Saylor Predicts Bitcoin to ‘Move Up Smartly Again’ in 2025: Why Bet on Bitcoin Hyper

Michael Saylor, executive chairman of MicroStrategy and the top corporate Bitcoin holder worldwide, recently said he expects Bitcoin to “move up smartly again” toward the end of 2025. His words carry significance.

Saylor’s prediction comes at a time when institutional demand is fueling the market. Spot Bitcoin ETFs in the US now hold around 1.32 million $BTC, accounting for more than 6% of the circulating supply, with weekly inflows regularly surpassing 20,000 $BTC.

In the past month alone, ETFs have absorbed nearly nine times more $BTC than miners produced. This steady demand is one of the strongest structural signals the market has ever seen.

For investors, the message is clear: the institutional era of Bitcoin has arrived, and the stage is set for a major upward move. While Bitcoin itself remains crucial, its potential gains are more gradual than before.

That’s where Bitcoin Hyper ($HYPER) comes into play. Having raised just over $18M during its presale, it provides an opportunity to leverage Bitcoin’s growth while aiming for higher returns.

Join the presale of Bitcoin Hyper now.

Why Saylor’s Call Resonates

Michael Saylor has become synonymous with corporate Bitcoin conviction. Through every market downturn, he reiterated his belief that Bitcoin is the ultimate hedge against inflation and monetary debasement.

Today, MicroStrategy holds nearly 639,000 $BTC, making it the largest corporate treasury of any kind.

When he says Bitcoin will “move up smartly again” in late 2025, he’s not referencing speculation; he’s referring to fundamentals. ETFs buy more than miners can supply, institutions are finally positioned through regulated vehicles, and corporations increasingly hold BTC on their balance sheets.

The imbalance between demand and new supply is the exact condition that historically signals Bitcoin’s strongest rallies.

That’s why the market is looking towards projects that combine Bitcoin’s credibility with innovation and scalability.

Bitcoin Hyper ($HYPER) is tailored precisely for that niche. Designed as a Layer 2 scaling solution, it enhances speed, capacity, and new functionalities for Bitcoin.

Users can bridge BTC, make transactions with near-instant finality, and access staking or DeFi applications, all while settlements are secured by Bitcoin’s main chain and verified with zero-knowledge proofs.

By utilizing Solana’s Virtual Machine (SVM), Bitcoin Hyper offers scalability without compromising trust.

Why the Presale of Bitcoin Hyper Matters

The momentum is strong, and with over $18M now raised, Bitcoin Hyper has established itself as one of the top presales of 2025. The appeal is straightforward:

- Direct Bitcoin alignment – Enhances BTC rather than competing with it.

- Utility-driven design – Unlocks DeFi, staking, and scalable operations.

- Strong presale traction – Over $18M raised before listing.

- Attractive entry price – Discounted access ahead of exchanges.

This isn’t about chasing hype; it’s about positioning for growth in a way that supports Bitcoin’s institutional adoption story.

Tokenomics: Building for Growth

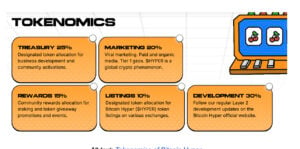

Another strength of Bitcoin Hyper is the clarity and the transparency of its tokenomics, which are designed to balance innovation, adoption, and community incentives:

This allocation shows us a commitment to both long-term growth and active community participation, which are incredibly important in Web3.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

UK crypto holders brace for FCA’s expanded regulatory reach