Money and Crypto: How Much Actually Exists in 2025

The answer depends on what we count as money: only paper bills or everything — from deposits to digital assets.

From Cash to Digital: What Money Really Is Today

Many still think of money as cash. But in today’s economy that is just a small fraction. Most of it is digital: in accounts, in deposits, circulating through financial platforms.

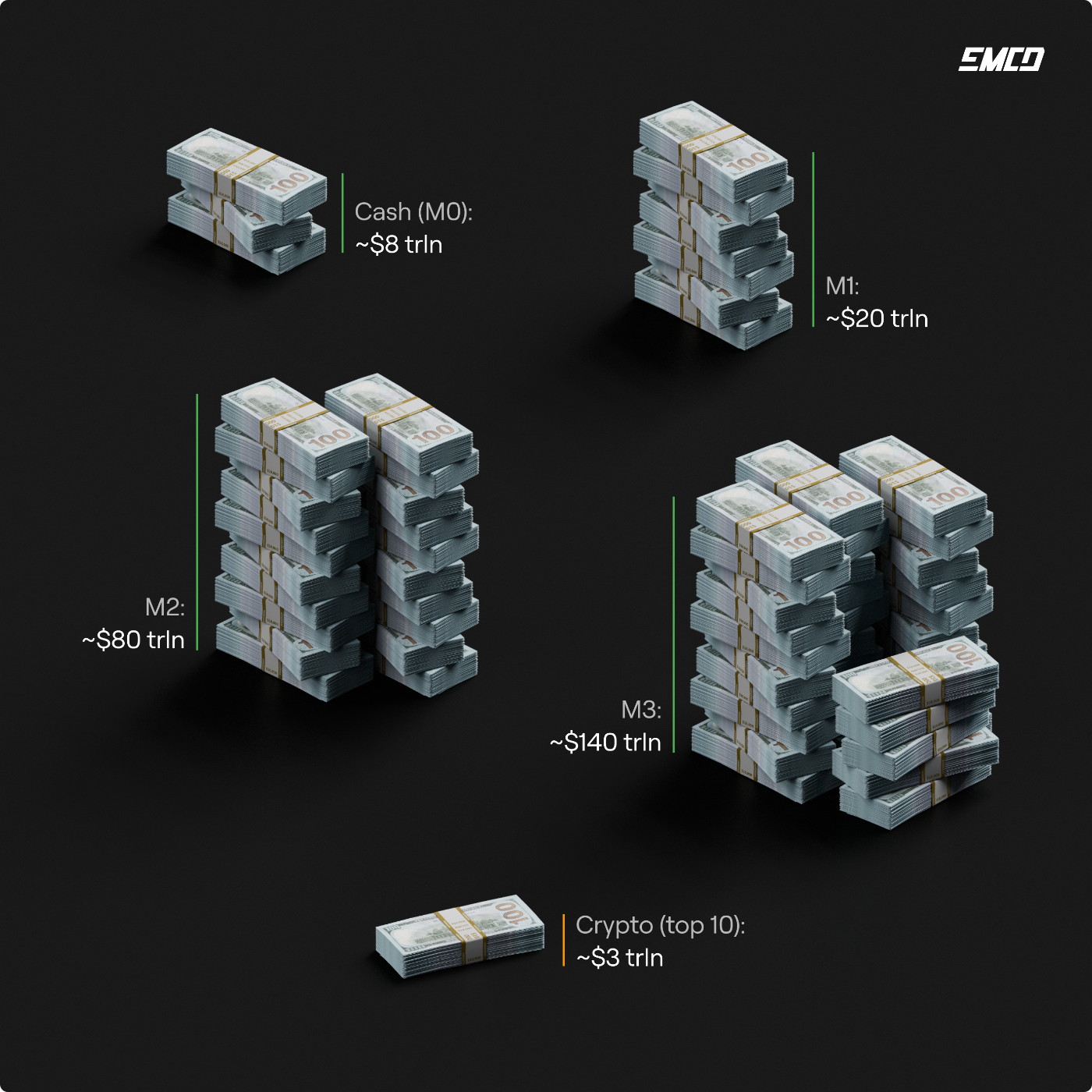

Economists split money supply into levels from M0 to M4. Each next one includes the previous and adds new forms.

M0 — cash \n M1 — plus checking accounts \n M2 — savings included \n M3 — large deposits and market instruments \n M4 — everything plus credit elements

The higher the level, the less physical it is and the more it reflects real economic circulation.

Why the World Still Counts in Dollars

To compare scales, we need a common reference point. That is the dollar. Not because other currencies don’t exist, but because the system works this way.

About 85% of global FX transactions involve the dollar. More than 58% of international reserves are also held in USD, making it the universal settlement tool for the world economy. Most global debt is denominated in dollars as well.

Oil, gas, gold, and other commodities are almost always priced in USD. Even if the settlement is in euros or yuan, the reference price is still the dollar.

Crypto works the same. Exchanges, stablecoins, and DeFi protocols all use USD as the main metric. That is why when people compare crypto to money supply, they use dollars. It is convenient, clear, and objective.

Bitcoin and Crypto on the Global Scale in 2025

Now comes the key part. What is all crypto worth, and how does it compare to global money?

By mid-2025bitcoin market cap ranges between $2.05 and $2.05–2.18 trln. The top 10 cryptocurrencies, including ether and BNB, are worth about $3.3 trln. That is roughly 90% of the entire digital asset market, with the rest split among thousands of smaller projects.

Broad money (M3) in 2025 is around $140–150 trln. Some wider estimates of total assets, including non-financial, go up to $500 trln, but those are beyond classic monetary aggregates.

The result: against M3 bitcoin is about 1.4%. The top 10 cryptos combined — about 2.2 %. That is small in absolute terms, but for a young industry it is significant growth. Yes, the numbers rise, but compared to the whole system, it is still a tiny slice.

Small Share, Big Shift: The Real Power of Crypto

Cryptocurrencies do not need to take over the world instantly. Their strength is not in share of money supply, but in the model. This is an alternative money architecture — no central control, open-source code, independent logic. For the first time in history money can exist without being issued by a state.

Yes, crypto is just 1–2% today. But this is the percent you can move without a bank or centralized intermediaries, 24/7, anywhere in the world. And that bonus is not just numbers — it is a rule change.

A question I keep asking myself: are we ready for that share to grow much bigger?

I’ll keep sharing numbers, trends, and personal insights here — follow me to keep up.

You May Also Like

XMR Technical Analysis Jan 22

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here’s the Day-by-Day, Hour-by-Hour List