Analyzing the details of Flying Tulip's $1 billion "reversible financing" operation: How can ordinary people participate?

Author: Azuma, Odaily Planet Daily

On September 30, Flying Tulip, a full-stack on-chain exchange founded by the "former DeFi king" Andre Cronje (AC), officially announced that it had completed US$200 million in private financing and planned to raise another US$800 million in public offerings at a valuation of US$1 billion to build a comprehensive platform integrating native stablecoins, lending, spot trading, contract trading, and on-chain insurance.

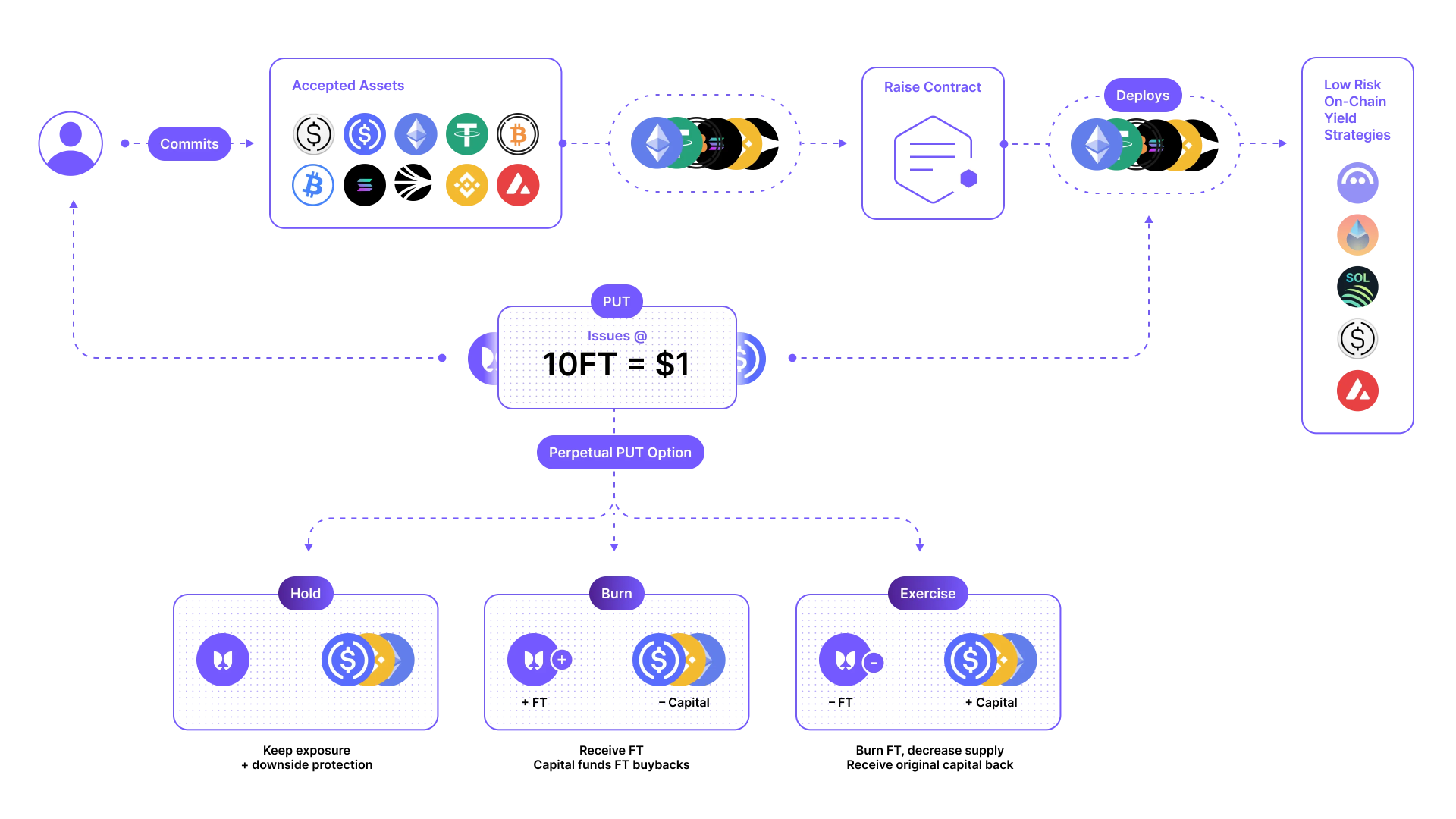

In Flying Tulip's financing announcement, the most eye-catching content, besides the huge financing target of "US$1 billion", is that Flying Tulip will adopt a fundraising method that is completely different from traditional private or public offerings. Specifically, Flying Tulip will provide all investors with a reversible "redemption" option through a perpetual put option, allowing investors to destroy the token FT at any time and redeem the principal based on the invested assets (such as ETH).

However, Flying Tulip did not disclose too many details about the mechanism in its initial announcement on September 30. It was not until last night that Flying Tulip officially released the project document. The document not only covers the specific designs of various product lines such as trading and lending, but also explains in detail the specific operating logic of the "on-chain redemption right".

The following is a detailed analysis of Flying Tulip's financing based on Odaily Planet Daily's official documentation. We hope this analysis will help potential investors make informed decisions.

Key Point 1: Total Fundraising and Total FT Supply

The maximum supply of FT tokens is 10 billion, the supply is fixed, there is no inflation, and it will only be destroyed.

Investors will receive 10 FT tokens for every $1 invested. Flying Tulip will only mint FT tokens based on the actual amount of funds raised. If only $500 million is raised, only 5 billion FT tokens will be minted and distributed. When the fundraising reaches $1 billion, the minting window for FT tokens will reach 10 billion, at which point no additional tokens will be minted.

Key Point 2: Redemption Rights

According to Flying Tulip, after investors make their investment, the corresponding FT will be locked in a "perpetual put option", which will attach a long-term "on-chain redemption right" to these token shares.

Based on market conditions, investors always have three options for disposing of their token shares. Flying Tulip does not restrict users’ operation ratios. For example, users can freely choose to redeem part of their positions while holding part of them.

- The first option is to hold a static position. Simply put, this means doing nothing. This allows you to retain your redemption rights or wait for FT to appreciate. The "perpetual put option" offered by Flying Tulip has no time limit.

- The second option is to redeem the principal. Users can choose to redeem part or all of the exact assets initially invested. Once redeemed, the corresponding amount of FT will be permanently destroyed. For example, if FT falls below the issue price (US$0.1) after opening, users can redeem their principal to avoid losses.

- The third option is to withdraw FT. After withdrawal, users can freely use their FT tokens to trade on CEXs or DEXs, or participate in various DeFi opportunities. Once withdrawn, the corresponding "perpetual put option" will immediately expire, and the user's principal invested in the private or public offering will be released. Flying Tulip will use these funds for protocol operations and FT repurchase.

It is worth mentioning that, in addition to the initial investment, any FT purchased on the open market does not include a "perpetual put option", that is, secondary market participants do not enjoy the same "redemption" rights as initial investors.

Point 3: Use of financing funds

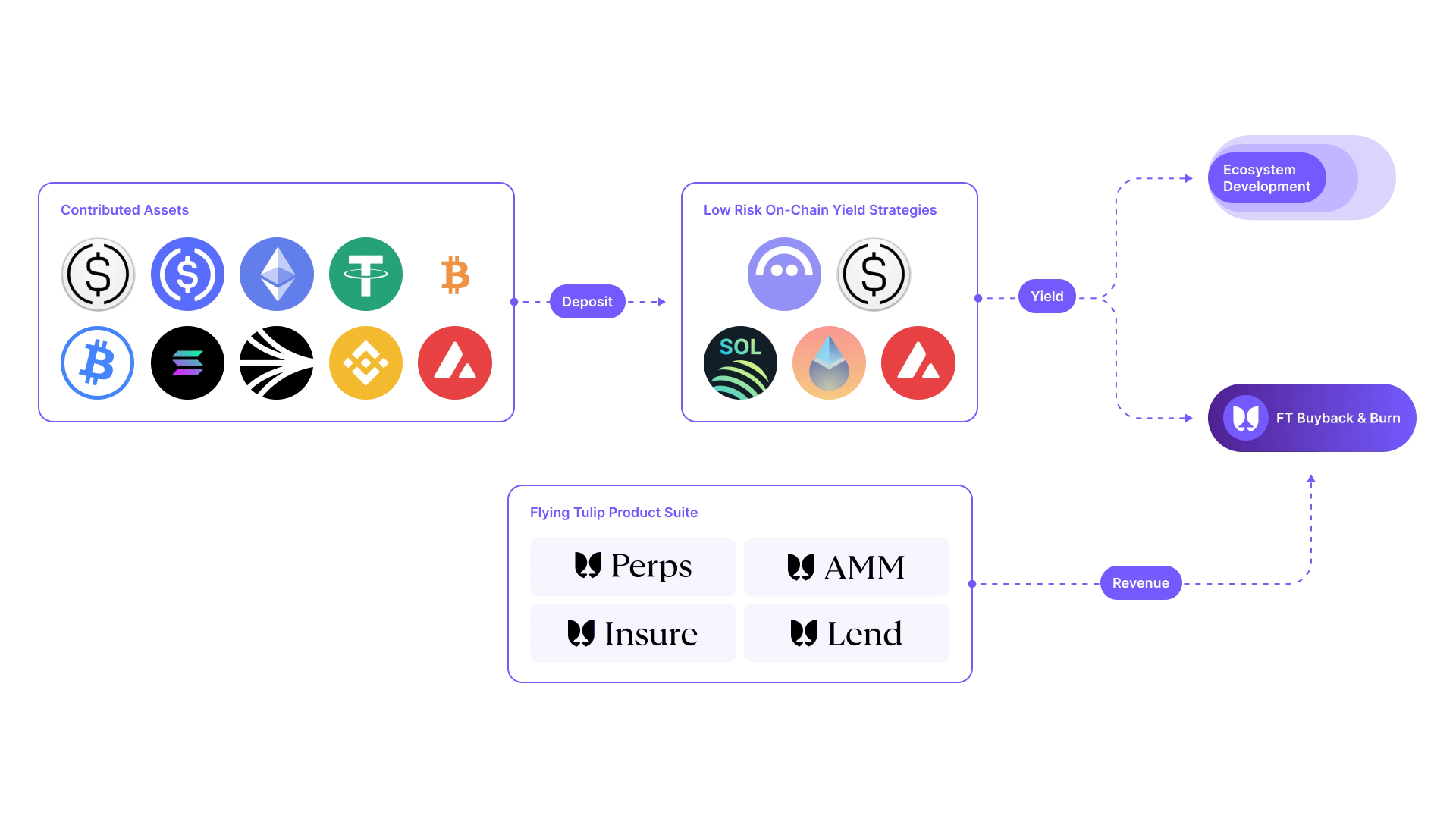

Although Flying Tulip has promised not to use the funds raised, in fact, during the term of a certain "perpetual put option", the corresponding financing amount will be allocated by Flying Tulip to a low-risk on-chain income strategy (not involving leverage and cross-chain) to ensure that it can respond to investors' redemption needs in a timely manner. Objectively speaking, this is a major risk point for Flying Tulip, but the risk level is relatively low.

Flying Tulip gave examples of the interest-earning methods of some of the main supported currencies during financing. Mainstream stablecoins will be deposited in Aave, ETH will be pledged as stETH, SOL will be pledged as jupSOL, AVAX will be staked natively, and USDe will be pledged as sUSDe.

As for the income generated by these funds, Flying Tulip stated that the primary use is to finance the continued development of the ecosystem, infrastructure and operations. After meeting the ecosystem budget, the remaining income will be used for the continued repurchase and destruction of FT.

It's important to clarify that this revenue is not directly tied to the Flying Tulip team's incentives. The Flying Tulip Foundation and team's revenue comes solely from the project's full product line (lending, trading, etc.). This revenue will be distributed among the Foundation/Team/Ecosystem/Incentives in a 40:20:20:20 ratio.

Point 4: Financing Participation Methods

Flying Tulip has disclosed in its official documents that the financing will support five chains - Ethereum, Solana, Sonic, BNB Chain, and Avalanche.

- Supported currencies on the Ethereum chain: USDC, ETH, USDT, USDe, USDS, USDtb, WBTC, cbBTC;

- Solana on-chain supported currencies: USDC, SOL;

- Sonic chain supports currencies: USDC, S;

- BNB Chain supports the following currencies: USDC, BNB;

- Avalanche on-chain supported currencies: USDC, AVAX;

The specific launch date for the fundraising has not yet been disclosed; please follow Odaily Planet Daily for further details. Furthermore, Flying Tulip recently stated on its official website that due to strong demand from institutional investors for public offerings, users planning to participate in amounts exceeding $25 million can contact the official website for customized custody solutions.

Personal strategy: Go all out if you can

To put it bluntly, I personally tend to participate more vigorously.

Firstly, 100% of FT will be minted at the same price in the form of private or public offerings, which means that the cost for all investors is equal; secondly, the "perpetual put option" provides sufficient downside protection when the FT price is lower than or equal to US$0.1. Even when it is higher than US$0.1, the potential downside protection will give coin holders strong psychological support; thirdly, Flying Tulip has designed more FT repurchase mechanisms, which may be conducive to the potential upward trend of the coin price.

There are not many opportunities in the industry to "guarantee principal and bet on returns". Compared to "whether to participate", perhaps the real question is "whether you can grab the quota" after the public offering is opened.

You May Also Like

BitGo expands its presence in Europe

Wormhole Unveils W Token 2.0 with Enhanced Tokenomics