Solana’s (SOL) $168 Drop Sends Crypto Sentiment into Fear Zone As New Crypto Coin Keeps Rising

Furthermore, this correction is in line with a general crypto crash, where the total market cap is down 1-2% to $413 trillion after sharp sell-offs.

As a result, long positions in SOL were liquidated on a massive scale, which fueled forced sell-offs that exacerbated the fall from recent highs of near $230. Furthermore, Bitcoin broke below its $112,000 peak as macroeconomic headwinds pushed back the prospects of Solana ETF approvals and dragged Ethereum and other altcoins down by 2%.

Also, the crypto fear and greed index dropped 37 points to 27, bringing back memories of the trade tension lows of April when Bitcoin reached $77,000. Yet, even as why is crypto down is the subject of raging debate, a new crypto coin comes robustly and attracts investors amidst the chaos.

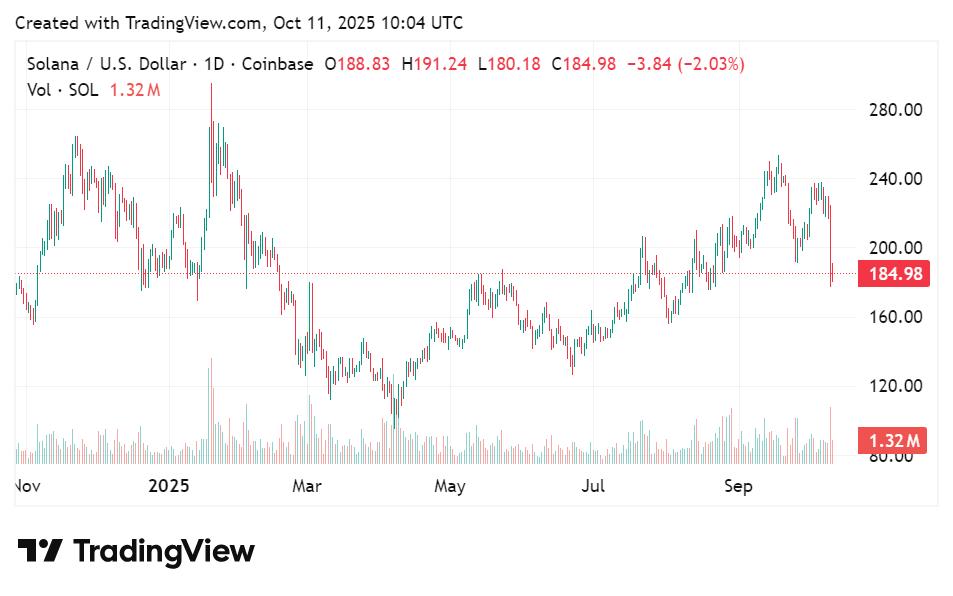

Solana Encounters Steep Plunge

Traders watched Solana’s token tumble 9-10% in mere hours, settling around $168 as early trading unfolded. Liquidators seized opportunities from overleveraged bets, wiping out $19.27 billion in positions across the board. Consequently, this crypto crash today intensified pressures on correlated assets, with Ethereum mirroring the slide.

Moreover, President Trump’s 100% tariff on China announcements echoed past events, stoking fears of prolonged stagnation. In fact, the crypto fear and greed index’s drop to fear levels last occurred amid similar April escalations. Furthermore, Solana’s vulnerability highlights ongoing crypto prices volatility, where rapid reversals punish the unwary.

Mutuum Finance Builds Momentum

Developers at Mutuum Finance (MUTM) have pushed forward with their lending and borrowing protocol, announcing core features set for Sepolia Testnet rollout in Q4 2025. Liquidity pools form the backbone, alongside mtTokens for deposits, debt tokens for loans, and automated liquidator bots to safeguard positions.

Initial support targets ETH and USDT for lending, borrowing, or collateral duties. Consequently, this setup promises seamless access to yields without surrendering asset control.

Furthermore, the protocol’s dual markets—peer-to-contract for instant pooled funds and peer-to-peer for tailored agreements—cater to diverse needs, from quick ETH-backed USDT loans to custom niche token deals.

Presale Accelerates in Phase Six

Backers have poured $17,250,000 into Mutuum Finance since the presale launched, swelling total holders to 16,910. Phase 6 of 11 phases now unfolds at 65% capacity, pricing tokens at $0.035—a 250% rise from the opening phase’s $0.01.

Buyers today stand to gain 420% upon launch at $0.06, as tokenomics dictate steady appreciation. Moreover, Phase 6 sells out swiftly, closing doors on this entry point soon; Phase 7 follows with a 14.3% hike to $0.04.

In addition, the team recently unveiled a dashboard tracking the top 50 holders, rewarding sustained rankings with bonus tokens. Thus, early participation in this new crypto coin yields not just gains but ongoing perks.

Security Bolsters Protocol Integrity

Certik auditors have recently completed their analysis of Mutuum Finance, and they have scored them a 90/100 tokens which highlights strong defenses. The platform has further launched a bug bounty program together with Certik where they are offering $50 thousand USDT in four severity levels – critical, major, minor and low to reward vulnerability reporting.

Consequently, these steps serve to strengthen the ecosystem against threats, making its operations dependable to lenders and borrowers alike. Furthermore, overcollateralization requirements and dynamically variable borrow rates adapt to utilization so that liquidity is balanced during even turbulent spells.

Giveaway Sparks Community Engagement

Mutuum Finance has announced its largest giveaway yet with $100,000 worth of MUTM tokens being distributed to 10 winners to the tune of $10,000 each timed with presale momentum.

The process of eligibility includes an investment of at least $50; providing the wallet address to receive prizes; completing the quests diligently to increase chances; and verifying eligibility by maintaining a minimum stake. This initiative helps build closer ties as it shows the new crypto coin’s appeal in a shaky market

Opportunities Emerge from Fear Shadows

As Solana’s $168 drop propels the crypto fear and greed index into dread, Mutuum Finance stands firm, channeling investor focus toward utility-driven growth.

This new crypto coin not only weathers the storm but invites strategic entries at discounted rates, promising yields through its lending framework. Therefore, savvy participants explore such avenues now, positioning for recovery amid the broader crypto investment landscape.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Solana’s (SOL) $168 Drop Sends Crypto Sentiment into Fear Zone As New Crypto Coin Keeps Rising appeared first on Coindoo.

You May Also Like

Softer CPI keeps PBoC easing in play – TD Securities

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement