Japanese Firm Metaplanet Acquires $623M in Bitcoin, Becomes 4th-Largest Corporate Holder

Japanese Metaplanet has purchased 5,268 Bitcoin for $623 million, bringing its total holdings to 30,823 BTC, worth approximately $3.3 billion at an average acquisition price of $108,038 per coin.

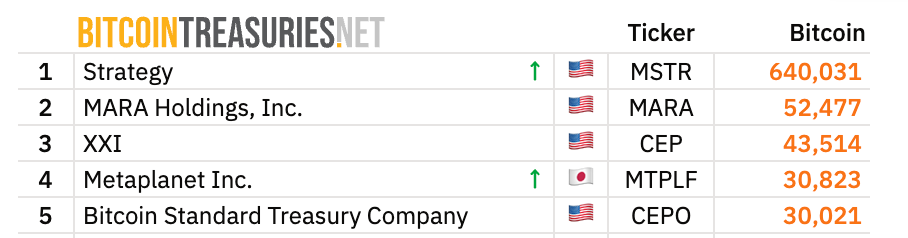

The Tokyo-listed company now ranks as the fourth-largest corporate Bitcoin holder globally, surpassing its fiscal year 2025 target of 30,000 BTC ahead of schedule.

Source: Bitcoin Treasuries

Source: Bitcoin Treasuries

The acquisition puts Metaplanet’s behind Strategy’s 640,031 BTC, MARA Holdings’ 52,477 BTC, and XXI’s 43,514 BTC.

CEO Simon Gerovich has set an ambitious goal of accumulating 210,000 Bitcoin by 2027, representing approximately 1% of the total Bitcoin supply.

Metaplanet achieved a 33.0% BTC yield in the third quarter of 2025, adding 4,412 BTC in gains through its treasury operations.

The company’s quarterly BTC yield has consistently exceeded targets, with Q4 2024 posting 309.8%, Q1 2025 achieving 95.6%, and Q2 2025 recording 129.4%.

Options Trading Revenue Surges 116% as Phase II Strategy Launches

Metaplanet’s Bitcoin Income Generation business reported $16.28 million in quarterly revenue, representing a 115.7% increase from Q2 2025.

The breakout performance prompted management to revise full-year consolidated guidance to $45.4 million in revenue and $31.38 million in operating profit, representing a 100% increase in revenue and 88% increase in operating profit compared to prior forecasts.

The options trading segment has also grown rapidly since its launch, with Q4 2024 generating $4.62 million, Q1 2025 producing $5.14 million, and Q2 2025 reaching $7.55 million, before the surge in Q3.

Metaplanet allocated $136.3 million exclusively to Bitcoin Income Generation operations, using capital to sell Bitcoin options and monetize implied volatility while keeping long-term holdings in cold storage.

The company unveiled Phase II of its strategy on October 1, introducing complementary business lines designed to amplify accumulation capacity without common equity dilution.

The plan includes three revenue streams.

Internal Bitcoin Income Generation through proprietary options trading, Bitcoin.jp platform revenue from media and conferences, and Project NOVA, a classified initiative scheduled for 2026 launch.

Management is scaling sophisticated trading operations by onboarding global talent with expertise in institutional derivatives.

The revenue expansion will support planned perpetual preferred share issuances capped at 6% annual dividend yield, approved at the September 1 Extraordinary General Meeting, though not yet issued.

Metaplanet targets a perpetual preferred capacity of 25% of net asset value initially, with the potential to expand as revenue grows.

Class A perpetual preferreds will be non-convertible with no common equity dilution, while Class B may partially dilute upon conversion.

The company is considering listing these securities pending consultation with the exchange, although no formal examination has commenced.

Capital Group Takes 11.45% Stake as Stock Trades Below Bitcoin Holdings

Capital Group acquired an 11.45% stake, worth nearly $500 million, through its subsidiary, Capital Research and Management Company, becoming Metaplanet’s largest shareholder.

The $2.6 trillion asset manager increased ownership from 8.31% in August to 11.39% by September 17, surpassing the previous largest shareholder, National Financial Services.

The investment validates the corporate Bitcoin treasury model as over 196 public companies now hold Bitcoin on their balance sheets, totaling more than $120 billion in combined holdings.

The investment coincided with Metaplanet’s $1.45 billion international offering completed on September 17, which issued 385 million new common shares to qualified institutional buyers.

The company raised over 500 billion yen ($3.34 billion) through multiple financing mechanisms, including moving strike warrants, convertible bonds, and equity offerings, since adopting its Bitcoin treasury strategy.

Eric Trump also joined Metaplanet’s advisory board in March and appeared at shareholder meetings to support the Bitcoin-focused strategy.

Metaplanet’s Bitcoin.jp initiative will serve as the distribution gateway for Bitcoin-related content, education, products, and services in Japan.

The premium domain platform will generate revenue through multi-channel partnerships, advertising, white-labeled services, and affiliate programs while hosting Bitcoin Magazine Japan and the Bitcoin Japan 2027 conference.

At the time of publication, Bitcoin is trading at close $116,000 after a 2.53% increase in the past 24 hours.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push