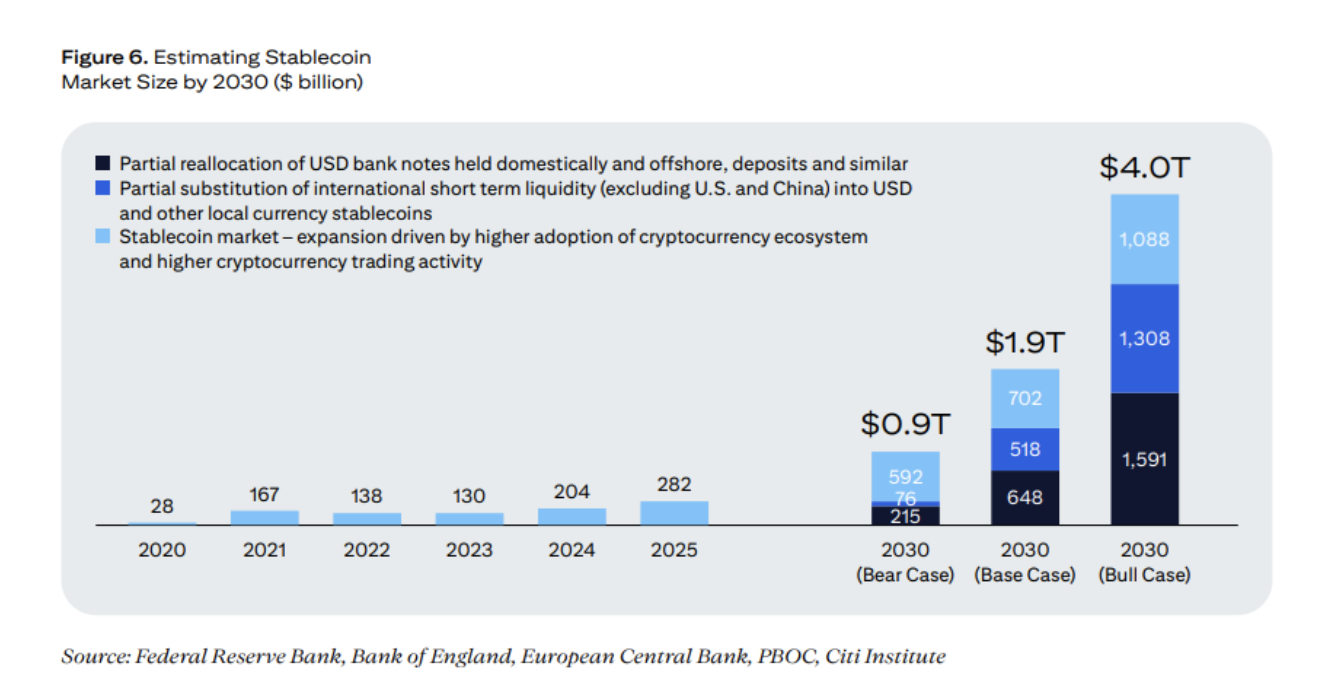

Citi Report Predicts $1.9 Trillion Stablecoin Market: Here’s Why Traders Bet Everything on $BEST

That’s a conservative estimate as well. In the best-case scenario, Citi’s report suggests that stablecoins could grow to $4T by the end of the decade.

Unlike other cryptocurrency assets, stablecoins maintain a fixed value, making them ideal for new users who want to trade cryptocurrency in the same way as fiat currency.

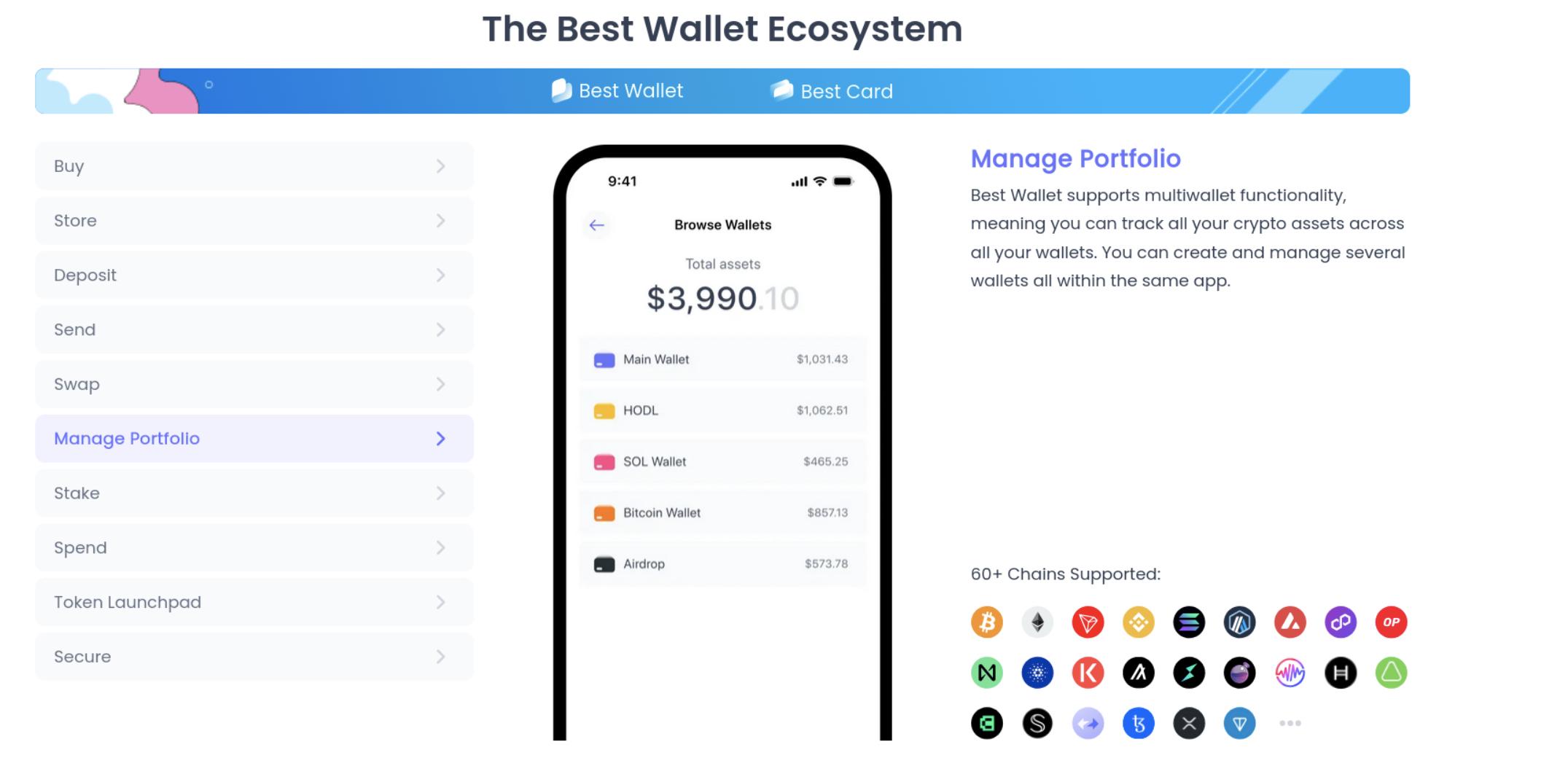

Of course, entering the crypto world can be complicated, but an easy-to-use crypto wallet like Best Wallet can simplify much of the process while keeping your assets secure. The Best Wallet Token ($BEST) is also introducing some exciting new features for Best Wallet.

Why is the Stablecoin Market Expected to Grow to $1.9 Trillion by 2030?

Regulatory clarity is a major factor driving expansion in the stablecoin market. The US has taken the lead in global stablecoin adoption by shifting from its previously crypto-unfriendly stance, signaling to the world that the future of the dollar depends on the success of stablecoins.

Citi’s report called the GENIUS Act a ‘gamechanger’. Stablecoin providers in the US are now required to back their issued tokens one-for-one with equivalent cash assets, which has built the confidence necessary for investors to diversify into stablecoin assets and earn dollar-backed crypto yields.

Caption: Source: CitiGroup

Caption: Source: CitiGroup

Citi has also noted that stablecoins are not in direct competition with other crypto assets. Instead, its assessment is that each class of crypto assets has unique benefits, meaning a healthy crypto ecosystem won’t result in a single winner but several different best-in-class assets working alongside each other.

As a result, successes in the rest of the crypto market also strengthen the value of stablecoins overall. It’s the ideal situation for the Web3 world – a place where multiple crypto coins can flourish.

Read on and take a closer look at how Best Wallet handles a unified portfolio, as well as the benefits of its utility token, Best Wallet Token ($BEST).

Best Wallet – Trade Altcoins With a Mobile-First Wallet

Best Wallet is a mobile-first crypto wallet that’s designed to make crypto as easy to trade with as your existing bank apps, instead of requiring you to learn all of the technical details behind blockchains and digital wallets.

Keeping track of one digital asset isn’t that difficult, but as soon as you start to diversify your holdings across different blockchains, it can become a headache to keep track of all your different digital wallets, especially if you need to record your transactions for compliance purposes.

Best Wallet keeps it easy with support for six major blockchains in one mobile app:

- Bitcoin

- Solana

- Ethereum

- Base

- BNB Chain

- Polygon

That’s only the start – Best Wallet is building support for up to 60 different blockchains. All of your portfolios can be managed from inside Best Wallet with a single unified interface.

The Best Wallet app is available for download now from the official Best Wallet site. Once you have the app, you can explore new coins across a comprehensive crypto marketplace, featuring both established coins and vetted new crypto sales, giving you an edge in the Web3 market.

It has the added benefit of letting you upload an encrypted backup of your wallet to the cloud, giving you peace of mind knowing you’re the only one who can unlock it. Even if your phone is stolen, you can instantly download your entire portfolio to Best Wallet on a new device and keep trading.

Visit the Best Wallet website to learn more.

Best Wallet Token ($BEST) – Providing Utility and Value to Best Wallet

Holding the $BEST token makes Best Wallet even better. You’ll get exclusive early access to new crypto projects in the presale marketplace before they go live elsewhere, as well as better returns on the upcoming Best Wallet staking aggregator.

It’ll also reduce the transaction fees you pay when trading crypto, making $BEST a great way to maximize the value of Best Wallet. Additionally, you’ll gain access to the Best Wallet DAO if you want to vote on support for new blockchains or additional features in the app.

In the meantime, you can download the Best Wallet app today and try it out in preparation for the release of $BEST.

You can currently buy $BEST in the presale for $0.025735, but don’t wait – the presale has already raised over $16 in token sales, so your chance to get $BEST cheaply is slipping away.

While you’re at it, you can stake any $BEST you purchase for up to 81% in rewards annually. However, since it’s a dynamic presale, the longer you wait, the lower your returns will be.

Buy $BEST today for the most value on Best Wallet.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Citi Report Predicts $1.9 Trillion Stablecoin Market: Here’s Why Traders Bet Everything on $BEST appeared first on Coindoo.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!