Uncover the Hidden Anti-Money Laundering Power of Stablecoins No One Discusses

Opinion by: Debanjan Chatterjee, financial analyst

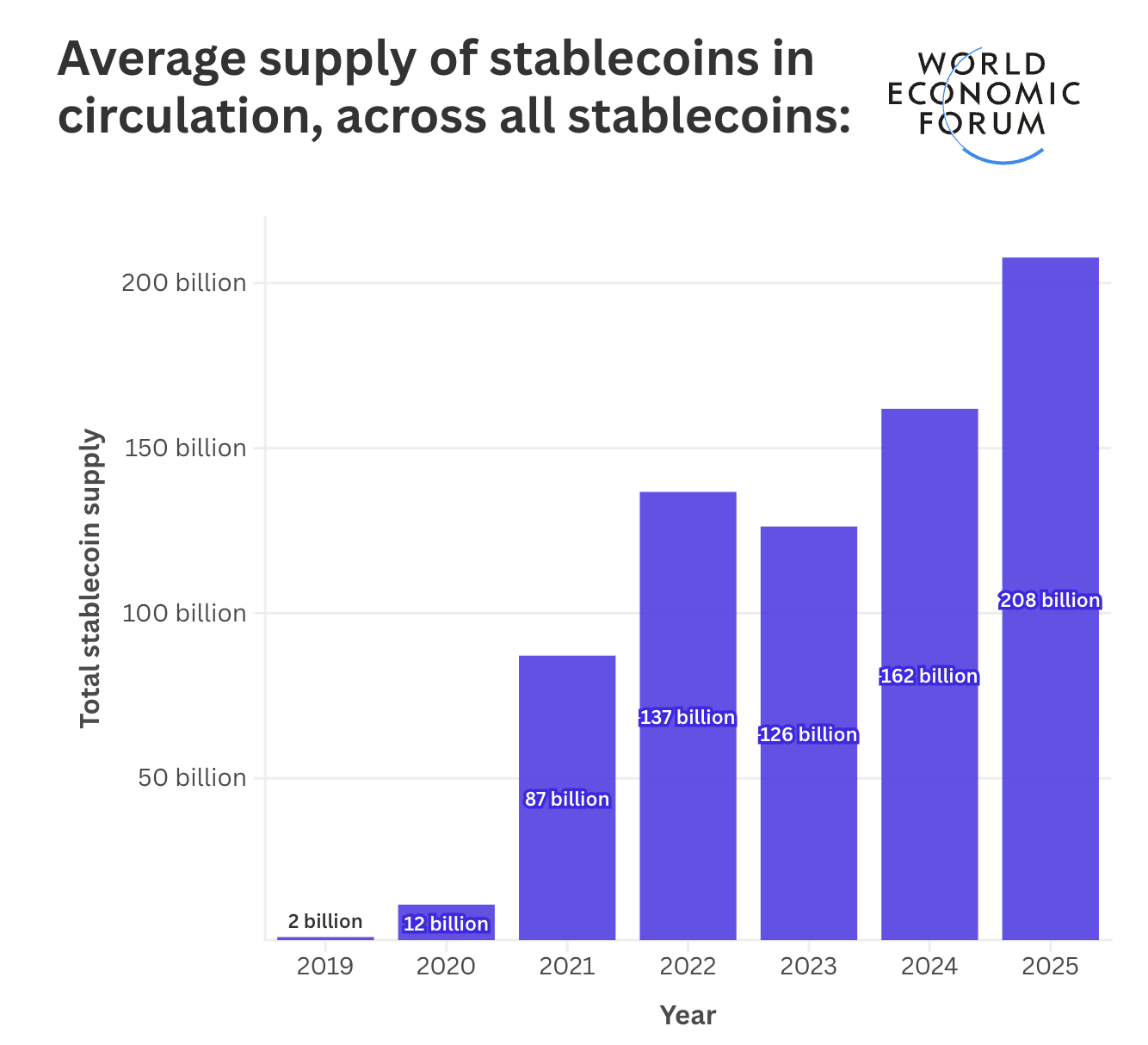

The rapid growth of the stablecoin industry is shaping the future of global finance, driven by clearer regulations and expanding real-world applications. Stablecoins now facilitate faster, cheaper transactions compared to traditional banking systems, with their total circulating value exceeding $200 billion. Major technology firms, retail giants, and financial institutions are increasingly issuing their own stablecoins, reminiscent of historical local currencies issued by banks before the Civil War—a system that inadvertently helped prevent illicit transactions due to limited acceptance outside issuing banks.

Average supply of stablecoins in circulation, across all stablecoins. Source: World Economic Forum.

Average supply of stablecoins in circulation, across all stablecoins. Source: World Economic Forum.

With the advent of cross-chain interoperability, users can seamlessly convert between different stablecoins or off-ramp to fiat currencies without cumbersome hoops. Such instant, borderless capital flows call for robust anti-money laundering (AML) standards. Regulatory frameworks now emphasize stringent AML compliance for stablecoins, recognizing their potential to aid law enforcement in combating financial crimes. Blockchain transparency offers a powerful tool for tracing transactions across borders, supporting international efforts against illicit finance.

Contrasting with traditional finance’s siloed structure—where banks operate as closed ecosystems—blockchain’s open, immutable ledger enables authorities to access comprehensive, real-time data, making it easier to identify suspicious activities. Suspicious activity reports from multiple financial institutions often only reveal partial pictures, complicating investigations. Blockchain’s transparency helps overcome these barriers by providing a unified view, reducing investigative hurdles.

As stablecoin adoption accelerates, movement across different jurisdictions may facilitate more sophisticated AML efforts. Live data streams from blockchain transactions can expose patterns of criminal activity, including sanctions evasion efforts where illicit funds flow between banking channels and stablecoins. This integrated approach enhances law enforcement’s ability to respond swiftly and effectively.

Looking forward, widespread stablecoin infrastructure promises enhanced cooperation between traditional financial institutions and the crypto industry. This collaboration can lead to more effective detection of criminal operations, such as money laundering tied to human trafficking, drug trade, or DeFi hacks. Recognizing that blockchain transactions can serve as vital signals, financial regulators and institutions are beginning to embrace the potential of these assets in safeguarding the global financial network against crime.

The road ahead

The integration of stablecoins into the broader financial system represents a transformative step in leveraging blockchain transparency for fighting illicit finance. Future developments are poised to foster international cooperation, utilizing real-time blockchain data to strengthen anti-money laundering efforts and improve regulatory compliance across the crypto markets. As this infrastructure matures, it will demonstrate how the inherent properties of blockchain—immutability, openness, and traceability—can revolutionize compliance and crime prevention in the digital age.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article was originally published as Uncover the Hidden Anti-Money Laundering Power of Stablecoins No One Discusses on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Will XRP Price Increase In September 2025?

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be