China Launches New Stablecoin Amid Global Digital Currency Race

The push for greater stability and international utility in cryptocurrency markets has led to the launch of the first regulated stablecoins tied to national fiat currencies designed specifically for cross-border transactions. This week, AnchorX introduced its AxCNH stablecoin, pegged to the Chinese yuan (CNH), at the Belt and Road Summit in Hong Kong. The stablecoin aims to enhance trade and investment flows within the Belt and Road Initiative, a major infrastructure project connecting China to the Middle East, Europe, and maritime trade routes.

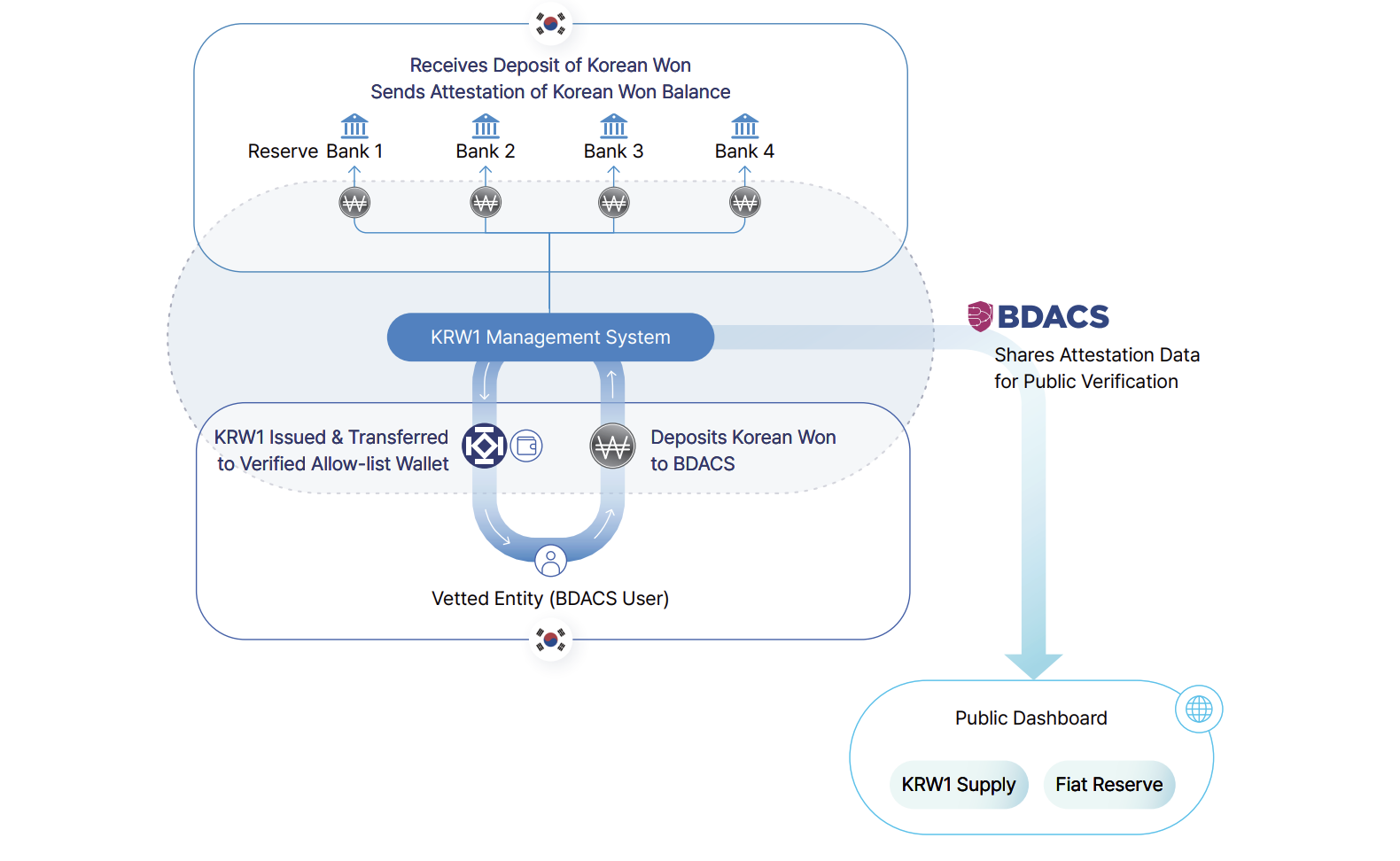

Following a regulatory shift in China favoring the use of stablecoins for international markets, AxCNH enters a growing sector of geo-strategically significant digital assets. Additionally, BDACS, a digital infrastructure firm, announced the launch of KRW1, a Korean won-pegged stablecoin, further fueling the global stablecoin race. Both these tokens are overcollateralized, meaning each is fully backed 1:1 by fiat deposits or government debt, ensuring stability and trustworthiness in cross-border dealings.

A visual outline of how the KRW1 stablecoin is managed. Source: BDACS

A visual outline of how the KRW1 stablecoin is managed. Source: BDACS

Currency stablecoins, especially those backed by fiat, are now gaining geopolitical significance. Governments worldwide are increasingly placing their national currencies on blockchain to position them within the expanding crypto ecosystem. By doing so, they aim to offset inflation and boost demand for their currencies internationally, as digital stablecoins facilitate near-instant, borderless settlements — a stark contrast to slower legacy financial systems.

The US government’s national debt has exceeded $37 trillion amid global economic pressures. Source: US Debt Clock

The US government’s national debt has exceeded $37 trillion amid global economic pressures. Source: US Debt Clock

Inflation driven by excess currency supply diminishes fiat value, prompting the need for stablecoins that are overcollateralized with government debt and cash assets. Companies like Tether and Circle are pivotal in this movement, helping to convert government bonds into digital tokens accessible via mobile devices. This process effectively turns individual users into indirect bondholders, potentially lowering yields on sovereign debt and easing the government’s debt burden.

Notably, Tether has become one of the largest holders of US Treasury bills globally, surpassing many developed nations. Experts have pointed out that stablecoins could serve as a hedge in times of economic uncertainty, with some analysts suggesting that the US is leveraging stablecoins and gold to counteract soaring national debt and dollar depreciation, reinforcing the strategic importance of digital assets in the broader financial landscape.

The role of stablecoins in the evolving financial system

As stablecoins gain prominence in the global financial ecosystem, their integration with traditional fiat currencies, influence on inflation, and impact on government debt are increasingly scrutinized. Their capacity to provide seamless, affordable cross-border transactions could reshape international trade and investment, fueling the transformation of blockchain’s role in finance.

This article was originally published as China Launches New Stablecoin Amid Global Digital Currency Race on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Qatar wealth fund commits $25bn to Goldman investments

Positive view remains intact above 185.00, with bullish RSI momentum