Bitcoin Bull Market Endures as On-Chain Data Confirms Strength

- On-chain MVRV ratio signals market resilience, showing neither panic nor euphoria among Bitcoin investors.

- Long-term holders reduce selling, cutting available supply and supporting conditions for continued market strength.

The Bitcoin market has been volatile lately, but on-chain data suggests the bull market is far from over.

Recent analysis from XWIN Research Japan on CryptoQuant confirms that despite occasional price dips, the market structure remains resilient.

Currently, Bitcoin is trading at about $112,031, up 1.10% in the last four hours and 2.13% in 24 hours, while daily spot volume has reached $3.63 billion. These figures provide important background for understanding what is really happening behind the scenes on the blockchain.

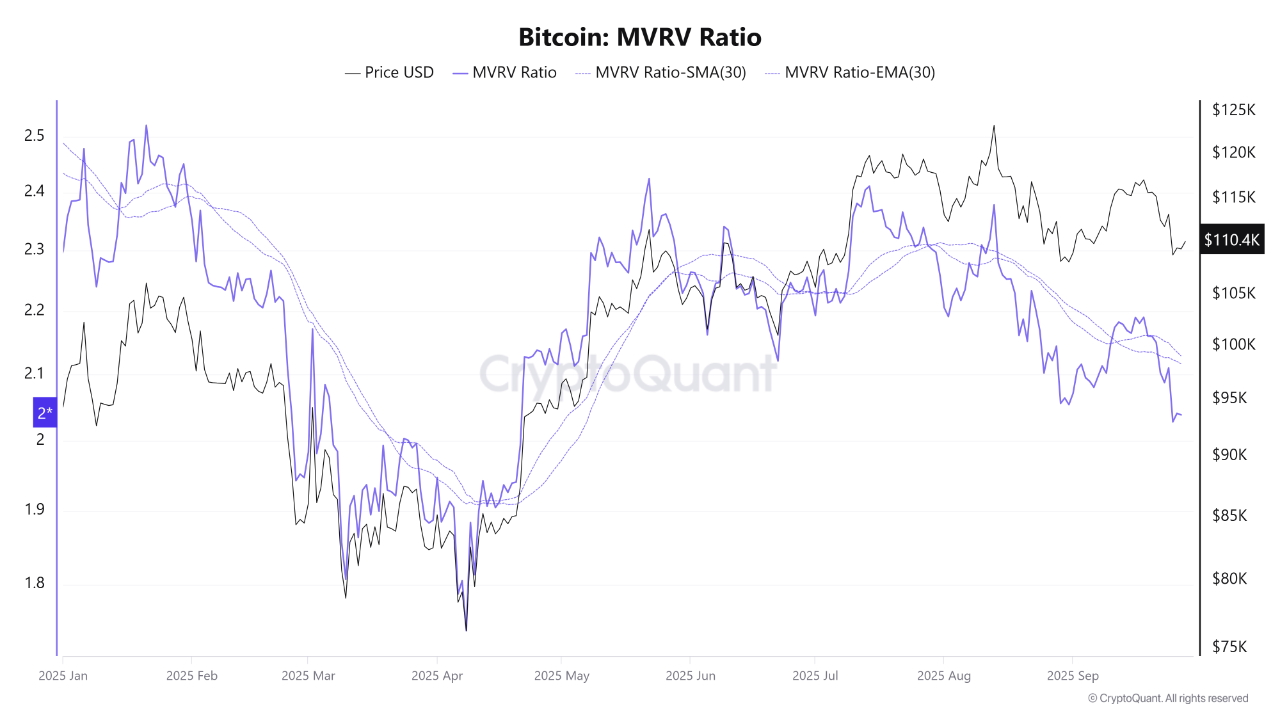

MVRV Ratio and Long-Term Holders Signal a Mid-Cycle Pause

The MVRV ratio, which compares market value to the average investor’s cost basis, is currently hovering around 2.0. This level typically reflects a neutral condition: there is no deep panic, but neither has it entered an overly euphoric state.

Source: CryptoQuant

Source: CryptoQuant

Investors are still holding onto healthy profits, while the market is experiencing a cooling-off phase. Historically, when the MVRV remains at this level after an initial rally, the market is typically catching its breath before entering a stronger expansionary phase.

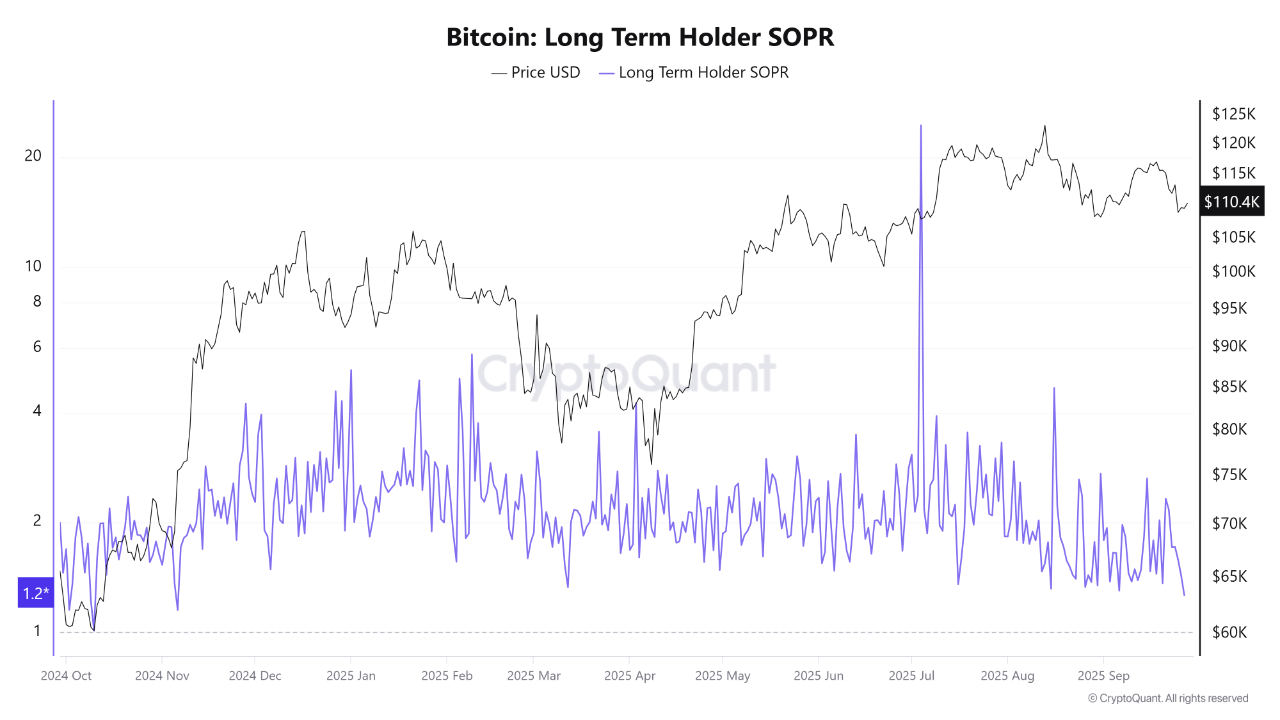

On the other hand, the behavior of long-term holders (LTHs) provides an additional story. Data shows that those who have held Bitcoin for months or even years are less tempted to release their assets to the market.

Source: CryptoQuant

Source: CryptoQuant

This confidence automatically narrows the supply, thus dampening short-term volatility. This is not the first time this has occurred. In 2017 and 2020, similar phases served as a pause before prices soared even higher. Therefore, it’s understandable that many analysts are calling the current situation a potential “mid-cycle” moment.

Furthermore, previous CNF reports have shown that supply on exchanges continues to shrink, while investor sentiment remains neutral.

This combination often indicates stored market energy awaiting release. Social signals even illustrate retail impatience, and past experience shows that such conditions often trigger major breakouts.

Bitcoin Faces Short Squeeze Risks Amid Institutional Confidence

Beyond on-chain factors, there are other dimensions that further strengthen optimism for Bitcoin. Michael Saylor, for example, predicts Bitcoin will outperform gold by up to tenfold.

The reason is simple: Bitcoin can be moved easily across borders, can be programmed as needed, and is already the reserve currency of many large companies. Institutions also seem unfazed by price fluctuations. Recent data shows that global treasury holdings have now surpassed 1.5 million BTC.

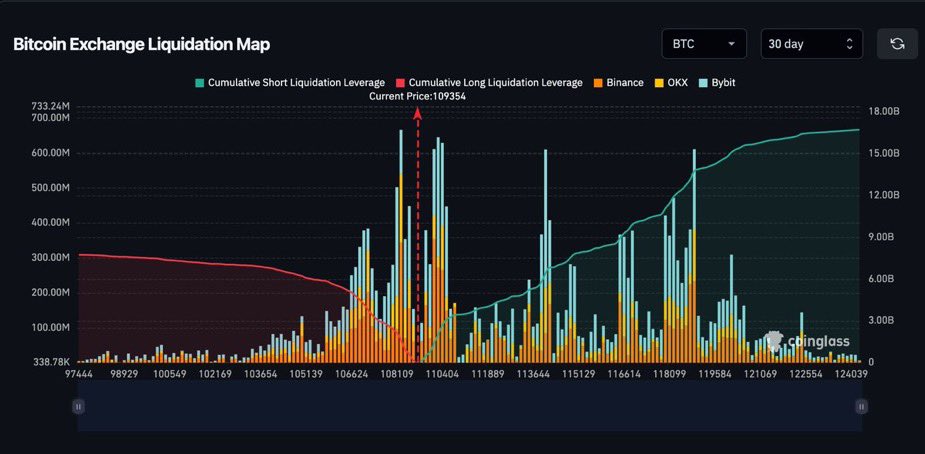

However, a larger shadow still looms. Whale Insider reports that there are $15 billion worth of Bitcoin short positions ready to be liquidated if the price reaches $120,000.

Source: Whale Insider on X

Source: Whale Insider on X

The question arises: is the market truly ready to break through that level anytime soon? If so, this wave of liquidations could provide additional fuel for the next rally.

Amid all these developments, there’s a small irony worth pondering: while retail investors are often panicking or impatient, long-term holders and institutions appear far more calm and prepared.

]]>You May Also Like

Three Reasons Why Pi Network (PI) Could Crash Again After Hitting a 3-Week High

Taiko Makes Chainlink Data Streams Its Official Oracle