Pi Network & Remittix Are Two Crypto Assets That Analysts Say You Should Be Holding In The Last Quarter Of 2025

Despite the turbulence, analysts highlight Pi Network (PI) and Remittix (RTX) as two assets worth holding heading into the final quarter of 2025.

Pi Network Price Eyes Rebound After Hitting Lows

The Pi Network price recently sank to a record low of $0.1863 before stabilizing near $0.2738. Much of this decline came after large holders slowed accumulation and broader sentiment weakened, with the Crypto Fear and Greed Index sliding toward fear territory.

PI Network Price Chart | Source: CoinGecko

Technically, Pi Network is showing signs of accumulation. A falling wedge pattern on the daily chart, coupled with Wyckoff Theory accumulation stages, suggests a rebound could be on the horizon. Short-term price targets as high as $0.50 are being floated if momentum returns.

For now, the attention is on TOKEN2049, where Dr. Chengdiao Fan, Pi Network’s co-founder, will give her first big public lecture. Analysts expect her to reveal the project’s roadmap and adoption plan. A possible return to its all-time high of $2.99 remains widely debated in Q4.

Remittix: A Unique Approach That’s Winning Market Momentum

While Pi Network consolidates, Remittix has been gaining impressive traction in the PayFi (payment-focused DeFi) market. Unlike typical presale tokens, RTX is building a utility-first ecosystem that supports instant crypto-to-fiat transfers across 30+ countries with 40+ supported cryptocurrencies.

The project’s presale has now raised $26.9 million, with 673 million tokens sold and the token price is at $0.1130, a steep rise from its initial stage.

Key factors driving Remittix’s momentum include:

- Beta wallet live: Bridging crypto and global payments and ensuring real FX tracking.

- Referral program with 15% USDT rewards: Incentivizing rapid adoption.

- Strong presale performance: Growing retail demand signals market readiness.

These elements position RTX as more than just another presale coin. It is being viewed as a new standard in the payments space.

RTX Could Be a Standout Q4 Gainer

Pi Network is eyeing a 10x move toward $3, but analysts argue that Remittix is entering Q4 with the perfect setup to outperform. With its presale almost fully subscribed, the next catalysts could be explosive:

- Exchange Listings: With two CEX listings announced, once trading begins, the associated liquidity could translate into immediate price discovery.

- Utility Expansion: PayFi adoption across regions could unlock real-world transaction flows, with the beta wallet already live.

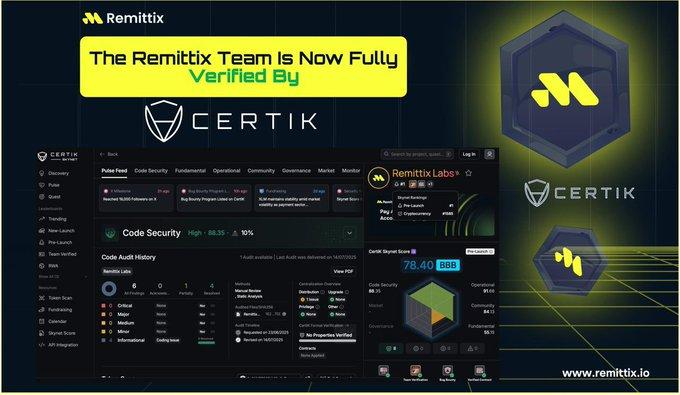

- Investor Confidence: The completed Certik audit and strategic tokenomics ensure sustainable growth post-listing.

With its strong fundamentals and rising investor excitement, Remittix is being tipped as a 100x bet for Q4 2025, especially if the post-listing environment mirrors the enthusiasm seen in its presale phase.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Pi Network & Remittix Are Two Crypto Assets That Analysts Say You Should Be Holding In The Last Quarter Of 2025 appeared first on Coindoo.

You May Also Like

SEI Technical Analysis Feb 6

South Korean Crypto Exchange Accidentally Gave Away $95 Billion in Bitcoin