Ford (F) Stock Hits 52-Week High as Investors Bet on Electric Truck Dreams

TLDR

- Ford Motor Company stock reached a new 52-week high at $11.99, delivering 24.63% returns year-to-date

- The company plans to launch a $30,000 electric pickup truck by 2027 on its new Universal EV Platform

- Ford is recalling over 115,000 vehicles due to steering and electrical defects

- The automaker will cut up to 1,000 jobs at its German EV plant due to weak European demand

- Ford’s EV division posted a $1.3 billion loss in Q2, widening from the previous year

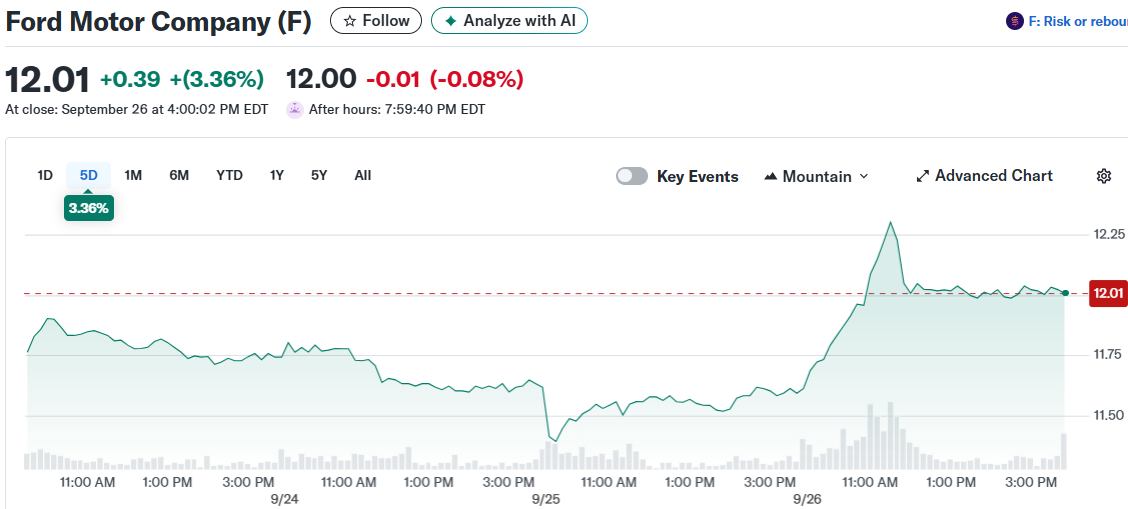

Ford Motor Company stock reached a new 52-week high of $11.99, marking an impressive 24.63% return year-to-date. The automaker’s shares have climbed steadily as investors weigh the company’s electric vehicle ambitions against ongoing operational challenges.

Ford Motor Company (F)

Ford Motor Company (F)

The stock’s recent performance reflects renewed investor confidence in Ford’s strategic direction. With a market capitalization of $47.56 billion, the company offers shareholders a 6.45% dividend yield. However, analysts suggest the stock appears slightly overvalued at current levels.

Ford’s management recently unveiled plans for a $30,000 electric pickup truck set to launch by 2027. This unnamed vehicle will be the first built on Ford’s new Universal EV Platform. CEO Jim Farley emphasized the company’s commitment to this strategy, stating they’ve lived through too many failed attempts by Detroit automakers to create affordable vehicles.

The new platform promises manufacturing efficiencies with 20% fewer parts than typical vehicles and 15% faster assembly times. Ford aims to compete in a market where the average EV transaction price sits around $57,000, making their target price point attractive to consumers.

Production Challenges Mount

Despite these ambitious plans, Ford faces immediate operational hurdles. The company will cut up to 1,000 jobs at its Cologne, Germany electric vehicle facility due to weaker-than-expected European demand. The plant will shift to single-shift operation starting January 2026.

Ford’s EV division continues bleeding money, posting a $1.3 billion loss in the second quarter. This represents a widening loss compared to the previous year, driven by battery production costs, tariffs, and investments in next-generation models.

The automaker previously promised its EV segment would achieve profitability by the end of 2026. That timeline now appears increasingly optimistic given current losses and market conditions.

Ford is also grappling with multiple safety recalls affecting over 215,000 vehicles. The National Highway Traffic Safety Administration announced recalls for steering column defects in 115,539 vehicles. Additional recalls involve electrical issues in Ford Expedition and Lincoln Navigator SUVs that could cause underhood fires.

Over 100,000 Taurus sedans face recall due to door trim that might detach while driving, creating hazards for other motorists. These safety issues add to Ford’s operational costs and regulatory scrutiny.

Strategic Moves in Global Markets

Ford is establishing a wholly owned subsidiary in China to manage passenger car and pickup truck operations. The new entity will handle marketing, sales, and service, with operations beginning in October.

This move comes as traditional automakers reassess their EV commitments. Toyota recently scaled back its 2026 EV manufacturing goals by one-third. Volvo abandoned its plan to go fully electric by 2030, citing rising costs and uncertain consumer demand.

Ford’s stock carries a beta of 1.53, indicating higher volatility than the broader market. Investors are essentially betting on the company’s ability to execute its EV strategy while managing current losses and operational challenges.

The automaker’s dividend yield remains attractive to income-focused investors. However, the sustainability of these payments depends on Ford’s ability to return its EV operations to profitability.

Ford’s recent stock performance suggests investors remain cautiously optimistic about the company’s electric vehicle pivot. The $30,000 pickup truck represents a potentially game-changing product if Ford can deliver on its promises by 2027.

The post Ford (F) Stock Hits 52-Week High as Investors Bet on Electric Truck Dreams appeared first on CoinCentral.

You May Also Like

U.S. Moves Grip on Crypto Regulation Intensifies

Sokin Appoints Former FT Partners VP Tom Steer as Chief Financial Officer