Hyperliquid News: $21M Stolen from Hyperliquid User, Private Key Leak Exposed

A Hyperliquid user suffered a leak of private key to a $21 million crypto theft, one of the largest security risks in crypto.

The way Hyperliquid was decentralized resulted in a shocking theft of $21 million when the secret key of one of the traders was hacked.

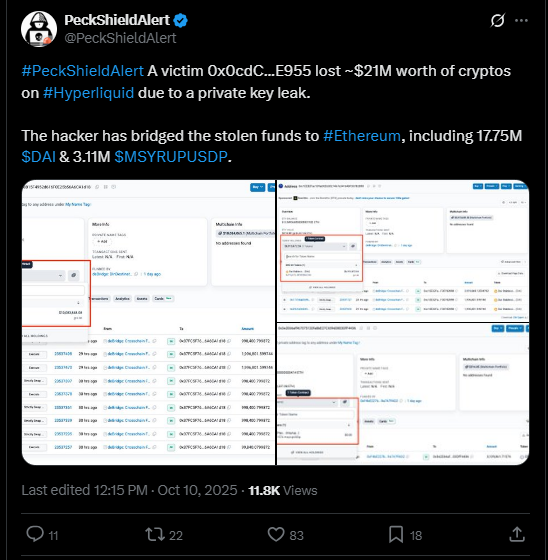

PeckShield (a blockchain security company) noted that the attacker promptly transferred the stolen funds, which comprised 17.75 million DAI and 3.11 million MSYRUPUSDP to the Ethereum network.

Source – X

When the private key was leaked, the address of the wallet belonging to the victim was stolen 0x0cdC…E955.

This key is the master key unlocking funds access to the wallet, meaning anyone who as it s/he can steal funds.

PeckShield highlighted that it was especially severe, as the breach is among the most expensive risks in crypto.

Private Key Exposure: The Cryptocurrency Butcher.

Digital assets are controlled by private keys, which are the master keys to digital assets. To lose possession of this key is equivalent to giving a thief the master code of the bank vault. This attack on Hyperliquid is a vivid lesson in the weakness of decentralized systems, where user security depends mostly on the security of key management.

Although smart contract protection is on a high level, the security of individual wallets is not strong.

PeckShield has not revealed the way the private key has been compromised but indicated the possible risks, such as phishing, malware, or a lack of proper key storage.

The stolen funds were bridged to Ethereum immediately, which complicated the recovery process.

Hyperliquid’s Rocky Security Profile in Spotlight

This episode contributes to the current security issues of Hyperliquid. The platform runs a perpetual exchange that is decentralized and has on-chain order books and sub-second finality. However, it is now under fire following the enormous loss incurred by a trader.

Hyperliquid just completed more than $3.5 billion in trading volume, and the Hyperdrive lending protocol is gaining momentum.

Nonetheless, this incident casts doubt on the danger traders subject themselves to when they are in possession of their private keys and on the security of their wallets in the decentralized exchanges.

The post Hyperliquid News: $21M Stolen from Hyperliquid User, Private Key Leak Exposed appeared first on Live Bitcoin News.

You May Also Like

US Congress Proposes AI Export Oversight Bill

Ubisoft (UBI) Stock: Restructuring Efforts and Game Cancellations Prompt 33% Dip