Feature Flags in Fintech Apps: Deliver New Features Without Big Risk

In fintech, every new feature brings risk. A payment app is not the same as a game or a social app. If something breaks, users can lose money, and trust goes away very fast. Still, product teams need to move quick and release new things. This is a big challenge for a Technical Product Manager.

One tool that helps a lot in this situation is feature flags.

\ Why Feature Flags Are Important ?

A feature flag means you deploy code live, but do not show it to all users. You control who sees it: maybe only your team, maybe a small test group, or maybe 10% of users. If something goes wrong, you can close the feature fast, without waiting for a new app release.

In fintech this matters even more:

- Risk is high – a small bug can make a payment fail.

- Regulation is strict – a mistake can bring compliance issues.

- User trust is fragile – one bad experience, many customers leave.

\ How It Works ?

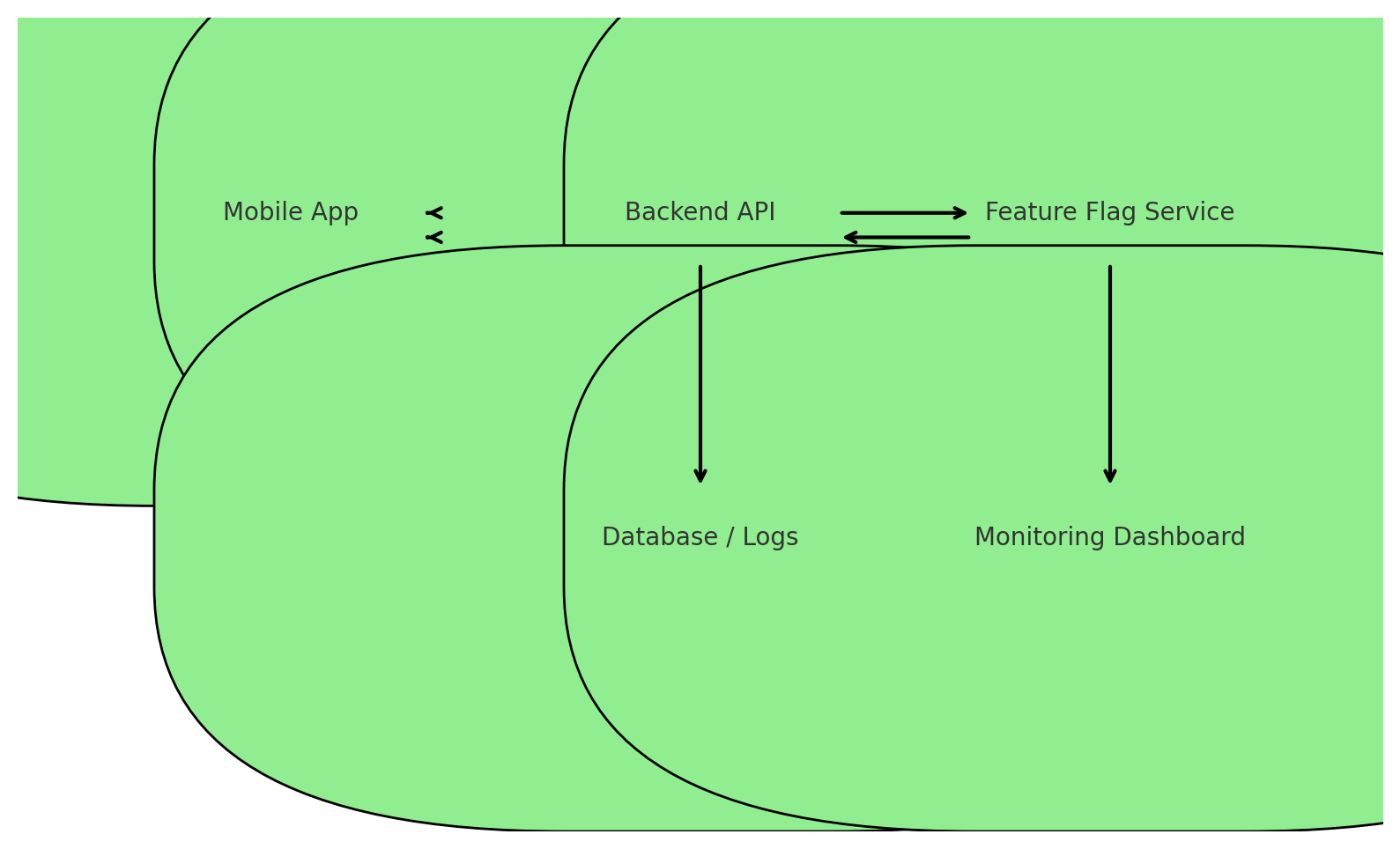

- Dev team builds the feature and deploys with a flag.

- PM decides which group can use it.

- Team watches metrics, feedback, and transaction health.

- If all is good → open to more.

- If there is a problem → close the flag quickly.

It looks simple, but behind it there are many details.

\ Real Example From Our Project

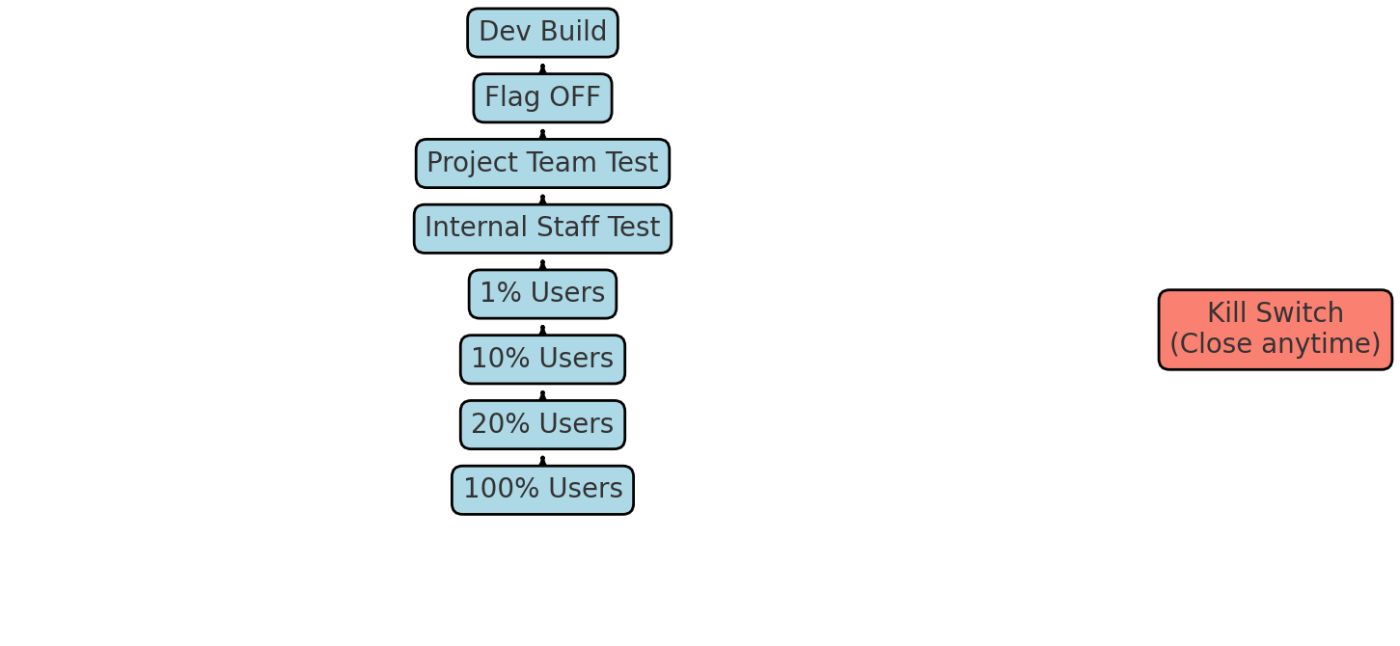

We rolled out one QR payment feature with this plan:

- Project team first – package went only to the project team, they tested in production but in safe way.

- Internal staff next – after it was OK, we opened only for company employees.

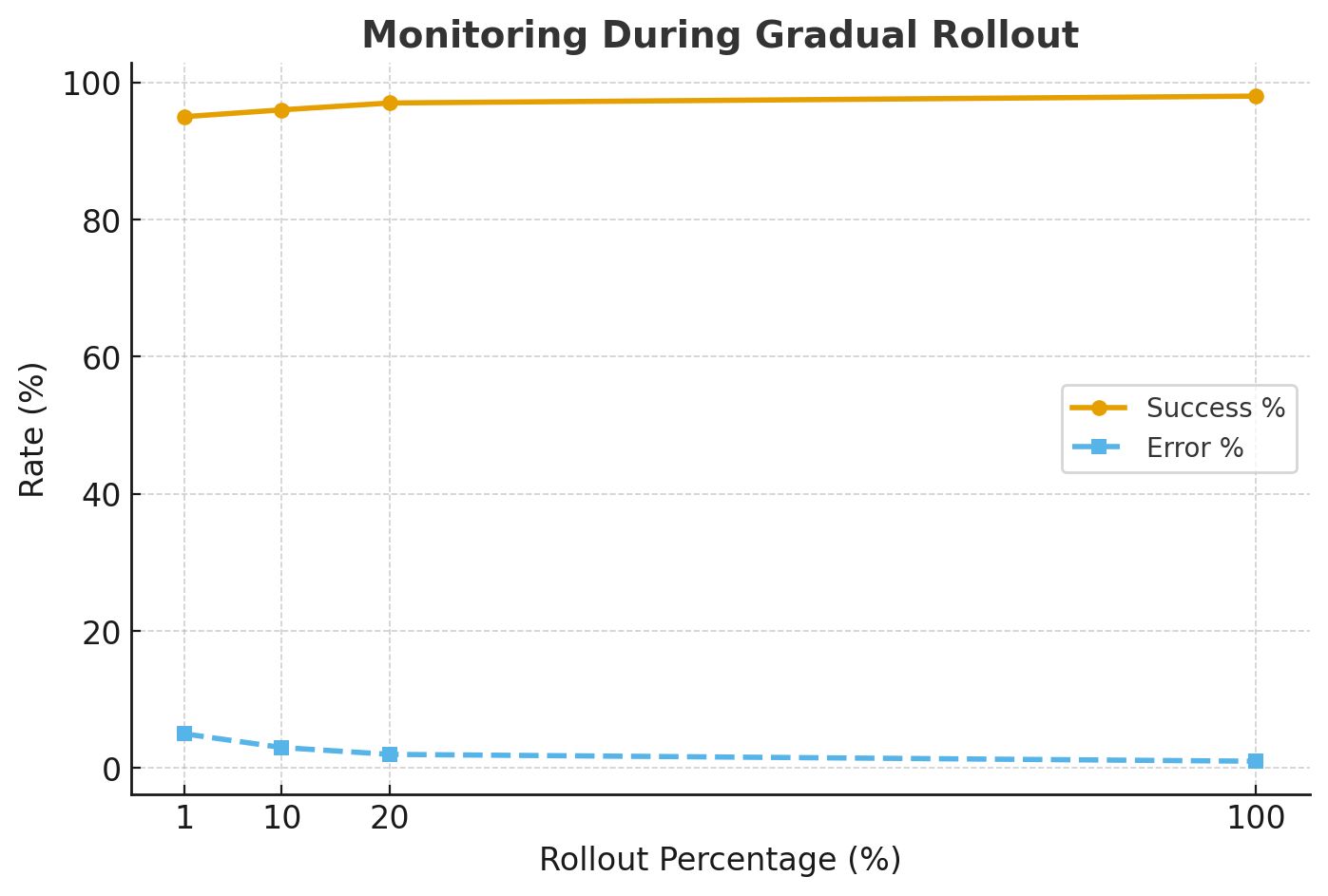

- Slow rollout – 1%, then 10%, then 20% of users. At every step, we checked transactions carefully.

All the time we kept a kill switch ready. If a bug showed up, we closed instantly. This gave us confidence to innovate but also protect users.

\ Fintech-Specific Challenges

Using feature flags in fintech is not always easy. Some issues are:

- Fraud risk: if the wrong group sees an unfinished feature, it can be abused.

- Transaction check: must monitor not only crashes, but also double charges, timeouts, wrong balances.

- Multiple platforms: fintech apps are on iOS, Android, web → the flag must behave the same in all.

- Regulation: in some markets A/B testing is not accepted, need compliance approval.

\ Best Practices for PMs

- Always have a kill switch. Without it, a feature flag is useless.

- Do rollout step by step. 1%, 5%, 10%… not 0 to 100.

- Define success before. Is good result no error? Or also better conversion, more usage?

- Prepare rollback plan. If you close the flag, what happens to users already touched the feature?

- Communicate wide. Dev, QA, ops, compliance, support all need to know rollout plan.

\ Tools and Approaches

Some teams build their own feature flag system. Others use LaunchDarkly, Firebase Remote Config, or similar. In fintech, often a custom solution is better because of security, data center rules, and audit logs.

Important is not the tool, but the process:

-

Who can switch on/off?

-

How quick does update reach users?

-

Is log ready for regulator if they ask?

\ More Scenarios Where Flags Help

- New login method – test Face ID or fingerprint with small group first.

- UI redesign – show new dashboard to 5% and see if adoption increases.

- Backend migration – move some payments to new service step by step.

In all cases, flags give chance to test, but also control.

\ Conclusion

Feature flag is simple idea but very powerful. In fintech apps it is a safety net for innovation. Without flags, each release is a big risk. With flags, PM and dev teams can be brave but also safe.

As a Technical Product Manager, you need to go fast but also protect users. This balance is what makes feature flags so important.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!