EU’s Chat Control Sparks Privacy Concerns Amid Web3 Transformation

As the European Union approaches a decision on the contentious “Chat Control” legislation, privacy advocates voice concerns that the proposed measures could undermine public confidence in digital communication and drive users toward Web3 platforms.

The debate centers on the EU’s draft Regulation to Prevent and Combat Child Sexual Abuse, which would require online platforms to scan private messages for illegal content before they are encrypted. Critics argue this effectively introduces backdoors into encrypted systems, contradicting the EU’s commitment to robust privacy protections.

“Granting entities with the capacity to monitor private messages nearly unlimited access is incompatible with the fundamental value of digital privacy,” said Hans Rempel, CEO of Diode. He considers the legislation a dangerous overreach that threatens user rights and security.

Elisenda Fabrega, general counsel at Brickken, highlighted the legal inconsistencies, noting that current EU jurisprudence—particularly Articles 7 and 8 of the EU Charter of Fundamental Rights—safeguards the confidentiality of communications and personal data. She explained that client-side scanning could enable content monitoring on user devices, even absent any suspicion of illegal activity, raising serious privacy concerns.

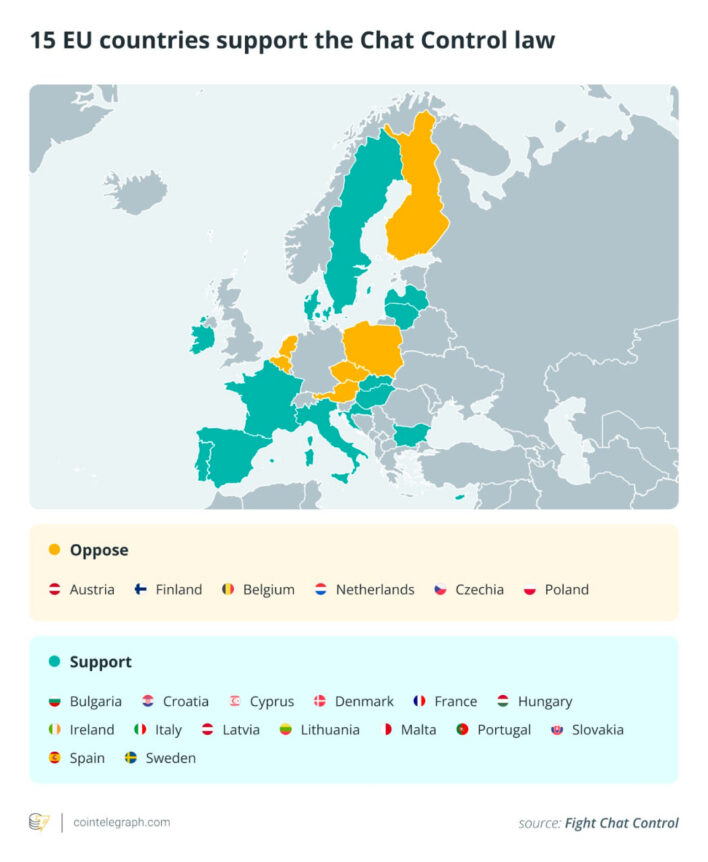

15 EU countries support the law. Source: Fight Chat Control

15 EU countries support the law. Source: Fight Chat Control

Related: US Treasury’s DeFi ID plan likened to placing cameras in every home

EU regulation sets a risky precedent

Experts warn that the legislation establishes a concerning precedent for both legal and technological reasons. “There are no guarantees,” Rempel cautioned, especially given that over 10% of all data breaches occur within government systems. The potential for misuse of such surveillance tools remains a major concern,” he added.

Fabrega emphasized that encryption is more than a technical feature; it embodies a promise of privacy to users. The erosion of trust in traditional messaging services could encourage many to seek refuge in decentralized Web3 alternatives, platforms designed with encryption at their core to preserve user sovereignty.

“Web3 champions privacy with the mantra ‘Not your keys, not your data,’” Rempel stated. “This approach ensures users maintain full control over their information from start to finish.”

Fabrega likewise expressed concern that if the Chat Control law passes, privacy-conscious users will increasingly migrate toward decentralized platforms, fragmenting the European digital market and complicating the EU’s efforts to influence global privacy standards.

Related: EU’s plan to scan private messages gains momentum

The final decision now hinges on Germany

Germany, holding the decisive vote, has yet to make a final stance on the legislation. While support among EU countries is strong, they do not yet meet the 65% population threshold necessary for approval. A favorable vote from Germany could pave the way for the law’s passage; opposition or abstention, however, could halt it.

“I believe the likelihood of approval is relatively low,” Rempel remarked. “But history shows that attempts to infringe on fundamental rights in the name of safety are likely to continue.”

With ongoing debates around crypto regulation, privacy, and digital rights, the outcome of the EU’s Chat Control proposal remains critical for shaping the future landscape of the crypto markets and decentralized technology adoption.

This article was originally published as EU’s Chat Control Sparks Privacy Concerns Amid Web3 Transformation on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

WTI drifts higher above $59.50 on Kazakh supply disruptions