AVAX Explodes by 12% Daily as BTC Price Recovers From Sub-$112K Drop: Market Watch

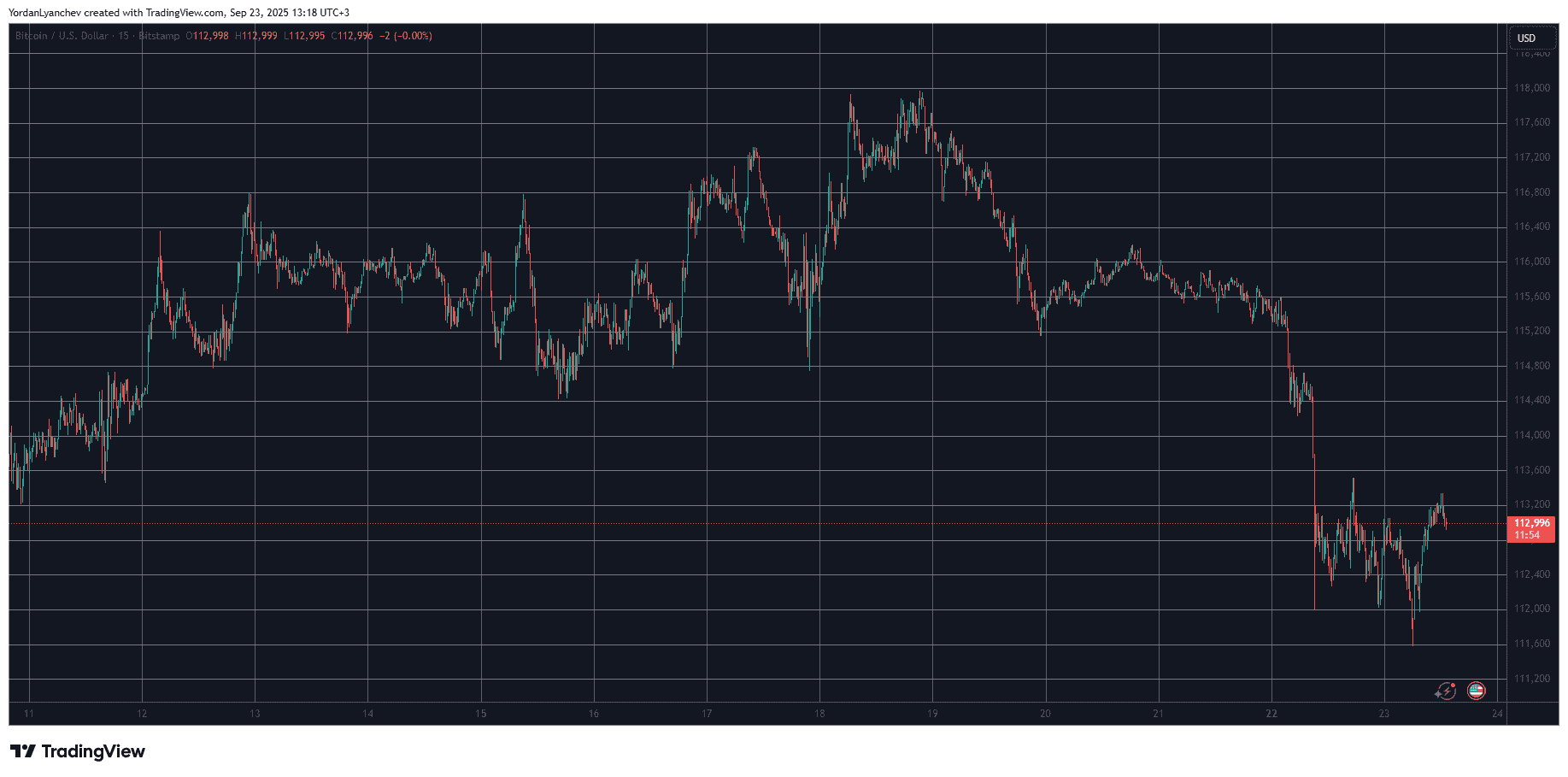

Bitcoin’s adverse price move on Monday drove the asset even further south during the early Tuesday morning hours when it slipped to $111,600 for the first time in two weeks.

While most of the larger-cap alts have remained relatively sluggish on a daily scale after yesterday’s crash, AVAX has gone on a tear with a double-digit pump.

BTC Recovers

The primary cryptocurrency enjoyed most of the previous business week, especially Thursday, after the US Federal Reserve finally reduced the key interest rates by 25 bps. At the time of the announcement, BTC had calmed at around $116,000 but shot up to $118,000 on Thursday morning to mark a monthly peak.

That price ascent didn’t last long, though, as bitcoin started to lose traction almost immediately and fell to $115,200 on Friday. It found support there during the weekend and spent it trading sideways between that level and $116,000.

Monday began with a bang in the wrong direction, however. At first, bitcoin dipped to $114,400 before the bears resumed full control of the market and pushed it south to $112,000, leaving over $1.7 billion in liquidations across the entire market.

BTC bounced in the following hours, but dipped once more earlier today to a new two-week low of $111,600. It has recovered some ground since then and now sits close to $113,000.

Its market capitalization has stalled at $2.250 trillion on CG, while its dominance over the alts stands tall at 56.4%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

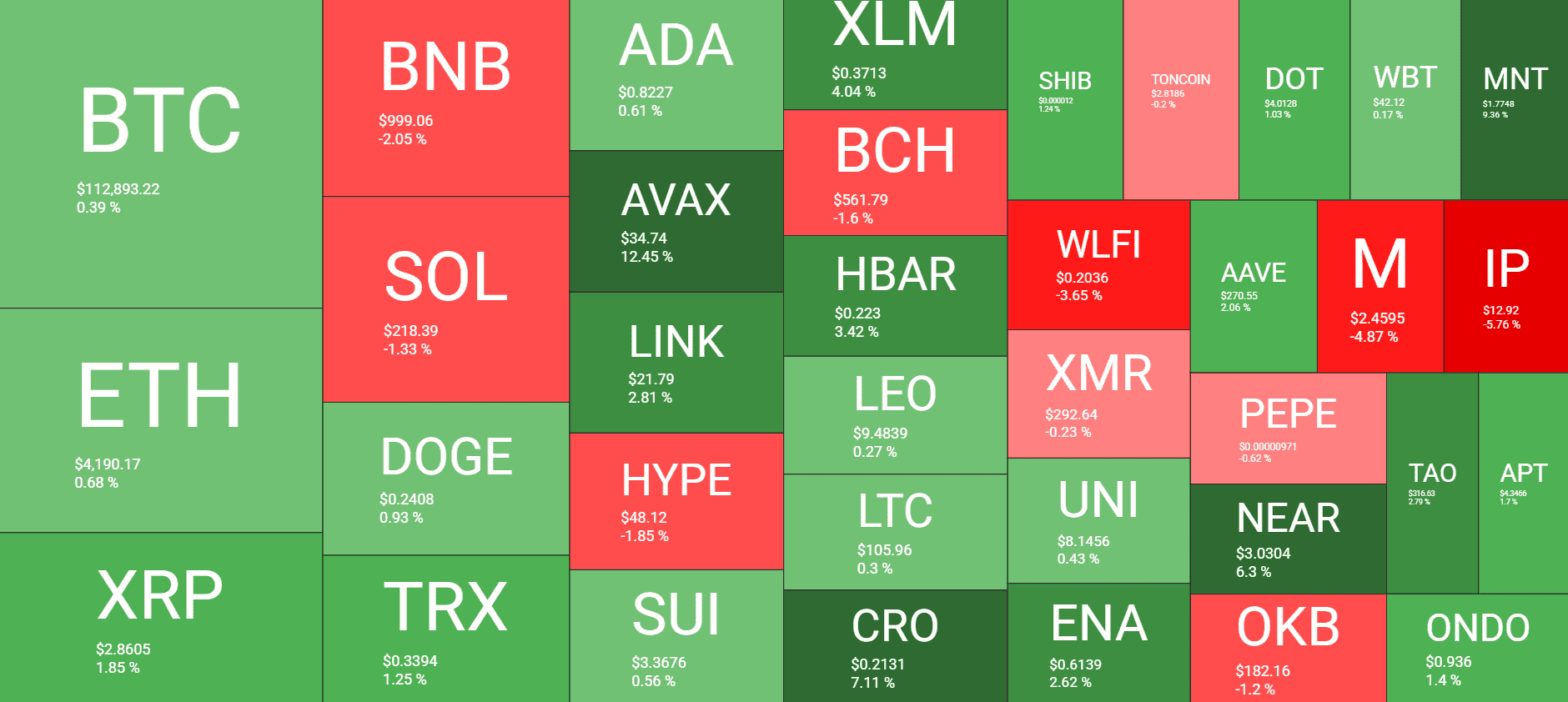

AVAX Steals the Show

Most larger-cap alts produced massive losses yesterday. Now, though, they sit slightly in the green following the bloodbath, including ETH, XRP, TRX, DOGE, ADA, LINK, and SUI. BNB, SOL, and HYPE are still with minor losses on a daily scale.

Avalanche’s native token is among the few exceptions. AVAX has skyrocketed by more than 12% daily and now trades close to $35. CRO has also bounced off rather well, and so have MNT and NEAR.

The total crypto market cap has regained over $40 billion since the recent low and is up to $4 trillion on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto

Cryptocurrency Market Overview. Source: QuantifyCrypto

The post AVAX Explodes by 12% Daily as BTC Price Recovers From Sub-$112K Drop: Market Watch appeared first on CryptoPotato.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Zepto Life Technology Launches Plasma-Based FungiFlex® Mold Panel as CLIA Reference Laboratory Test