Cannabis Firm Flora Growth Raises $401 Million Treasury for Zero Gravity Blockchain Pivot

TLDR

- Flora Growth secured $401 million ($35M cash, $366M in 0G tokens) to become first publicly traded company holding Zero Gravity tokens

- The Nasdaq-listed cannabis firm will rebrand to ZeroStack while keeping FLGC ticker after shareholder approval

- Deal led by Solana treasury firm DeFi Development Corp values 0G token at $3 per token with $3 billion fully diluted valuation

- Zero Gravity blockchain trains AI models using distributed clusters and claims 357x efficiency improvement over existing frameworks

- 0G Foundation plans Monday token airdrop to early supporters with major exchange listings to follow

Flora Growth, a Nasdaq-listed cannabis company, has completed a $401 million private placement to become the first publicly traded firm holding Zero Gravity (0G) tokens. The deal marks a major pivot from cannabis operations to blockchain infrastructure backing.

The financing combines $35 million in cash with $366 million in digital assets, primarily 0G tokens valued at $3 each. DeFi Development Corp, a Solana treasury firm holding $480 million in SOL, led the investment alongside Hexstone Capital and Carlsberg SE Asia PTE Ltd.

Flora Growth plans to rebrand as ZeroStack following shareholder approval while maintaining its FLGC ticker symbol on Nasdaq. The transaction is expected to close by September 26, with additional backing from firms including Dao5, Abstract Ventures, and Dispersion Capital.

Zero Gravity’s AI Infrastructure Claims

Zero Gravity Labs is developing a decentralized operating system for distributed AI model training. The company claims to have successfully trained a 107 billion parameter model using distributed clusters over standard internet connections.

The blockchain project asserts a 357x efficiency improvement over existing distributed AI frameworks. Zero Gravity currently operates in testnet phase, with mainnet launch timing tied to token release according to previous company statements.

The 0G Foundation, which governs the protocol independently, previously secured a $250 million token purchase agreement. Zero Gravity Labs separately raised $75 million in seed funding before this Flora Growth deal.

Token Launch and Market Valuation

The 0G Foundation will distribute tokens through an airdrop to early supporters on Monday. Major cryptocurrency exchange listings are planned to follow the initial distribution.

At the $3 per token price used in the Flora deal, Zero Gravity would carry a $3 billion fully diluted valuation. This pricing puts the project in similar valuation territory to established crypto projects at current market rates.

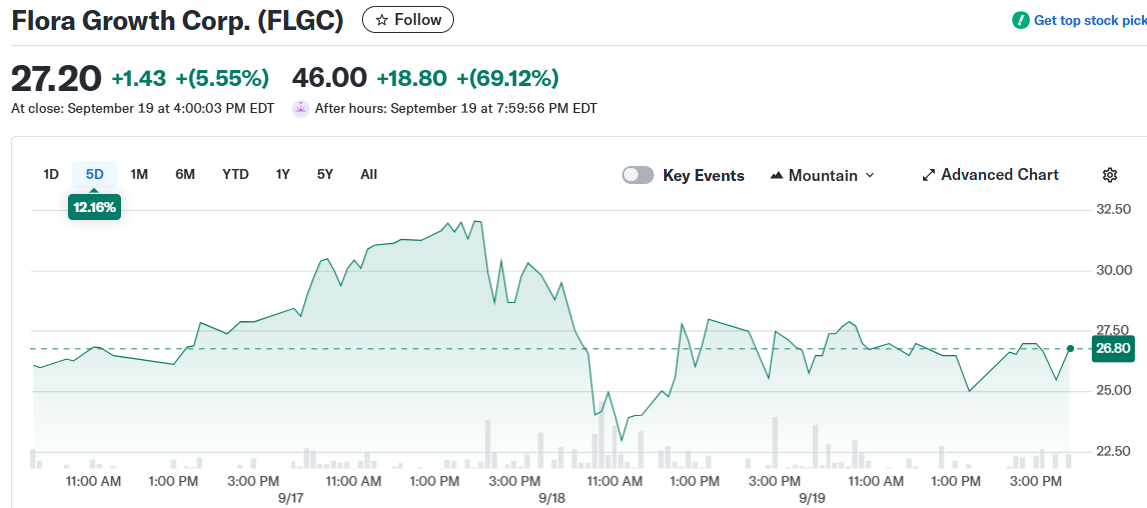

Flora Growth stock jumped 69% in after-hours trading following the deal announcement. The surge reversed the company’s 32% year-to-date decline according to Yahoo Finance data.

Flora Growth Corp. (FLGC)

Flora Growth Corp. (FLGC)

Treasury Strategy Details

As part of the arrangement, Flora will hold some treasury assets in SOL tokens beyond the primary 0G allocation. DeFi Development Corp emphasized maintaining full SOL exposure while adding upside potential through this deployment.

Incoming Flora Growth CEO Daniel Reis-Faria positioned the move as offering institutional investors equity-based exposure to AI infrastructure development. The treasury strategy targets transparent and cost-efficient AI model training capabilities.

Some investors in the private placement received pre-funded warrants exercisable after shareholder approval. The deal structure allows participants to benefit from potential 0G token appreciation following public launch.

The 0G Foundation plans Monday’s token airdrop to early supporters with major exchange listings scheduled afterward.

The post Cannabis Firm Flora Growth Raises $401 Million Treasury for Zero Gravity Blockchain Pivot appeared first on CoinCentral.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

WTI drifts higher above $59.50 on Kazakh supply disruptions