Worldcoin Price Today Steadies as $3.25B Market Cap Fuels Breakout Potential

The move signals a potential turning point for the crypto asset, but holding ground at current levels remains the decisive factor. Analysts believe that the coin’s performance in the coming weeks will set the tone for whether it can extend gains into the next market cycle.

Breakout Faces Key Validation Zone

In a recent X post, analyst Berke Oktay highlighted that WLD had successfully cleared a major resistance area that previously capped its rallies. The breakout placed the coin above a yellow trend marker, now acting as the critical zone for confirmation. Maintaining position here is seen as essential for establishing a reliable path toward higher targets.

Source: X

Over the past two weeks, the asset has been consolidating around this threshold, showing that buyers are defending the level while sellers remain cautious. If the coin sustains momentum above this line, it strengthens the probability of a broader move upward, giving bulls the confidence to target higher resistance ranges. Analysts point to $4.30 as the next immediate hurdle, followed by $6.20 if upward pressure continues.

Looking ahead to the next bull run, projections suggest the token could test ambitious price points between $9.70 and $12.00 if the market cycle accelerates. These levels mark historical supply zones where sellers previously dominated, meaning breaking past them would require substantial demand. Still, the breakout signals that the crypto is positioning itself early for potential upside once broader market conditions improve.

Critical Zone Defines Short-Term Outlook

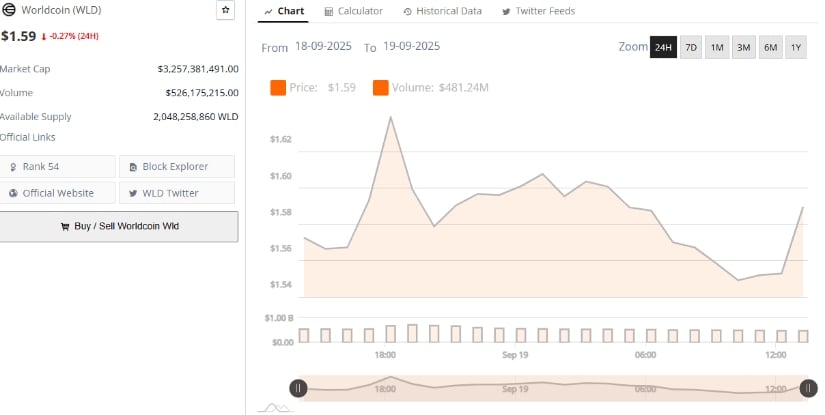

On one hand, the asset’s market capitalization stands at $3.25 billion, placing it at rank 54 in the broader crypto market. Over the last 24 hours, trading volume reached $526 million, showing that despite minor price weakness, liquidity around the token remains strong.

Source: BraveNewCoin

This stability around the $1.59 level comes as the coin consolidates after its recent breakout. Analysts note that holding above the breakout zone is critical for sustaining momentum, and market participants are closely monitoring whether demand can push the asset higher.

With an available supply of more than 2.04 billion tokens, the coin’s next move could decide if it gathers strength to challenge higher resistance levels in the coming sessions.

Resistance Break Could Spark Strong Recovery

At press time, WLD was trading at $1.59, showing resilience after a period of sideways movement. The chart highlights a long-term resistance band near the $4.00 level, a barrier that has capped upward moves since early 2024. A successful break above this region could redefine the coin’s mid-term trend.

Source: X

Analyst Mindy noted on X that if the memecoin clears this resistance, it could “usher in a crazy comeback.” This reflects growing optimism that the asset may be preparing for a larger shift.

The projection suggests that once the $4.00 ceiling is broken, the asset could accelerate toward higher zones between $8.00 and $12.00. Market participants are watching volume closely, as increasing participation would strengthen the breakout case. For now, the consolidation phase remains a critical test of momentum.

You May Also Like

Ray Dalio: Five major forces shaping the economy, the US faces a $9 trillion debt rollover challenge, and why gold remains the most established form of money

Trump urges passage of U.S. Clarity Act, attacks banks for 'undercutting' GENIUS

Copy linkX (Twitter)LinkedInFacebookEmail