Pepe Coin Price Prediction: Could Remittix Return Higher Gains To Early Backers Than PEPE Did In 2022

But after its early breakout, many wonder if PEPE can still deliver significant upside or if that lightning-in-a-bottle moment is gone.

The latest Pepe Coin price prediction suggests moderate growth, driven by market sentiment and capital rotation from other meme tokens. Meanwhile, early investors are turning toward Remittix (RTX), a PayFi token combining real utility and startup-level growth.

Pepe Coin Price Prediction: Modest Upside After Consolidation

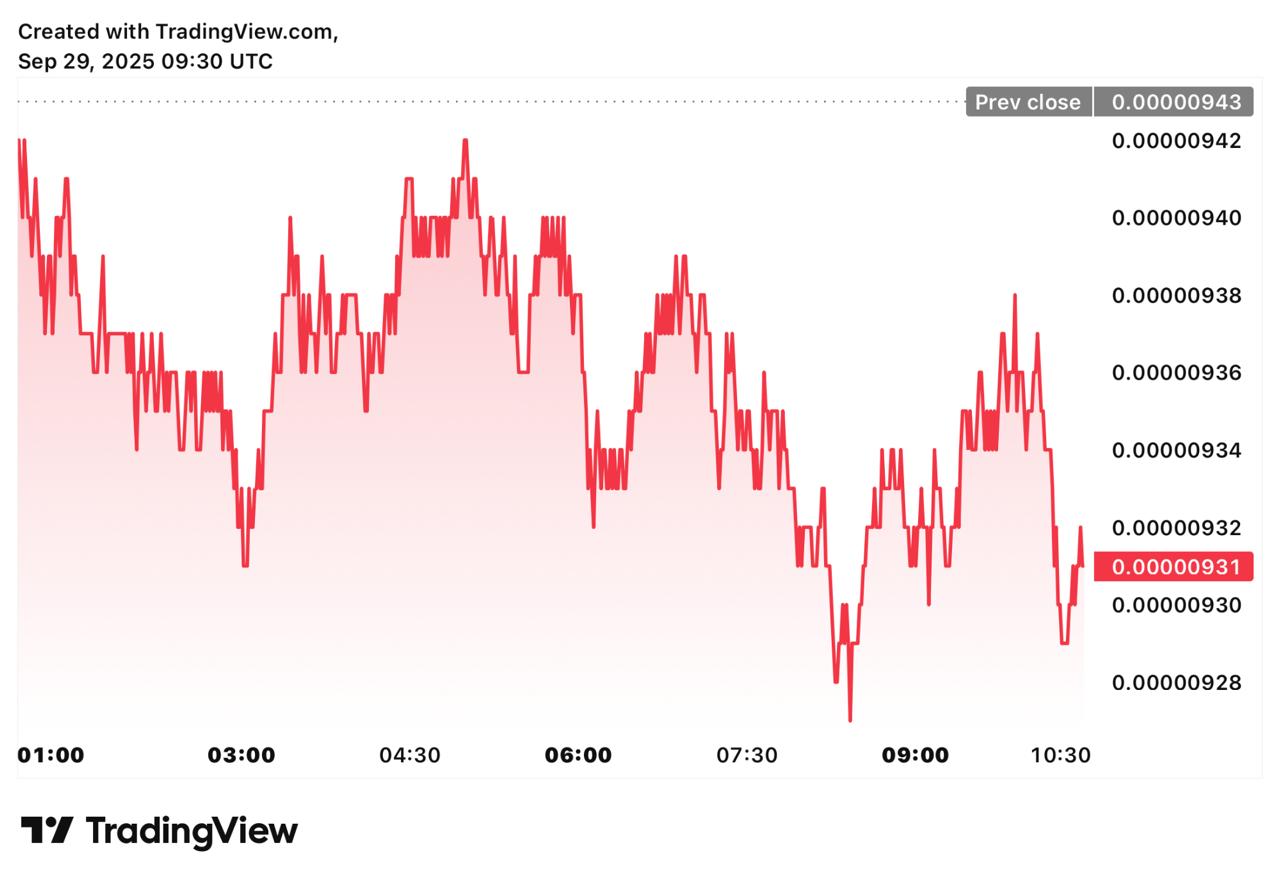

The Pepe Coin price trades near $0.00000931, down from its 2023 peak but still holding firm after a long consolidation phase. Technical analysts identify strong support around $0.00000090 and resistance at $0.0000013, which have framed its trading range for months.

In the near term, most Pepe Coin price predictions expect sideways action unless a new wave of meme speculation kicks in. To break higher, PEPE would likely need fresh liquidity and stronger exchange inflows, something analysts say is possible during the next Bitcoin-led rally. A climb toward $0.0000018 is feasible, but reclaiming old highs will require another viral catalyst.

What’s clear is that the easy gains are behind it. PEPE’s early investors saw historic 100x returns in 2022–2023, but the token now behaves more like a mid-cap meme asset than a moonshot. Its long-term path depends on sustaining engagement, not just hype.

Still, with millions of holders and an active online presence, Pepe Coin remains a crowd favorite for speculative traders.

Remittix: Real Utility, Record Funding, and Early Rewards

As meme tokens stabilize, Remittix (RTX) is stepping into the spotlight with a real use case and strong investor backing. Built on Ethereum, it enables users to send crypto directly to global bank accounts, complete with real-time FX conversion and no need for centralized exchanges. That practical approach has helped Remittix raise over $26.8 million, positioning it among the most successful launches of 2025.

Momentum is also building through its 15% USDT referral program, which rewards users daily via the project dashboard. Combined with a working beta wallet and full CertiK verification, Remittix is turning heads as one of the best cryptos to buy now for long-term adoption potential.

Why Remittix Is Catching Attention:

- Presale surpasses $26.8M, reflecting massive community demand

- 15% USDT referral program, rewarding participants instantly

- Wallet beta testing is live, giving users a hands-on PayFi experience

- Verified by CertiK and ranked #1 Pre-Launch Token on Skynet

- Solves real payment challenges, bridging crypto and bank transfers

For investors comparing upside potential, analysts argue that early Remittix (RTX) buyers could see larger percentage gains than late-stage Pepe Coin holders, simply because Remittix is still in its growth phase.

Pepe Coin Price Prediction Levels Out, While Remittix Surges Past $26.8M

The Pepe Coin price prediction suggests stability but limited fireworks compared to its breakout years. It remains a strong meme-sector name, just not the 100x rocket it once was. In contrast, Remittix offers something different: a live product, an audited trust, and a fast-growing user base.

For those seeking early-stage exposure with real-world impact, RTX is shaping up as one of 2025’s most compelling plays.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Pepe Coin Price Prediction: Could Remittix Return Higher Gains To Early Backers Than PEPE Did In 2022 appeared first on Coindoo.

You May Also Like

Two companies account for 97% of the market, and transaction volume surges by 1100%: Predicting the reshaping of the market landscape and the next wave of entrepreneurial opportunities.

The U.S. Securities and Exchange Commission (SEC) dismissed charges against Justin Sun and the Tron Foundation; Rainberry agreed to pay a $10 million fine.