Dow Jones up 100 points as Fed takes focus away from Israel-Iran war

Stock markets are zeroing in on the Federal Reserve’s key interest rate decision, while the conflict in the Middle East takes a step out of the spotlight.

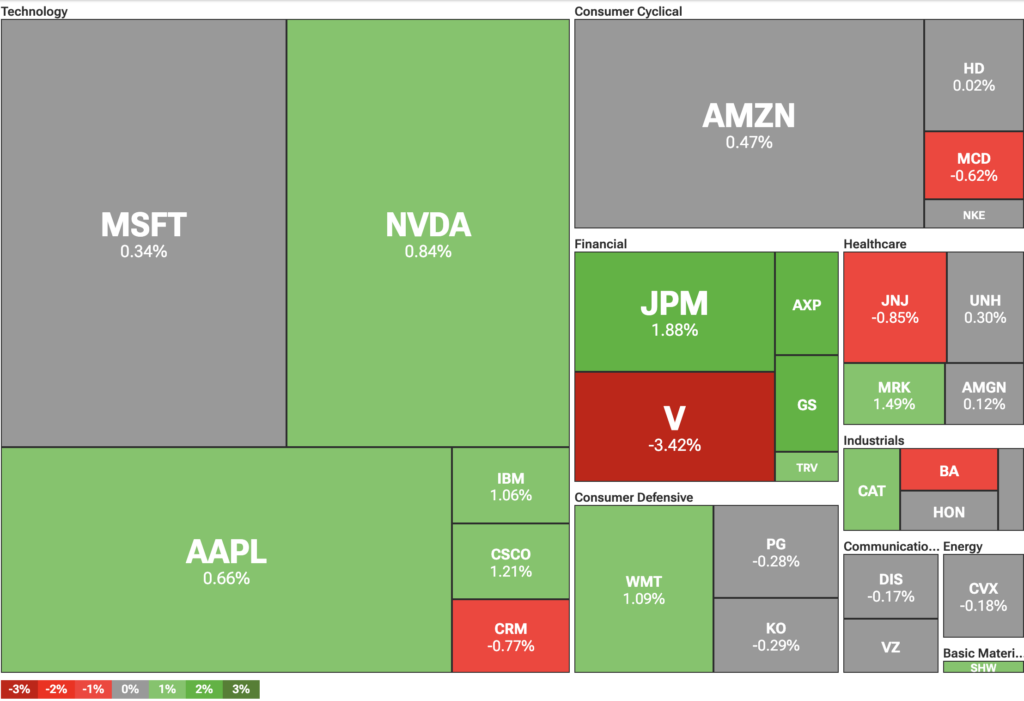

Major U.S. stock indices were higher ahead of the announcement. On Wednesday, June 18, the Dow Jones rose 132 points, or 0.31%. At the same time, the S&P 500 gained 0.40%, while the NASDAQ climbed 0.55%.

The Fed is scheduled to announce its interest rate decision on June 18 at 2 p.m. Eastern Time. Market consensus expects the central bank to keep rates steady. The Fed remains concerned about rising inflation, particularly following the introduction of former President Donald Trump’s “Liberation Day” tariffs.

Trump also anticipates no rate cuts. Earlier, he remarked that “stupid” Fed Chair Jerome Powell probably won’t cut rates. That remark is part of the ongoing pressure by the U.S. President on the Fed.

Trump has said interest rates should be at least two percentage points lower to support the economy. However, that scenario appears unlikely, especially as rising oil prices, driven by the Israel-Iran war, add to inflation concerns.

Trump escalates rhetoric over Iran

While markets are focusing on the Fed, tensions in the Middle East threaten to escalate further. Notably, Trump confronted Iran with a threatening tone, refusing to rule out direct U.S. military involvement. He stated that “it’s very late to be talking” with Iran.

“Nobody knows what I’m going to do,” Trump told reporters when asked whether or not the U.S. would strike Iran. U.S. continues to support Israel with its strikes on Iran, which have already done significant damage to its military capabilities. However, Iran is also retaliating against Israel with missiles and drones.

While Qatar and Oman are trying to mediate a ceasefire, they are urging Israel to de-escalate. On the other hand, Israel is doing its best to get the U.S. directly involved in the war, which would likely have immediate consequences on the entire region and the global oil market.

You May Also Like

XRP Sees Panic Selling as Glassnode Data Shows Significant Holder Losses

TOPONE Markets Advances AI-Powered Analytical Tools, Deepens Service Presence in Vietnam