Bitcoin falls to $108K, dropping 3.6% in 24 hours and nearly 7% over the week

Bitcoin fell to $108,000 on Thursday, dropping 3.6% in 24 hours, and nearly 7% for the week, according to data from CoinGecko.

The decline triggered widespread losses across crypto markets, sending Ethereum down 8% to $3,887 and bringing Ether’s four-week loss to 23%.

The sell-off came with a spike in liquidations, wiping out more than $1.1 billion in trades over a 24-hour period. The majority of that, over $1 billion, were long bets that prices would rise.

Dogecoin fell 7.6%, trading near $0.23, while Solana dropped 7.7% to $197.52. Both tokens are now down 21% over the last seven days, ranking them as the week’s worst performers in the top 100.

The pullback also lined up with weakness in U.S. equities. The S&P 500, Nasdaq, and Dow Jones Industrial Average all ended Thursday in the red.

Long-term holders dumped Bitcoin while ETFs went silent

Bitcoin’s latest rally, which hit a post-FOMC high of $117,000, has reversed into what analysts describe as a classic “buy the rumour, sell the news” pattern. Glassnode analysts said Thursday that Bitcoin is now “showing signs of exhaustion” as ETF demand stalled and long-term investors began locking in profits.

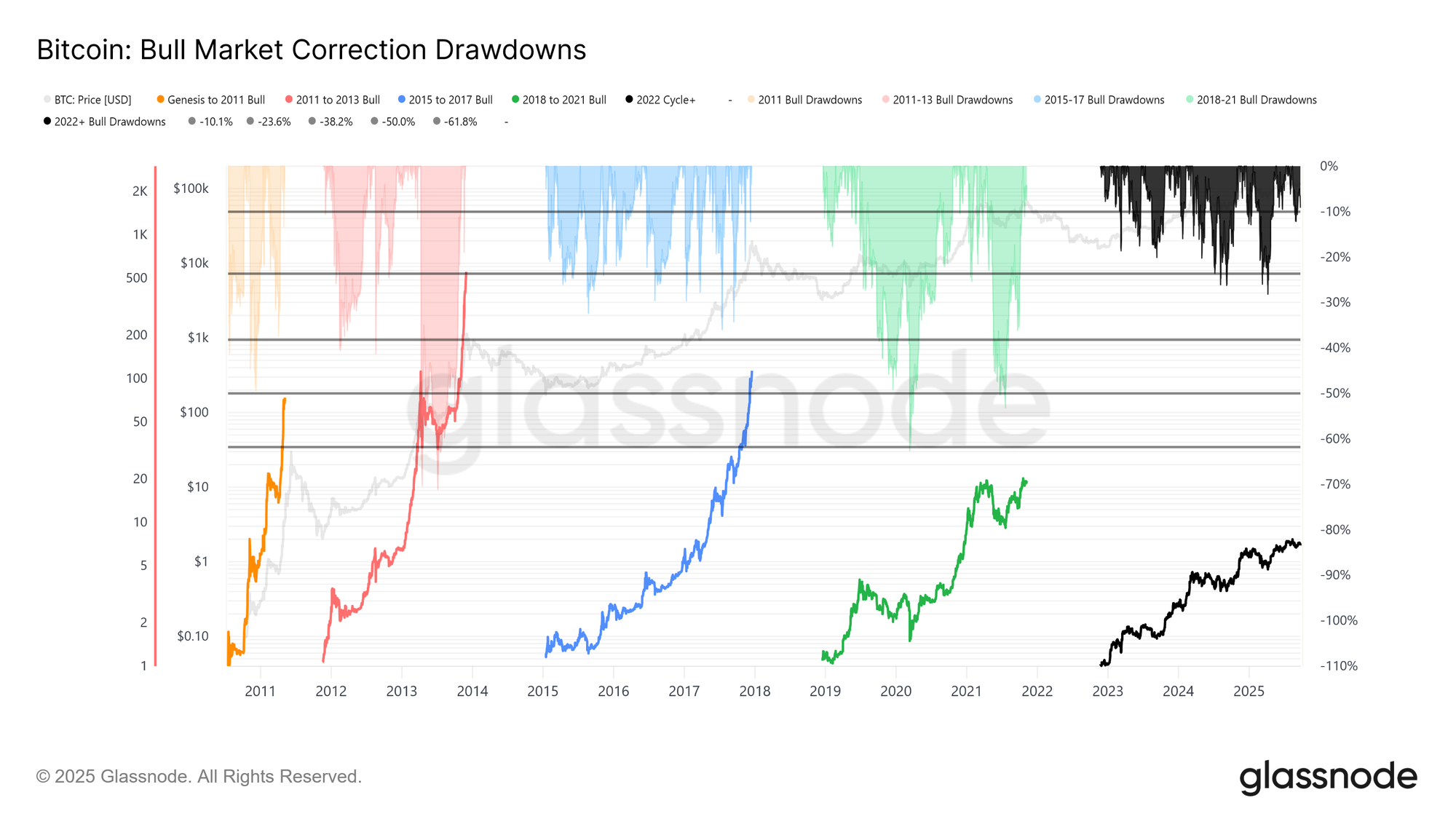

The current drop, from $124,000 down to $113,700, equals an 8% decline. That’s mild compared to this cycle’s 28% drawdown or the 60% drops seen in previous ones. But analysts also noted that Bitcoin’s volatility has been shrinking over time, now resembling the slow climb seen between 2015 and 2017. There’s been no blow-off top yet.

Source: Glassnode

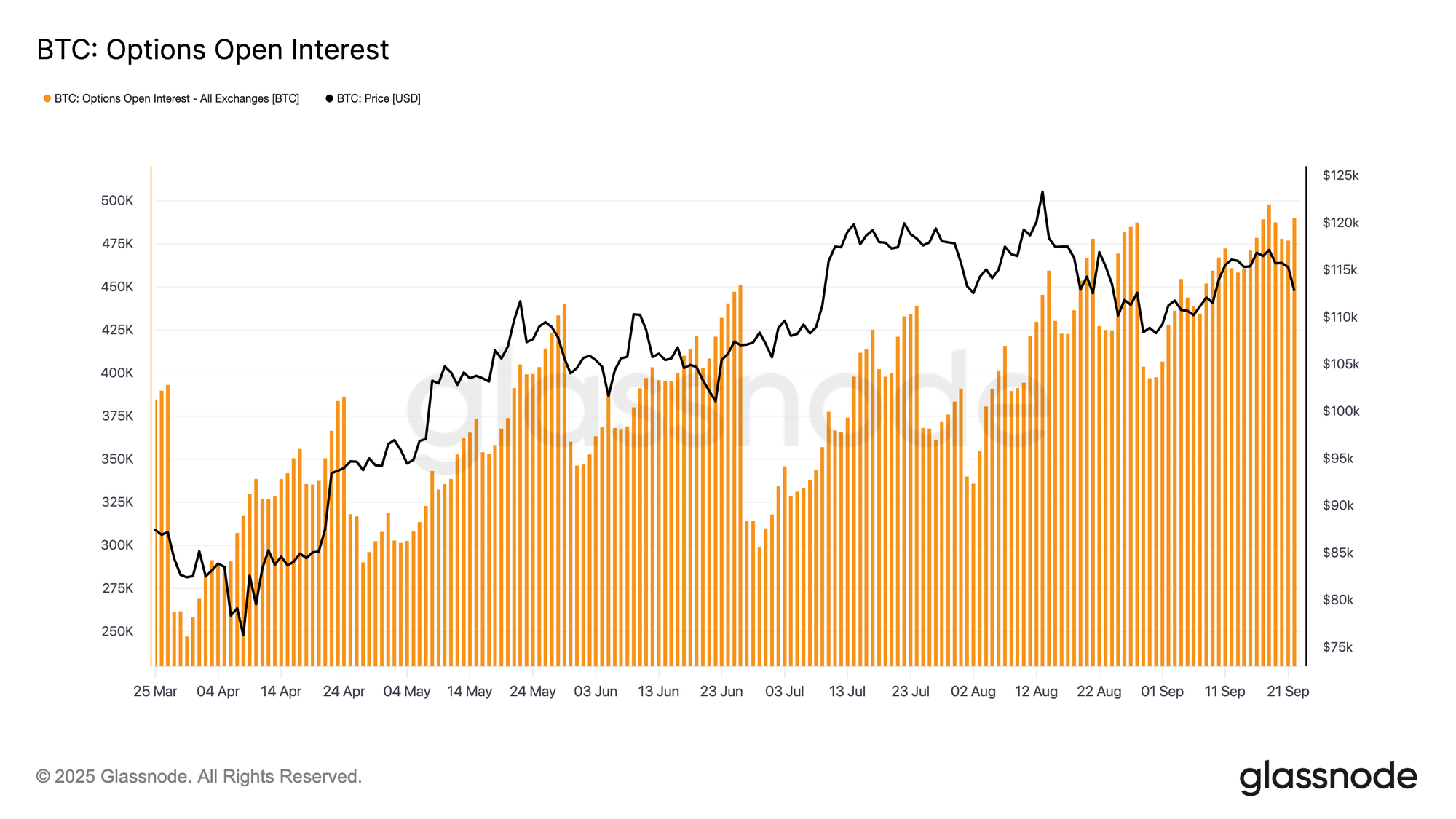

Source: Glassnode

This cycle has lasted around 1,030 days, just shy of the 1,060-day duration seen in the last two. On-chain data shows capital deployment has moved in three waves since November 2022, lifting Realized Cap to $1.06 trillion. Capital inflows are now at $678 billion, nearly twice the last cycle’s $383 billion.

This wave didn’t come all at once. Each time over 90% of moved coins were in profit, that signaled a top. The crypto just backed away from its third such spike. Long-term holders have sold 3.4 million BTC, already more than they did in past cycles.

ETF flows, which helped soak up that supply earlier in the year, fell off a cliff. Around the FOMC, long-term holders were unloading at a rate of 122,000 BTC per month, while ETF net inflows dropped from 2,600 BTC/day to nearly zero. That created a weak environment, as selling pressure rose and new demand dried up.

Futures and options exposed the market’s fragility

Spot markets cracked first. As Bitcoin dropped, trading volume exploded, and thin order books couldn’t handle the flow. That pushed the price under $113,000 and triggered a sharp flush in futures. Open interest dropped from $44.8 billion to $42.7 billion, forcing over-leveraged traders to exit and magnifying the fall.

Heatmaps from Coinglass showed major liquidation clusters between $114,000 and $112,000, clearing out leveraged longs. That created a short-term floor near $111,800, where the short-term holder’s cost basis now sits.

But price remains unstable. Risk levels still hover around $117,000, and without stronger buying, prices could swing even more. In the options market, volatility surged before the FOMC and then cooled once the rate cut was confirmed.

That didn’t last. A Sunday futures crash reignited the fear trade. One-week implied volatility jumped, and pressure spread to longer contracts. On Friday, 1W skew spiked from 1.5% to 17%, showing that traders scrambled for downside protection.

That rush was real. Two days later, the biggest liquidation since 2021 hit the market. The put/call volume ratio dropped after that, as traders cashed out their puts and moved to cheaper calls. Still, Skew data shows the market is still tilted toward more puts, keeping protection expensive and upside cheap.

Total options open interest is still near record highs. Most of that will reset after Friday morning’s expiry. Until then, dealers are pinned in a peak gamma zone, forced to hedge every tiny move.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.

You May Also Like

XAU/USD picks up, nears $4,900 in risk-off markets

Altcoin Season Incoming? Lyno AI Presale Buzz Surpasses Dogecoin and Shiba Inu Hype