XRP Mega Cycle Signals Repeat of 2017 Face-Melting Rally

TL;DR

- XRP fractal analysis suggests $6–$7 targets by November, echoing the explosive 2017 mega rally.

- New U.S. ETFs for XRP and Dogecoin launch, offering traditional investors broader market exposure.

- Technical charts show XRP consolidating before a potential breakout, with Fibonacci levels pointing toward higher targets.

Chart Comparison Shows Similar Cycle

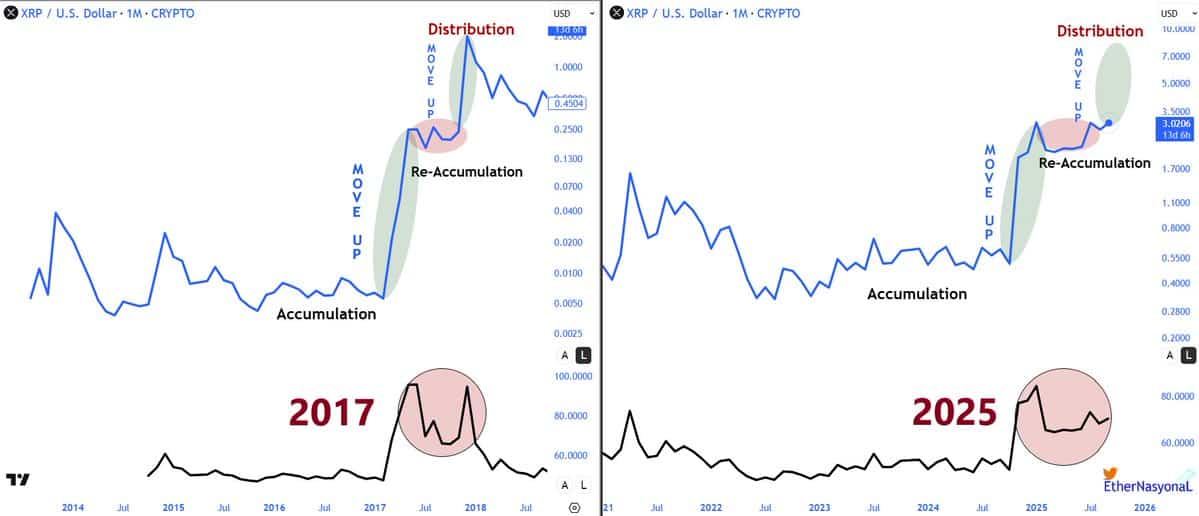

Analyst EtherNasyonaL shared a chart comparing XRP’s current structure to its 2017 cycle. The earlier move showed accumulation, a breakout, re-accumulation, and a parabolic distribution before the drop. That run pushed XRP from fractions of a cent to more than $3.

Interestingly, the 2025 chart follows a similar path. XRP has completed its accumulation and is now consolidating in re-accumulation. If the cycle repeats, the next move could be a rally into distribution, with projections pointing above $5–$7.

Source: EtherNasyonaL/X

Source: EtherNasyonaL/X

EtherNasyonaL commented: “Ripple face melting high is loading right there.” It suggests the market may be setting up for another steep rally.

Fractal Analysis Points to $6–$7

EGRAG CRYPTO shared a fractal-based view of XRP/USDT on the 5-day timeframe. A yellow fractal from an earlier breakout was applied to the current move to project possible price action.

Notably, the analysis shows XRP trading inside a rising channel, supported by upward-sloping averages. Fibonacci extensions are marked at $3.9 and $5.6, with further projections toward $6–$7 by mid-November. A longer extension points to $9.

EGRAG CRYPTO wrote:

The post added that fractals are tools for mapping patterns, not guarantees.

ETFs Bring XRP to U.S. Exchanges

XRP is also gaining attention in traditional markets. On September 18, REX Shares and Osprey Funds will launch the first U.S. exchange-traded funds tied to XRP and Dogecoin on the Cboe BZX Exchange. The tickers will be XRPR and DOJE.

Bloomberg Intelligence analyst James Seyffart explained: “This isn’t “pure” spot. But it will hold spot directly and other spot XRP ETFs from around the world to get its exposure.” He added that the filings allow for the use of derivatives if needed, though that is not the main design.

Consequently, the new ETFs give traditional investors another way to access XRP. This comes as technical analysts point to chart structures similar to the 2017 cycle, when XRP surged in one of its strongest historical rallies.

The post XRP Mega Cycle Signals Repeat of 2017 Face-Melting Rally appeared first on CryptoPotato.

You May Also Like

Horror Thriller ‘Bring Her Back’ Gets HBO Max Premiere Date

VivoPower To Load Up On XRP At 65% Discount: Here’s How