BYD (BYDDY) Stock: Falls 5% in September as Japan EV Sales Struggle

TLDRs;

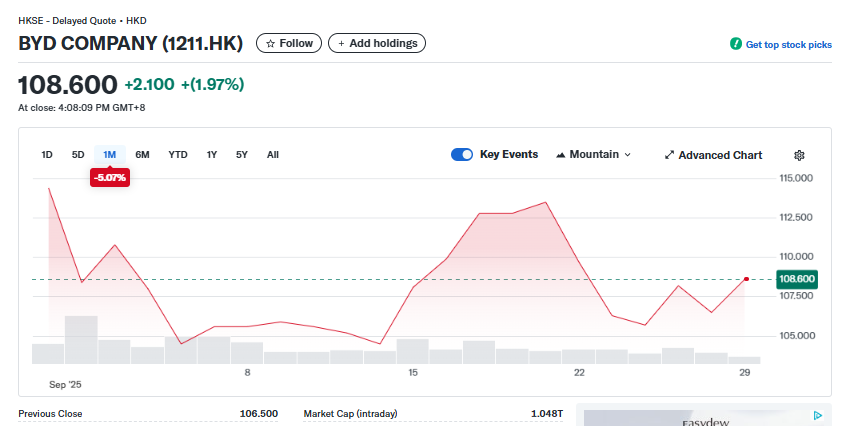

- BYD stock fell 5% in September amid weak Japan EV sales and Berkshire Hathaway’s complete exit from its long-held stake.

- Despite opening 45 dealerships and launching four models, BYD has sold only 5,300 EVs in Japan since 2023.

- Discounts up to ¥1 million plus subsidies cut prices by as much as 50%, a rare tactic in Japan.

- Japan’s consumers still favor hybrids from Toyota and Honda, leaving full EV adoption stuck at just 3.4% of sales.

Chinese electric vehicle (EV) giant BYD Co.(1211.HK) saw its stock dip 5% in September, weighed down by disappointing sales in Japan and investor unease following Berkshire Hathaway’s full divestment of its long-held stake.

Despite being the world’s top EV maker by volume, BYD’s international expansion remains uneven, with Japan proving to be one of its toughest markets yet.

BYD COMPANY (1211.HK)

BYD COMPANY (1211.HK)

Weak Sales Despite Aggressive Expansion

Since entering Japan in 2023, BYD has poured resources into building brand presence. The company has opened 45 dealerships, introduced four EV models, and announced plans to launch an electric kei car in late 2026, a microcar segment that dominates Japanese city streets.

Yet the results have been underwhelming. Between January 2023 and June 2025, BYD sold just 5,300 vehicles, highlighting a stark contrast to the company’s rapid uptake in Europe and China. In June, BYD managed only 512 units, far behind Nissan’s Sakura mini-EV, which sold 1,137 units that month.

The core issue appears to be consumer preference. While EV adoption globally is growing, in Japan only 3.4% of new car sales are fully electric. Most buyers continue to choose hybrid vehicles from Toyota and Honda, reflecting strong loyalty to local brands and skepticism toward foreign entrants.

Price Cuts to Spark Demand

To counter sluggish demand, BYD has launched aggressive discounts rarely seen in Japan’s automotive market. Buyers can now receive up to ¥1 million (US$6,700) off certain models, with government subsidies further lowering costs. When combined, prices can fall by as much as 50%, placing BYD’s Atto 3 crossover at just under ¥4.2 million.

Price competition has worked for BYD in China, where discounting helped cement its leadership. But in Japan, analysts warn it could backfire.

The strategy also stands out because Japanese automakers rarely slash sticker prices. If BYD’s gamble fails, it could reinforce perceptions that foreign EVs are struggling to find footing in the world’s third-largest economy.

Berkshire Hathaway’s Exit

Adding to September’s downward pressure, Berkshire Hathaway exited its BYD investment, ending a 15-year position that began in 2008 with a purchase of 225 million shares.

The conglomerate led by Warren Buffett had already been trimming its stake since 2022, but confirmation of a full exit sent BYD shares tumbling 3.6% in Hong Kong on September 22.

The timing compounds investor jitters. BYD stock is now down roughly 30% from its peak four months ago, as the company faces slowing domestic demand in China, escalating price wars, and intensifying competition from rivals such as Tesla, Nio, and Li Auto.

Global Outlook Remains Mixed

Despite the Japan setback, BYD remains focused on scaling exports. The company expects overseas sales to account for 20% of total deliveries in 2025, with Europe emerging as a bright spot.

However, with its share price sliding and confidence shaken by Berkshire’s exit, investors are cautious about near-term prospects.

The Japanese market remains a symbolic test for BYD’s global ambitions. Success there could validate its aggressive pricing model abroad. Failure, on the other hand, would underscore the challenges of breaking into a market dominated by hybrids and consumer loyalty to local brands.

The post BYD (BYDDY) Stock: Falls 5% in September as Japan EV Sales Struggle appeared first on CoinCentral.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip