Solana Price Forecast: SOL Dexs Pull Record $8B Volumes as Bulls Target $200 Recovery

Solana (SOL) price rebounded 3% on Sunday, October 8, reaching intraday highs of $190 and reclaiming its $100 billion market cap for the first time since early September. The recovery follows a week of volatility triggered by U.S. President Donald Trump’s renewed tariffs on China, which sparked record-breaking liquidations across global crypto markets.

Solana Price Rebounds Above $190 as DEX Activity Hits Record $8B

Despite the broader downturn, Solana’s decentralized ecosystem showed exceptional strength. On Saturday, Solana news aggregator data revealed that perpetual DEXs on the Solana network processed over $8 billion in trading volume during the market crash.

Notably, four Solana-based exchanges crossed $1 billion in 24-hour trading volume, led by Orca ($2.49B), Meteora ($1.7B), and Raydium ($1.5B).

While the broader crypto market saw liquidity outflows, Solana’s DEX ecosystem retained and recycled capital, keeping network value locked within the chain. Increased transactional intensity during high-volatility periods often enhances validator fees and token burn activity, which may contribute to SOL’s price stability and faster rebound relative to rival layer-1 assets on Sunday.

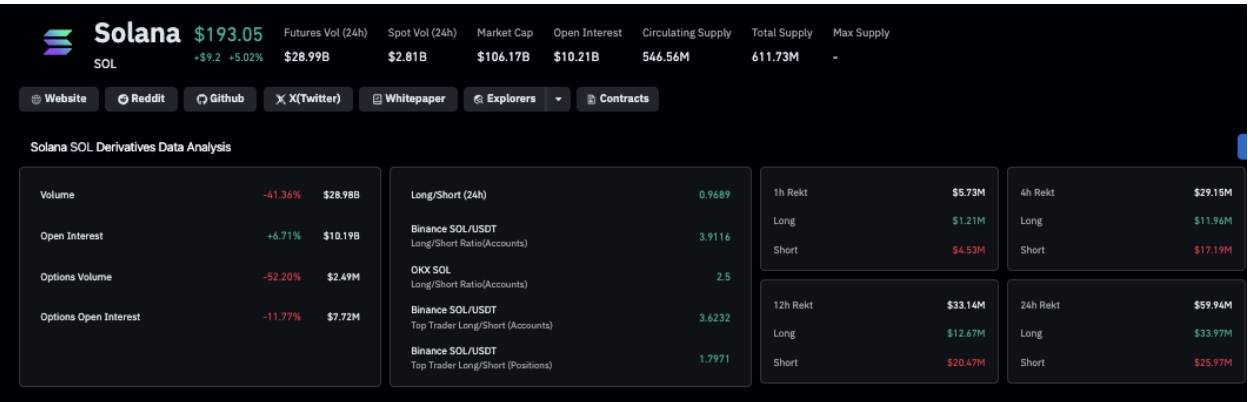

Solana Derivatives Market Analysis | Source: Coinglass

Derivatives trading also echoes optimism around Solana’s rebound prospects. Coinglass data shows that Solana open interest surged 6.9% to $10.2 billion on Sunday, even as prices only rose 5% to $192. This divergence suggests new long positions are being opened faster than spot demand, implying leveraged traders re-entry new positions after record-break forced liquidations on Friday.

Solana Price Forecast: Can SOL Sustain Momentum Above $200?

Solana’s technical indicators align with improving on-chain and derivatives data, suggesting that bulls are gradually regaining control. As seen below, Solana price bounced off the lower Bollinger Band support at $181.6, confirming renewed buying interest after the market-wide sell-off.

Solana (SOL) Technical Price Analysis | TradingView

SOL price has since reclaimed ground toward the mid-Bollinger level at $213.3, which now acts as the next key resistance zone. A decisive breakout above this midline could open the door toward the upper band at $244.9, aligning with the August swing high and serving as a key target for bulls this week.

Meanwhile, the Relative Strength Index (RSI) has risen modestly from oversold levels near 41.1 toward the neutral 49.7 mark, signaling that downside momentum is cooling. However, on the downside, a rejection from the $213 resistance could trigger a retest of $181 support.

nextThe post Solana Price Forecast: SOL Dexs Pull Record $8B Volumes as Bulls Target $200 Recovery appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

‘KPop Demon Hunters’ Gets ‘Golden’ Ticket With 2 Nominations