Cardano Accumulation Soars: Coinbase Bets Big On ADA’s Next Chapter, Is Price Rallying Soon?

With the price of Cardano (ADA) showing upward potential as the crypto market gains traction again, institutional buying pressure is experiencing a notable rise. One of the leading companies in the crypto sector that has been accumulating ADA at a substantial rate is American-based cryptocurrency exchange Coinbase.

Coinbase Step Up Cardano Accumulation

As the current bull market phase progresses, the accumulation of Cardano has accelerated significantly. Coinbase, an American cryptocurrency exchange, has stepped up its commitment to buying ADA, demonstrating a greater level of confidence in the altcoin’s long-term prospects.

Mintern, the Chief Meme Officer (CMO) at Minswap, shared the positive development on the social media platform X, sparking optimism within the Cardano community. By increasing its investment in crypto assets, Coinbase is significantly strengthening its strategic reserves.

Additionally, the buying action makes a clear statement regarding ADA’s role in the development of scalable blockchain infrastructure and decentralized finance in the future. This kind of heavy accumulation could impact and reshape ADA’s price trajectory, triggering the next potential move.

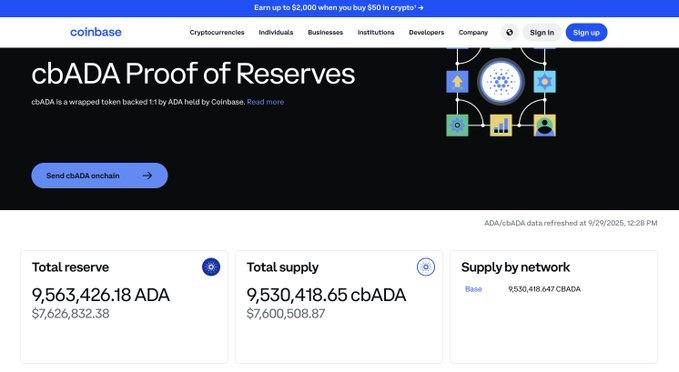

Coinbase recently released its proof of reserves for cbADA, its wrapped ADA on Base, which revealed that the crypto exchange holds a significant amount of Cardano in its reserve. Data from the report shows that its holdings have more than doubled in just one month, surpassing 9.5 million ADA.

This huge accumulation from the crypto exchange is fueling discussions of stronger institutional support and interest in ADA. Should this trend continue, it is likely to trigger a new wave of buying pressure that could bolster the current upward price trend.

Activity On The Leading Blockchain Is Skyrocketing

The significant rise in holdings coincides with the blockchain’s ongoing efforts to fortify its ecosystem through updates, growing uptake, and heightened on-chain activity. Cardano’s network activity has since fired up due to these advancements aimed at enhancing its ecosystem.

In another X post, Mintern reported that the total transactions carried out on the network are rapidly growing, reaching new heights. Such a development underscores the blockchain’s expanding relevance in the broader cryptocurrency landscape.

According to the report, the network’s overall transaction volume has reached over $2.7 trillion. This large figure indicates that user interaction is accelerating at an impressive rate and is a reflection of growing acceptance across decentralized applications, smart contracts, and staking participation.

As Cardano develops with strong scalability and innovation, the blockchain’s growing transaction count demonstrates investor trust and the network’s growing importance in the future of blockchain utility. Crypto pundit Dave stated that “Cardano is the only blockchain in the top 10 by market cap that has never experienced an outage since launch.”

According to the pundit, reliability is a crucial aspect of any blockchain, and that is what Cardano has offered over the past 8 years of its existence. Furthermore, Dave noted that the engineering of Cardano is proof of the effectiveness of resilience construction, which is necessary to absolutely run anything significant.

You May Also Like

Ukraine Gains Leverage With Strikes On Russian Refineries

Why Emotional Security Matters as Much as Physical Care for Seniors