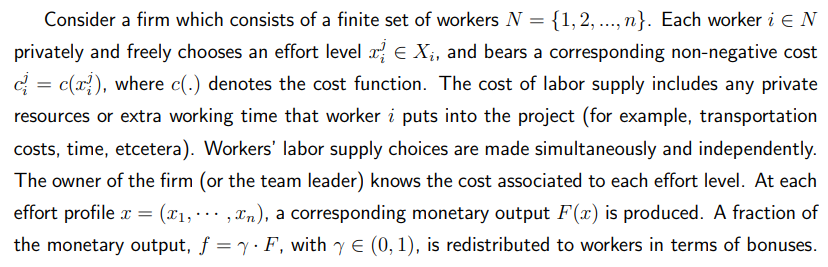

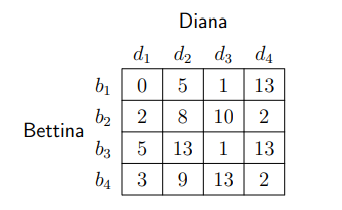

In this first application, we use our theory to show how bonuses can be distributed among workers in a way that incentivizes them to work efficiently.

\

\ The existence of a pure strategy Nash equilibrium in this teamwork game follows from Lemma 1. To see this, observe that the payoff function of a worker can be decomposed in two parts: the bonus that is determined by the Shapley payoff and the cost function. Lemma 1 shows that the sum of excess payoffs in any cycle of deviations equals 0 in any free and fair economy (or any strategic game with Shapley payoffs). The reader can check that the sum of excess costs in any cycle of strategy profiles is zero as well in the game. The latter implies that the sum of excess payoffs in any cycle of strategy profiles of the teamwork game is equal to 0. Therefore, the teamwork game admits no cycle of deviations. As the game is finite, we conclude that it admits at least a Nash equilibrium profile in pure strategies. (Recall that the total output of the firm, F, and the total bonus, f, are perfectly correlated.) We should point out that a pure strategy Nash equilibrium always exists in the teamwork game, even if costs are high. In the latter case, some workers, if not all, might find it optimal to remain inactive at the equilibrium. In such a situation, the owner might want to raise the total bonus to be redistributed to workers.

\

\

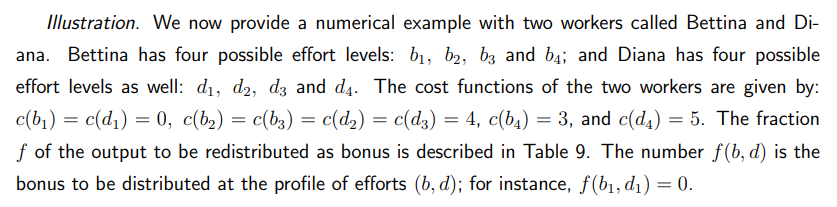

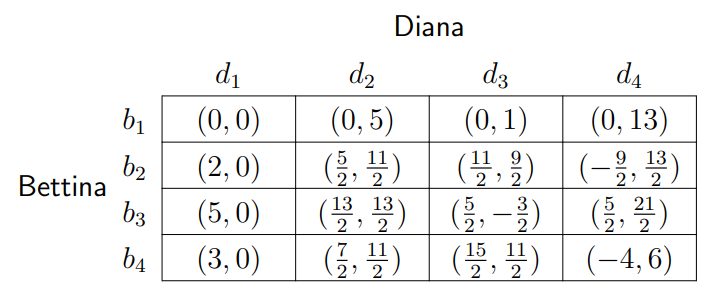

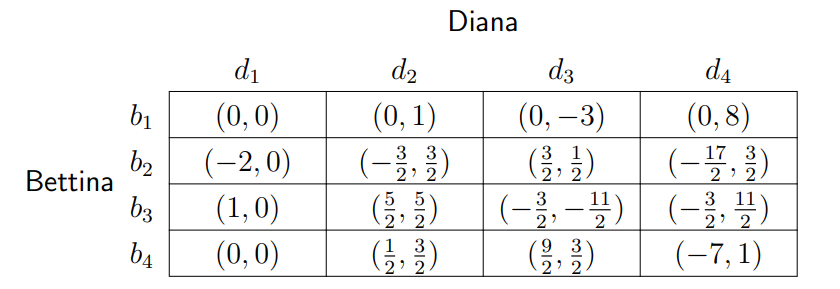

\ The corresponding Shapley payoffs are described in Table 10 and the net payoffs of Bettina and Diana in the teamwork game are described in Table 11.

\ The profile (b4, d3) is a pure strategy Nash equilibrium. Therefore, the owner of the firm can implement the profile (b4, d3) without any need of monitoring the actions of Bettina and Diana, as (b4, d3) is self-enforcing. The owner can implement the profile (b1, d4) as well. Note that the set of equilibrium effort profiles depend on the cost functions, and that no worker receives a non

\

\

\ positive bonus at the equilibrium. The reason is that each worker i always has the option to remain inactive, which is equivalent to Bettina choosing b1 or Diana choosing d1 in this illustration. The two equilibria in this teamwork game are Pareto-efficient.

\

:::info Authors:

(1) Ghislain H. Demeze-Jouatsa, Center for Mathematical Economics, University of Bielefeld (demeze jouatsa@uni-bielefeld.de);

(2) Roland Pongou, Department of Economics, University of Ottawa (rpongou@uottawa.ca);

(3) Jean-Baptiste Tondji, Department of Economics and Finance, The University of Texas Rio Grande Valley (jeanbaptiste.tondji@utrgv.edu).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

You May Also Like

Google's AP2 protocol has been released. Does encrypted AI still have a chance?

Zama to Conduct Sealed-Bid Dutch Auction Using Encryption Tech