Bitcoin’s Next Move: Support at $114K or Deeper Correction?

After briefly approaching $117,000 earlier this week, the leading cryptocurrency faced rejection at that zone and is now trading near $113,200.

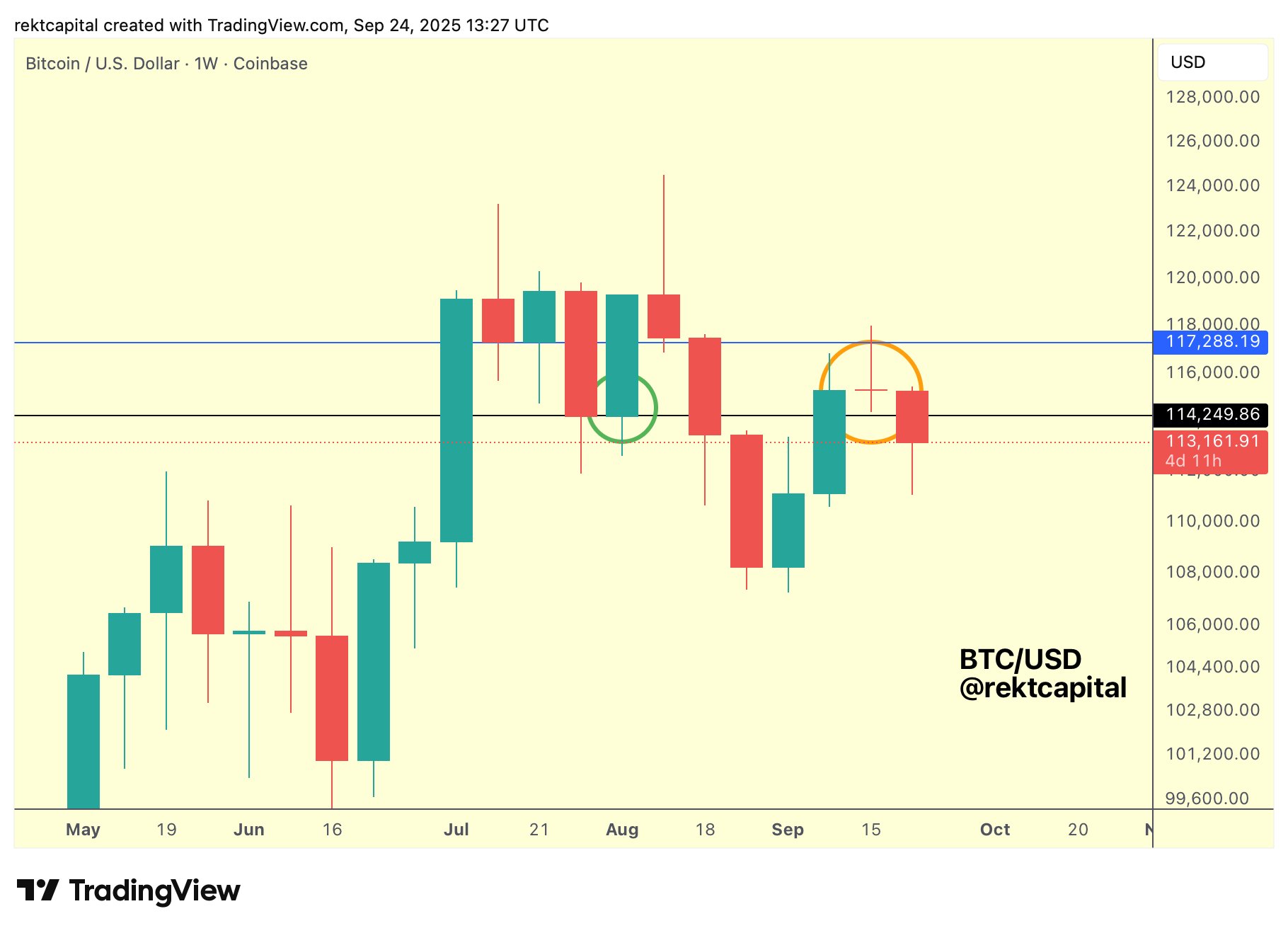

Market analyst Rekt Capital noted that the $117,200 level is proving to be a major resistance point. He added that the next test for Bitcoin will be whether it can hold $114,000 as support. If confirmed, the recent rejection may be seen as relatively shallow, potentially allowing for another push higher.

The daily Relative Strength Index (RSI) remains neutral around 55, suggesting neither overbought nor oversold conditions. This reflects market indecision as Bitcoin consolidates after a volatile September marked by rapid swings between $112,000 and $120,000.

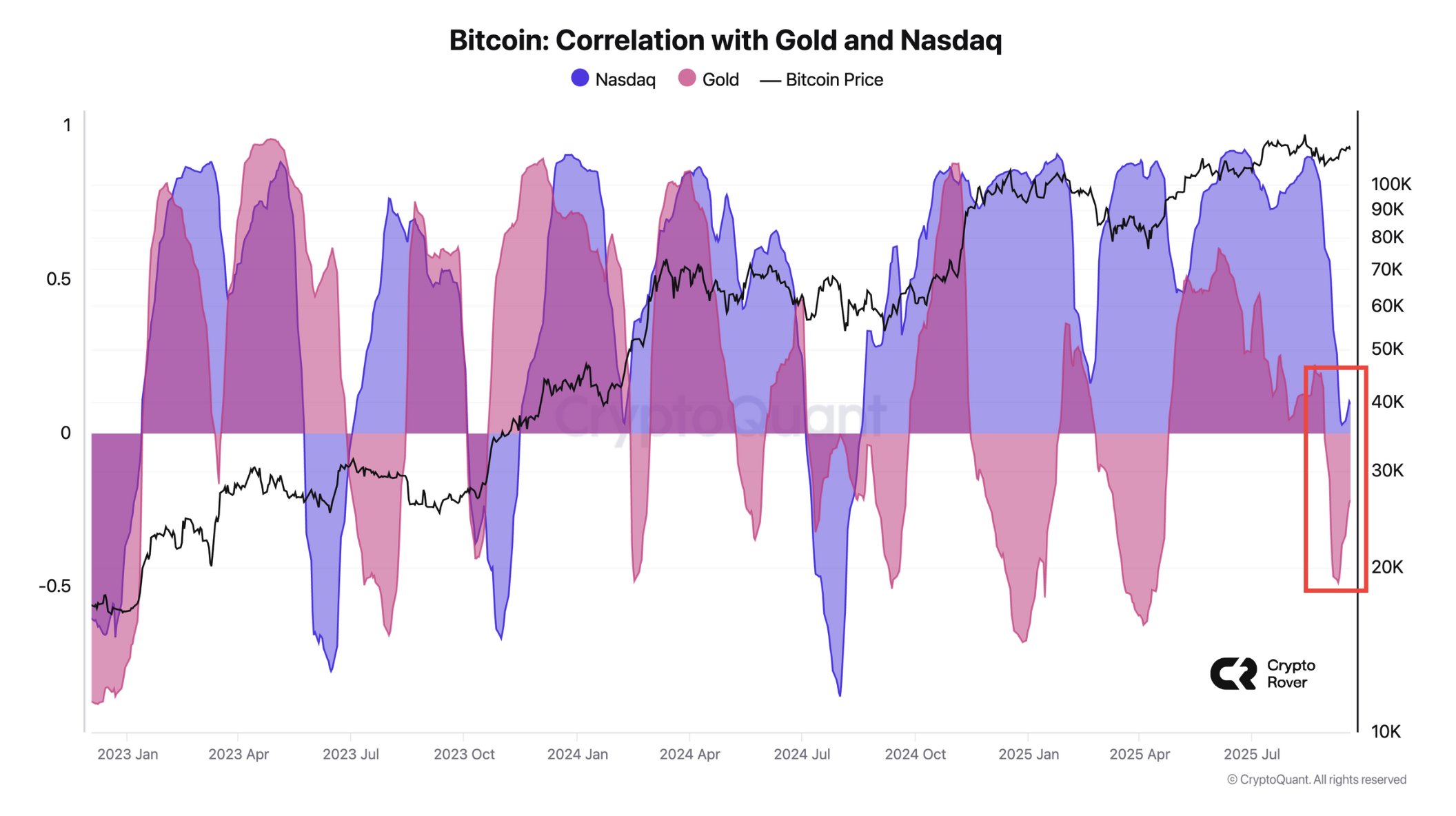

Meanwhile, fresh data highlights a divergence between Bitcoin and traditional markets. According to Crypto Rover, correlations with gold and Nasdaq stocks have recently weakened.

Historically, such breaks in correlation often precede sharp price moves as Bitcoin reasserts itself as a distinct asset class.

READ MORE:

Bitcoin Price: 3 Bearish Signals Point to Deeper Drop

Despite the pullback from $117K, Bitcoin remains well above its May lows near $110,000, which has served as strong support throughout the summer. Traders now look for confirmation at $114K to gauge whether this rejection is temporary or the beginning of deeper retracement.

With October historically one of Bitcoin’s stronger months, analysts caution that the coming weeks may prove decisive in shaping the next leg of the trend.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin’s Next Move: Support at $114K or Deeper Correction? appeared first on Coindoo.

You May Also Like

The Channel Factories We’ve Been Waiting For

Ripple (XRP) CEO Brad Garlinghouse Makes Another Statement Regarding the Anticipated US Cryptocurrency Legislation