What You Should Know About the Next Generation of Encryption

Table of Links

Abstract and 1. Introduction

-

Contribution

-

Related Work

-

Brief of Homomorphic Polynomial Public Key Cryptography and 4.1 DPPK

4.2 MPPK Key Encapsulation Mechanism

4.3 HPPK KEM

4.4 MPPK DS

-

HPPK Digital Signature Scheme

5.1 HPPK DS Algorithm

5.2 Signing

5.3 Verify

5.4 A Variant of the Barrett Reduction Algorithm

5.5 A Toy Example

-

HPPK DS Security Analysis

-

Conclusion, References, Acknowledgements, and Author contributions statement

4 Brief of Homomorphic Polynomial Public Key Cryptography

In this section, we are going to briefly describe the motivation behind and development of the HPPK scheme: the path from the original deterministic polynomial public key or DPPK, proposed by Kuang in 2021[1], then multivariate polynomial public key or MPPK, proposed by Kuang, Perepechaenko, and Barbeau in 2022[5], to the homomorphic polynomial public key over a single hidden ring in 2023[6], and over a dual hidden ring scheme[7]. MPPK schemes for digital signature or MPPK/DS have been proposed by Kuang, Perepechaenko, and Barbeau in 2022[8], then an optimized version was proposed by Kuang and Perepechaenko in 2023[9]. A forged signature attack was reported by Guo in 2023[10].

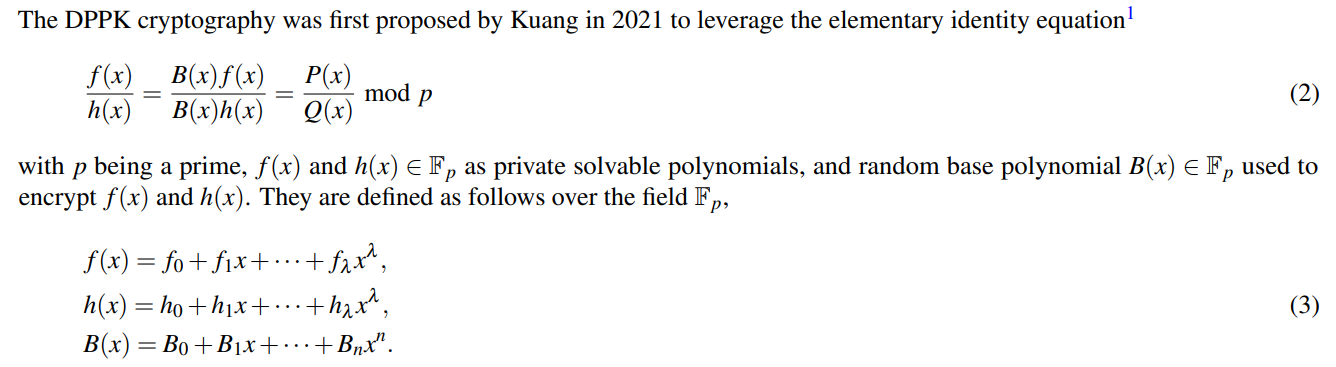

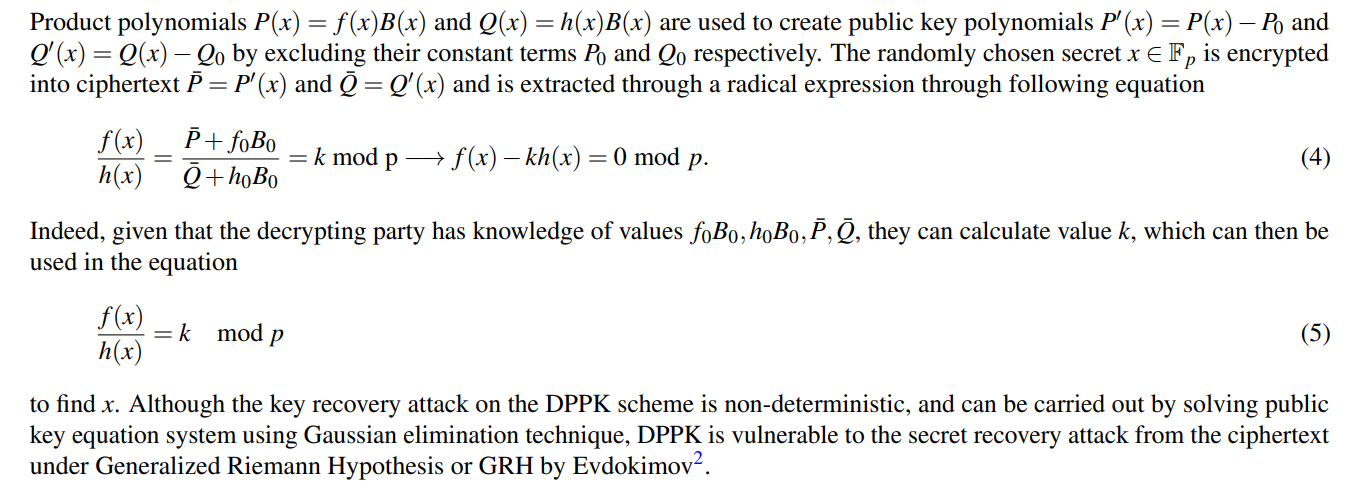

4.1 DPPK

\

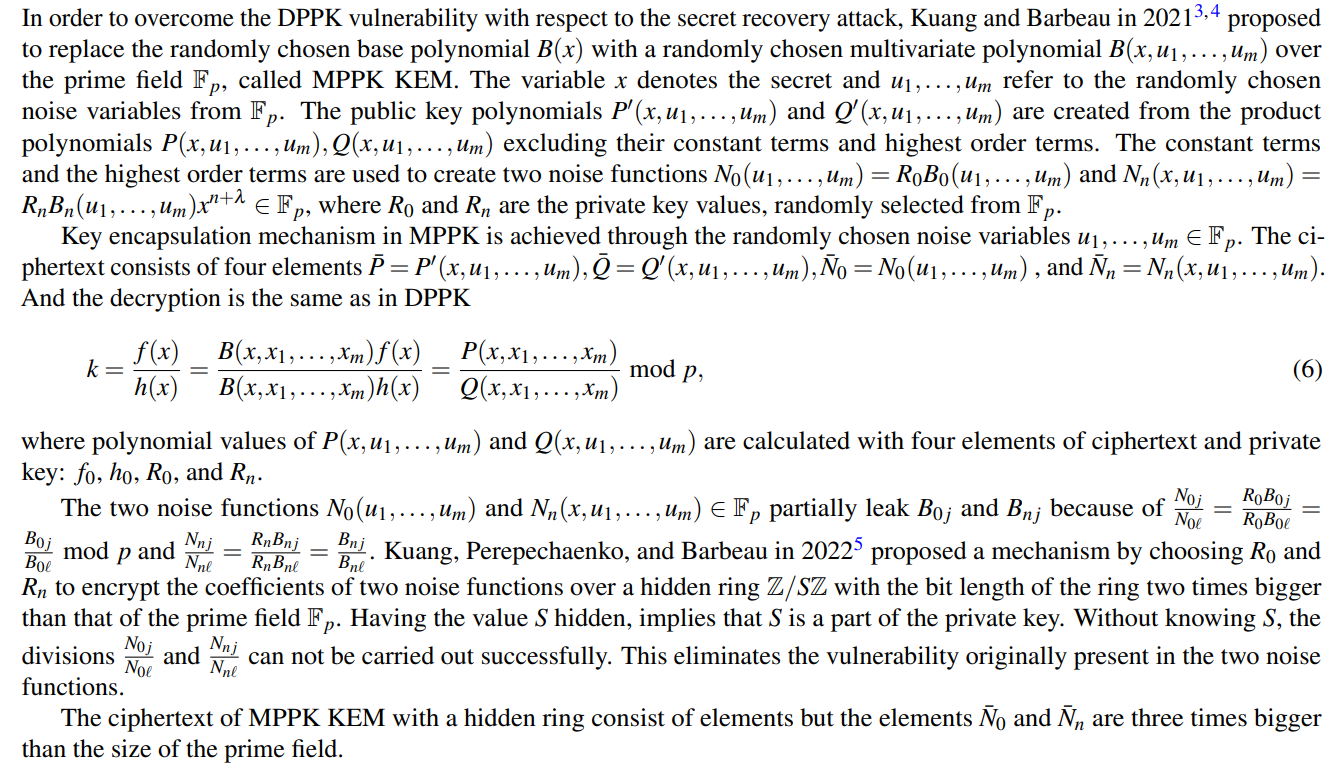

4.2 MPPK Key Encapsulation Mechanism

\

\

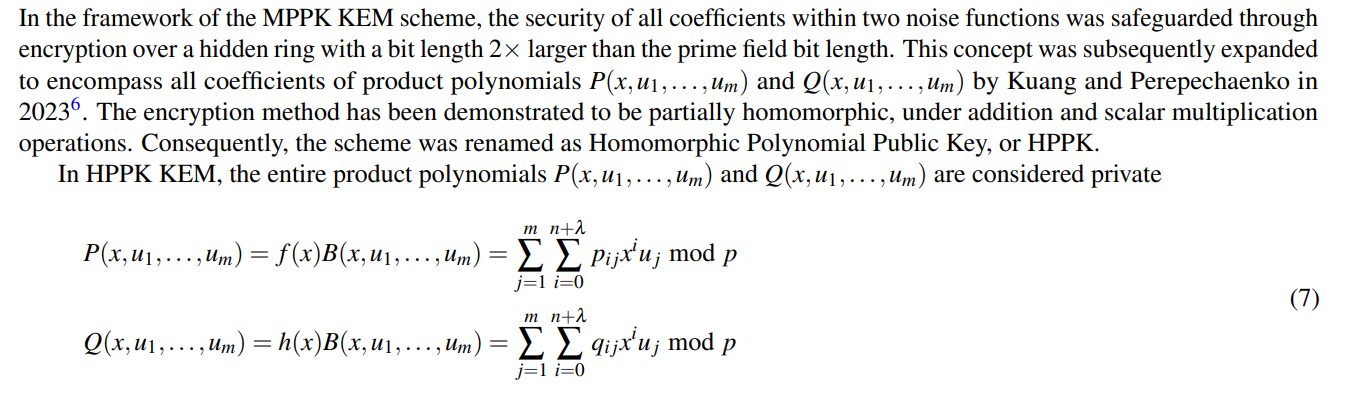

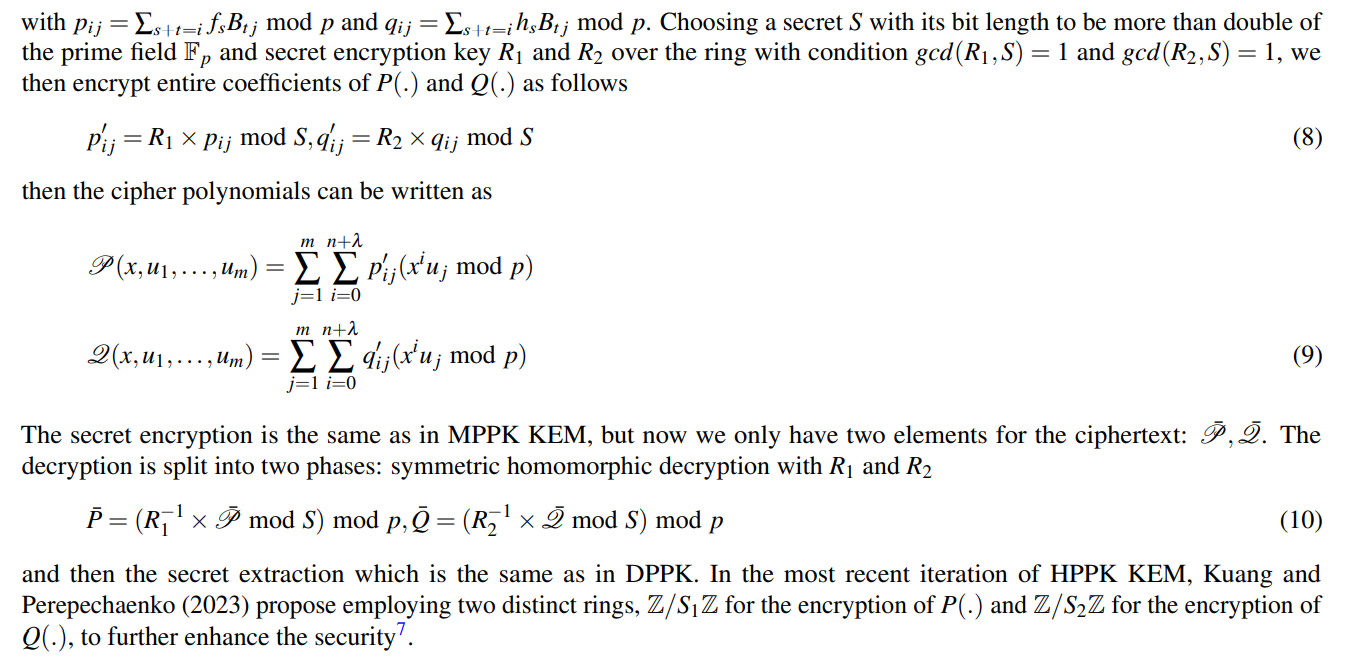

4.3 HPPK KEM

\

\ \ \

\

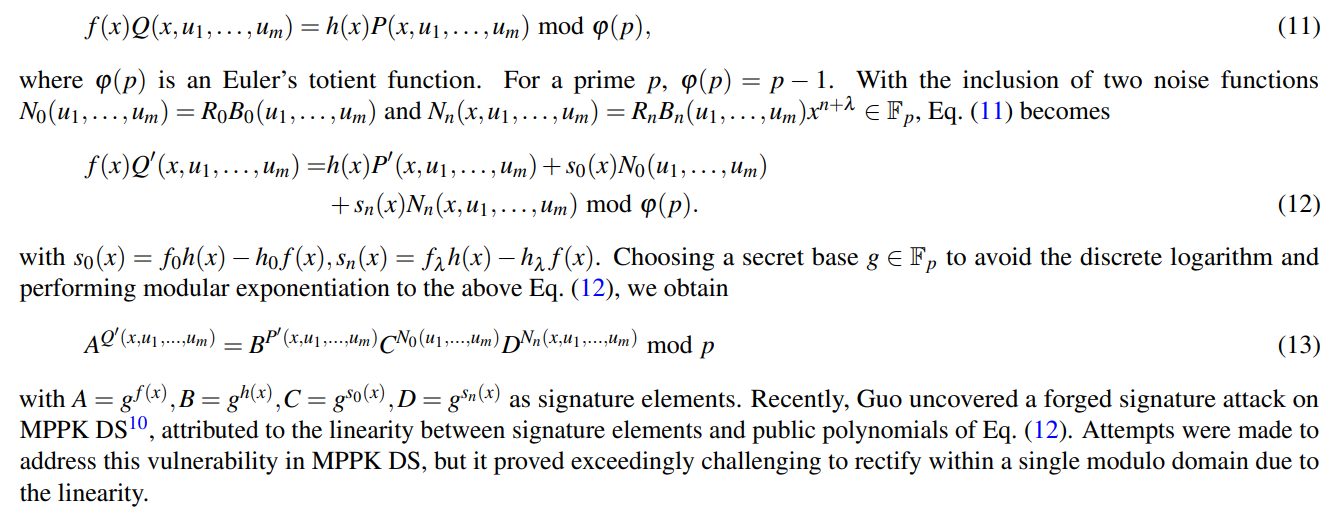

4.4 MPPK DS

A digital signature scheme based on MPPK has been proposed by Kuang, Perepechaenko, and Barbeau in 2022[8] and later optimized variant was proposed by Kuang and Perepechaenko in 2023[9]. MPPK digital signature scheme originated from MPPK over a single prime field[3, 4]. The signature verification equation stems from the identity equation

\ \

\ \ \

:::info Authors:

(1) Randy Kuang, Quantropi Inc., Ottawa, K1Z 8P9, Canada (randy.kuang@quantropi.com);

(2) Maria Perepechaenko, Quantropi Inc., Ottawa, K1Z 8P9, Canada;

(3) Mahmoud Sayed, Systems and Computer Engineering, Carleton University, Ottawa, K1S 5B6, Canada;

(4) Dafu Lou, Quantropi Inc., Ottawa, K1Z 8P9, Canada.

:::

:::info This paper is available on arxiv under ATTRIBUTION-NONCOMMERCIAL-SHAREALIKE 4.0 INTERNATIONAL license.

:::

\

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Zepto Life Technology Launches Plasma-Based FungiFlex® Mold Panel as CLIA Reference Laboratory Test