Solana DEX Sees Meme Tokens Fade as Stablecoin Trading Rises

- Meme token trading on Solana DEX dropped below 30%, reflecting a decline in speculative retail activity.

- SOL-stablecoin trading volume surged to its highest level since December 2023, signaling stronger market stability.

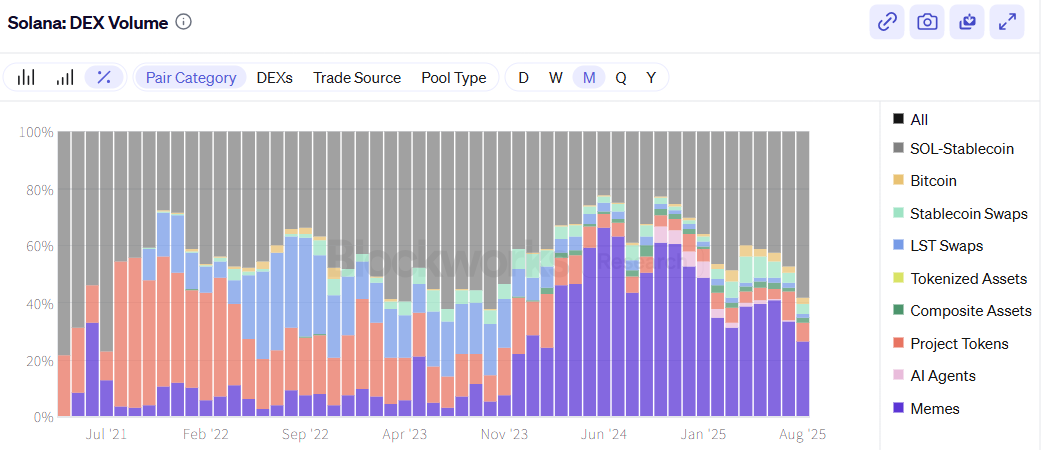

Major changes are underway in the Solana trading ecosystem. The latest data from BlockWorks shows that meme token dominance on Solana DEXs, which had skyrocketed to over 60% by the end of 2024, has now plummeted to below 30%.

In contrast, the SOL-stablecoin trading pair has risen sharply and now reaches its highest level since December 2023. This shift appears to reflect a shift in trader behavior, as traders begin to seek safer paths after the meme token hype wave wore off.

Stablecoins Gain Ground as Meme Frenzy Fades

Furthermore, the number of active daily traders on Solana DEXs has also declined dramatically. From a peak of around 4.8 million traders, there were only around 900,000 left in August 2025. This figure reflects a growing sense of fatigue with high-risk assets, particularly with numerous rug pulls and projects with no clear utility.

However, this shift also opens up space for more stable trading options, with stablecoins becoming a primary option for those looking to remain active without being caught up in the wild volatility of meme tokens.

Solana Proves Its Strength Through DeFi Growth

While many people used to rush to acquire tokens like BONK, WIF, or MEW, that trend is now shifting. Meme tokens once made Solana a household name, especially when network throughput reached 107,540 TPS in a stress test, as revealed by Mert Mumtaz, co-founder of Helius.

This speed was once a major draw for retail traders, but after the hype died down, not all tokens were able to survive. Many lost their appeal due to lack of utility.

On the other hand, CNF reported last week that Solana’s DeFi ecosystem is actually at its peak. Total value locked (TVL) hit a new record of $13.34 billion, reflecting the deepening involvement of institutional users and surging demand for staking.

This means that while the meme token sector appears to be weakening, the Solana ecosystem as a whole has not lost its momentum. In fact, substantial liquidity is now flowing into the more mature and long-term DeFi sector.

Furthermore, SOL’s price performance is also trending positively. In the past 24 hours, SOL has risen 0.81%. Looking at the long term, the increase has reached 33.48% in the past 30 days and even soared 82.84% over 90 days.

This trend signals one important thing: Solana is starting to move from a hype-driven phase to a more utility-oriented one. While many retail traders have left, new funds have emerged from large players seeking transaction efficiencies and DeFi opportunities.

With stablecoins becoming a key trading pillar, liquidity tends to be more controlled. This contrasts with previous periods when meme tokens often made the Solana market appear boisterous but volatile.

However, this doesn’t mean meme tokens will disappear completely. The community is still present, and projects with strong ideas may still survive.

]]>You May Also Like

XRP stuck in range as descending channel caps upside momentum

Why informal crypto markets offer a 1–2% premium?