Adobe Inc. (ADBE) Stock: Flat Despite 520% Surge in AI Holiday Shopping Forecasts

TLDRs;

- Adobe forecasts 520% growth in AI-powered online shopping traffic for the 2025 holiday season.

- Despite strong forecasts, Adobe (ADBE) shares remain down 21.26% YTD amid investor caution.

- Figma’s IPO success and market growth add pressure to Adobe’s creative software dominance.

- Subscription model and AI investments continue to underpin Adobe’s long-term growth outlook.

Adobe Analytics expects the 2025 U.S. holiday shopping season to be one of the most digitally driven yet, thanks to a sharp rise in artificial intelligence use among consumers.

The company projects online sales to hit US$253.4 billion, representing a 5.3% year-over-year increase. More notably, Adobe predicts AI-assisted shopping traffic will skyrocket by 520%, as consumers increasingly turn to generative AI tools for product recommendations, personalized deals, and shopping assistance.

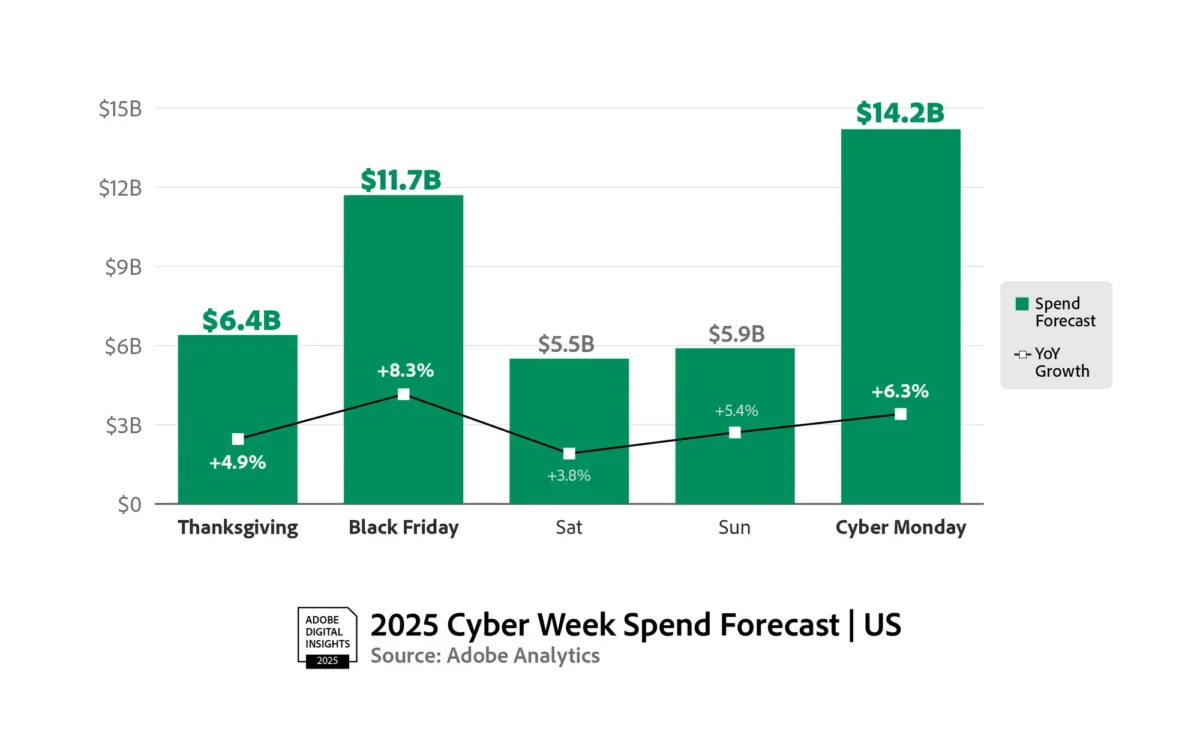

According to the analytics report, Cyber Monday will remain the largest online shopping day, reaching an estimated US$14.2 billion in sales, a 6.3% annual rise. Black Friday follows closely with a projected US$11.7 billion, up 8.3%, while Thanksgiving Day spending is expected to reach US$6.4 billion, marking a 4.9% increase.

Adobe’s shopping forecast for the 2025 holiday season

Adobe’s shopping forecast for the 2025 holiday season

The surge is being driven by steeper discounts averaging 28% off, higher mobile spending, and a continued shift toward “buy now, pay later” options, now a key driver of holiday purchases across the U.S.

Despite AI Boom, Stock Remains Down

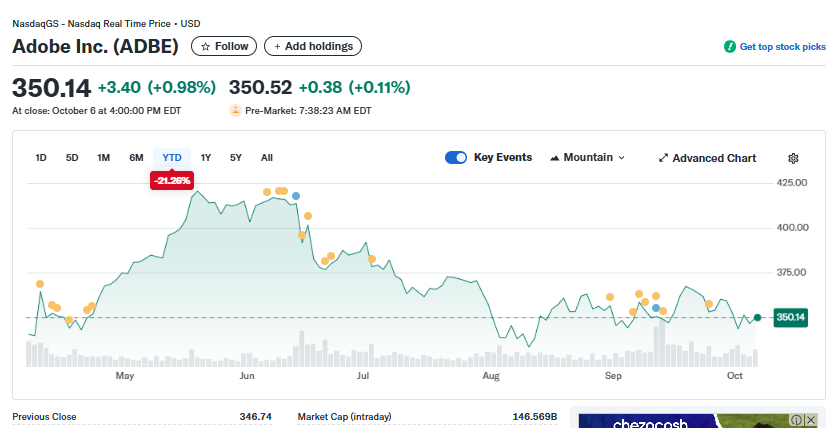

While Adobe’s data highlights booming demand for AI-powered shopping, its own stock performance tells a different story. As of October 6, Adobe Inc. (NASDAQ: ADBE) closed at $350.14, up slightly by 0.98% on the day, but still down 21.26% year-to-date.

Adobe Inc. (ADBE)

Adobe Inc. (ADBE)

The muted market reaction underscores investor caution despite the company’s recent financial strength. Adobe raised its fiscal 2025 revenue outlook last month, now expecting US$23.7 billion in annual revenue and adjusted EPS of up to US$20.9, surpassing prior guidance. Quarterly results also exceeded expectations, with Q4 revenue projected at US$6.1 billion, slightly above analyst estimates.

Even so, the stock’s sluggishness reflects a broader skepticism about growth sustainability, especially as competition intensifies in the AI and design software space.

Figma’s Rise Adds Competitive Pressure

A key factor behind Adobe’s recent share weakness is the resurgence of Figma, a rival in the collaborative design software market. After Adobe’s failed $20 billion acquisition attempt, Figma went public in early 2025 with a $17.84 billion valuation and reported 46% year-over-year growth, pulling market share away from Adobe XD.

Currently, Figma holds 10.88% of the design software market, compared to Adobe XD’s 5.66%. Its successful IPO underscored the strength of independent, cloud-based design platforms, a trend that has challenged Adobe’s traditional dominance.

Investors appear to be weighing Adobe’s strong fundamentals against the risk of losing creative market share, even as it pivots aggressively into generative AI through its Firefly platform.

Subscription Model Fuels Long-Term Resilience

Despite short-term volatility, Adobe’s long-term trajectory remains anchored in its subscription-based Creative Cloud model.

The shift from one-time software sales to recurring revenue has proven to be a stabilizing force, driving consistent cash flows and supporting ongoing innovation in AI.

Since transitioning to this model, Adobe’s revenue has grown from US$3.5 billion in 2010 to over US$11 billion by 2019, achieving a compound annual growth rate of 10.8%. The company maintains healthy profit margins near 29%, enabling continued investment in new technologies like generative imaging and automated design tools.

The post Adobe Inc. (ADBE) Stock: Flat Despite 520% Surge in AI Holiday Shopping Forecasts appeared first on CoinCentral.

You May Also Like

The Channel Factories We’ve Been Waiting For

XRP Price Prediction: Ripple CEO at Davos Predicts Crypto ATHs This Year – $5 XRP Next?