Bitcoin Whale Bets Against Price Surge with 3,500 BTC Short as Bitcoin Dips

Recent trading activity and market sentiment highlight a cautious outlook for Bitcoin as key support levels and large-scale short positions come into focus, amid broader macroeconomic developments and regulatory discussions. With a prominent whale fueling short-term bearish bets, traders are closely watching technical indicators and on-chain data to gauge the cryptocurrency’s next move.

- Bitcoin remains around the $114,000 level, with a key whale increasing its short positions amid market volatility.

- Short-term holders’ cost basis hovers just below $114,000, acting as a crucial support zone.

- Market participants are attentive to key moving averages, which currently serve as support and resistance levels.

- Bitcoin’s price response comes amid geopolitical and macroeconomic factors, such as US-China trade negotiations.

- On-chain analytics indicate long-term uptrend remains intact despite short-term momentum weakening.

Bitcoin’s price struggled to hold its recent rebound at the start of the week, amid growing concerns over a large whale adding to its short positions. The cryptocurrency hovered around the $114,000 mark, with traders watching for signs of a potential breakdown or further support.

BTC/USD one-hour chart. Source: Cointelegraph/TradingViewBitcoin whale increases bearish bets amid declining prices

Data from Cointelegraph Markets Pro and TradingView revealed Bitcoin retreating from the daily high of approximately $116,000. The decline followed a rapid fill of the CME Group’s Bitcoin futures gap, which is often viewed as a technical support marker, and subsequent dip below the open price.

Meanwhile, macroeconomic developments were largely overlooked by markets, which remained unreactive to U.S. government comments suggesting that trade talks with China could de-escalate tensions, potentially avoiding significant tariffs. Treasury Secretary Scott Bessent announced plans for upcoming negotiations, viewed by some analysts as tactical rather than strategic decoupling.

At the same time, attention turned to a notable Bitcoin whale reportedly capitalizing on a recent $20 billion liquidation event by shorting the asset just before the China news broke. This whale increased its short position, now holding approximately 3,500 BTC with a liquidation price near $120,000. While some view such activity as insider-informed trading, others believe these moves are part of broader market speculation.

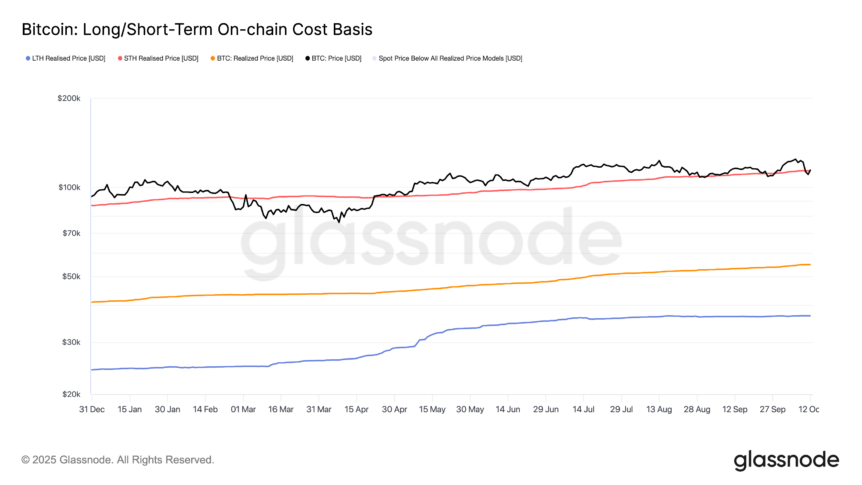

Speculators remain divided on Bitcoin’s immediate outlook. On-chain data shows that short-term holders, typically those holding for up to six months, act as a crucial support layer for the market, with their average cost basis close to $113,861. This level is closely monitored, as it could act as a bounce or breakdown point, depending on market direction.

Bitcoin: Short-term and Long-term Holder Cost Basis. Source: Glassnode

Bitcoin: Short-term and Long-term Holder Cost Basis. Source: Glassnode

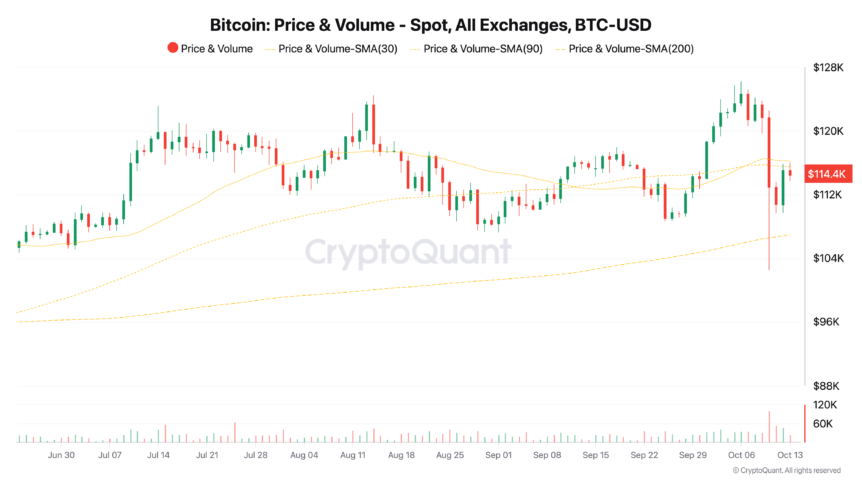

In addition, on-chain analytics platform CryptoQuant emphasizes the significance of key moving averages—specifically the 30-day, 90-day, and 200-day SMAs—which currently suggest a mixed technical outlook. While the long-term uptrend remains intact with price staying above the 200-DMA, short-term momentum appears to have weakened as Bitcoin dipped below the 30- and 90-day moving averages, creating a resistance zone that traders are watching closely.

BTC/USD one-day chart with 30, 90, 200SMA. Source: CryptoQuant

BTC/USD one-day chart with 30, 90, 200SMA. Source: CryptoQuant

This technical picture underscores the importance of on-chain support levels and market sentiment; despite the short-term fluctuations, many analysts maintain a cautiously optimistic view regarding Bitcoin’s long-term trajectory.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article was originally published as Bitcoin Whale Bets Against Price Surge with 3,500 BTC Short as Bitcoin Dips on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Trump just made a telling reveal in GOP's looming 2028 war: renowned strategist

Trump’s bogus Iran nuke claim hit with brutal fact check