MAGACOIN FINANCE Presale Momentum Builds — XRP and Cardano Traders Eye 9,000% ROI Potential

XRP recovered after a sharp 41% decline to trade above $2.47 with institutional bids reentering after extensive liquidations. Cardano also experienced a 21% drop to $0.64 and then settled around oversold areas. As volatility ran across the major altcoins, investors turned their focus to other early-stage ventures such as MAGACOIN FINANCE, whose presale is still generating considerable flows and has caused traders to label the project as the best altcoin to buy with 9,000% ROI.

XRP Price Rebounds After Chaotic Trading Session

Following one of the most unstable periods in 2025, XRP price recovered the losses. Between October 10 and 11, the token was down to $1.64 but it regained its course to rise to 2.47 at the end of the session. The $1.14 trading range represented one of the broadest intraday movements of recent months, prompted by the macro-based deleverage and panic liquidation.

According to CoinGlass data, more than 150 million XRP futures were liquidated in traders responding to the news of tariff threats in the United States. The volume was more than 817 million XRP, which is approximately three times the average of the last few days. There were increased institutional desks of between $2.34 to $2.45 and this was an indication of fresh purchasing desire. Analysts pegged the resistance at a critical level of $3.05 and possible upsurge to $3.65-$4.00 should the momentum persist.

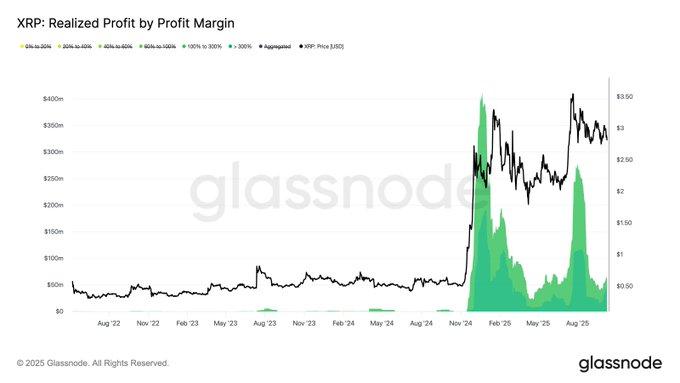

Source: Glassnode

Glassnode on-chain observers noted good profit-taking by investors that had bought XRP at less than one dollar. The platform identified two big waves of realization, in December 2024 and July 2025, which decreased the short-term momentum. The data show XRP can go to the next wave of accumulation like in the previous market cycles..

Cardano Faces Sharp Correction but Shows Recovery Signs

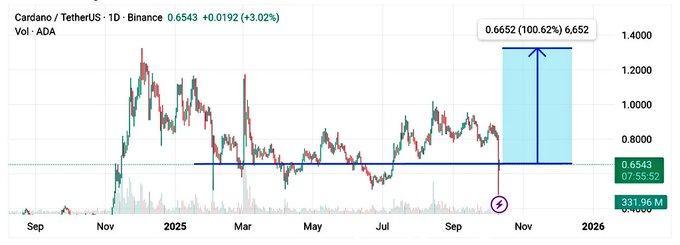

Cardano price was down by 21% in 24 hours and decreased to $0.64 after a significant selling spurt in the market. The token pierced several support levels causing liquidations in leveraged positions. Volume shot to over $4.6 billion indicating a quick out of the door behavior by traders trying to deal with the risk.

The technical data indicates that ADA is approaching oversold situation on the four-hour RSI and this indicates that the sellers would be fatigued. Analysts saw a possible stabilization point in the area of $0.58 to $0.60. Recovery of over $0.67 will give Cardano a new ground and greater resistance is at around $0.75.

Source: X

Although there was a sharp reversal at the time of the pullback, the mood among ADA holders is still positive. Influencer Sssebi observed that rebounds were bounced back within weeks with previous cycles of similar capitulations. The network metrics indicate active staking and involvement of developers, which means that long-term fundamentals are stable.

MAGACOIN FINANCE Gains Strength During Market Volatility

As the larger cryptos recovered, MAGACOIN FINANCE managed to perform better as it persisted in its presale. The project has now well exceeded a funding of over $16 million, and now attracts investors seeking high growth in a consolidating market.

Analysts explain that the high inflows are as a result of the transparent audits and the verified smart contracts in MAGACOIN FINANCE. CertiK and Hashex have conducted reviews of the project, which guarantees the integrity of contract and investor safety. Early participation has been promoted by its presale structure that goes up in price as each stage goes by.

According to the market analysts, MAGACOIN FINANCE can be characterized as one of the fastest-growing blockchain projects in 2025. The project is a potentially remarkable occurrence due to its scarcity-based tokenomics, community engagement, and growing collaborations when altcoin liquidity recovers. Analysts project a possible 9,000% ROI in case the existing momentum persists after exchange listings.

MAGACOIN FINANCE Positioned for the Next Market Rotation

Observers of the industry feel that the large-cap to mid-cap rotation of altcoins that will occur soon will favor MAGACOIN FINANCE. The project launched with confirmed audits and community ecosystems have been doing well historically after the market confidence has returned.

The initial momentum of MAGACOIN FINANCE and its stable basis is in line with such requirements. Moreover, the increase in the token’s popularity on social platforms and the growing number of investors suggest that more retail and institutional investors are becoming aware.

With liquidity shifting from older coins to newer assets, analysts consider MAGACOIN FINANCE the best altcoin to buy now.

Conclusion

The recovery of XRP and the stabilization of Cardano indicate a careful recovery period following strong volatility in the crypto market. Despite these ups and downs, MAGACOIN FINANCE stands out as one of the few projects that have performed exceptionally well during the period of uncertainty.

Supported by proven audits and high presale inflows, it remains appealing to investors who want to invest in structured, high-upside in the changing digital asset world of 2025. Don’t miss out like how traders missed the XRP and Cardano train.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post MAGACOIN FINANCE Presale Momentum Builds — XRP and Cardano Traders Eye 9,000% ROI Potential appeared first on Coindoo.

You May Also Like

Solana Price Prediction: Litecoin Latest Updates As Pepeto Gains Buzz With Analysts Calling 100x Potential

Taiko and Chainlink to Unleash Reliable Onchain Data for DeFi Ecosystem