Peter Thiel’s Erebor Gains Behind-the-Scenes Backing as New Silicon Valley Bank Rival Debuts

- Erebor, backed by Peter Thiel, has received a preliminary banking license from U.S. regulators, allowing it to operate pending further approval.

- The OCC recognizes the role of permissible digital asset activities within the federal banking system, emphasizing safety and soundness.

- U.S. regulatory momentum accelerates as crypto firms like Coinbase, Circle, and Ripple seek national bank charters amid ongoing legislative developments.

- Industry groups voice concerns over granting charters to crypto companies, citing policy and security risks, while some experts predict legal challenges.

- The move reflects broader efforts to integrate cryptocurrency and blockchain innovations into traditional banking frameworks.

Regulatory Milestone for Erebor and Crypto Industry

Erebor, a financial services enterprise supported by billionaire investor Peter Thiel, has successfully secured preliminary approval to establish itself as a federally chartered bank in the United States. The recent approval by the Office of the Comptroller of the Currency (OCC) marks an important development in the integration of digital assets into mainstream banking. Erebor still faces several compliance hurdles, including security and operational standards, which might delay full launch by several months.

Positioned as a lender focused on the innovation economy, Erebor aims to serve sectors such as cryptocurrency, artificial intelligence, and cutting-edge technology. A company source told the Financial Times, “We want to be a stable, low-risk, reliable bank doing normal banking things without risking everyone with undue exposure.”

Earlier reports indicated Erebor’s mission to become a critical funding source for early-stage startups that have faced hurdles accessing traditional capital amid regulatory tightening and market instability in 2023, especially after the collapse of Silicon Valley Bank, Silvergate, Signature Bank, and First Republic Bank, which shook the banking sector.

Crypto Firms Race for Regulatory Legitimacy

This regulatory approval comes amid a broader push within the U.S. crypto industry, as authorities take steps toward formalizing digital asset activities. President Donald Trump recently signed into law a major stablecoin bill, and Congress is debating additional legislation governing crypto market structure and potential Central Bank Digital Currency (CBDC) regulations.

Several crypto industry giants are now pursuing bank charters to expand their services and secure a more stable operational footing. Notably, Coinbase has applied for a national trust company charter with the OCC, aiming to leverage new licensing to enhance its payments and custody offerings—even though it has clarified it does not intend to become a traditional bank. Meanwhile, Circle and Ripple Labs have also filed applications to establish trust banks under federal regulation.

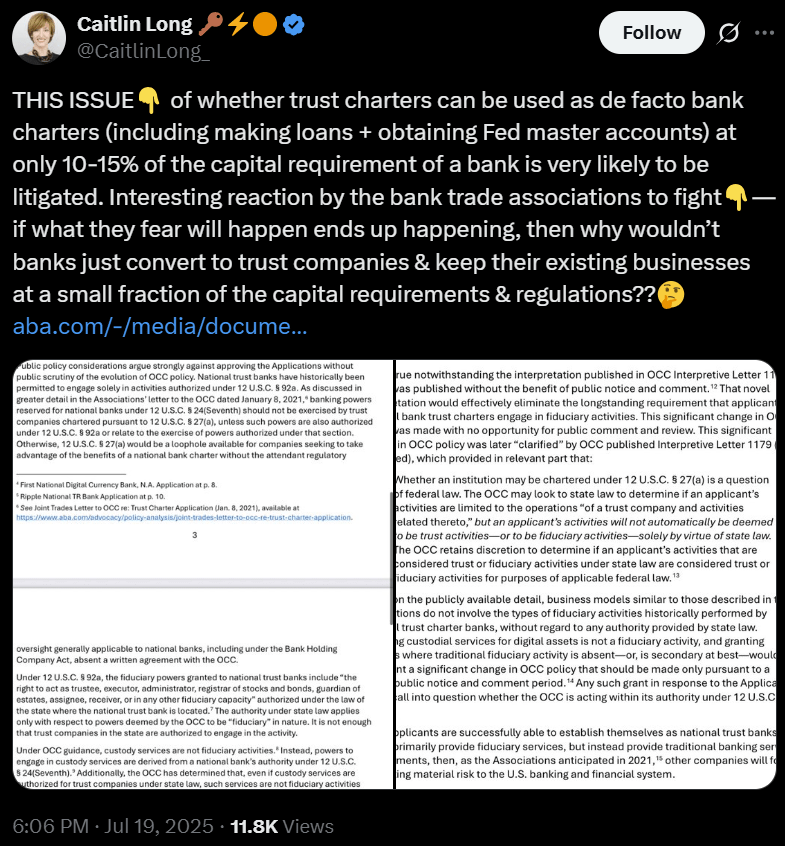

This burgeoning initiative, however, isn’t without opposition. Banking and credit union advocacy groups have urged the OCC to delay granting bank charters to crypto firms, raising concerns about policy risks and potential security issues. Caitlin Long, founder of Custodia Bank, counters these objections, arguing that such legal challenges are inevitable, especially over whether trust charters can effectively function as de facto bank licenses, enabling institutions to make loans and access Federal Reserve accounts with reduced capital requirements.

Source: Caitlin Long

Source: Caitlin Long

As the U.S. regulatory landscape evolves, crypto businesses see an opportunity to legitimize their operations and integrate more deeply with the traditional financial system. However, the road ahead remains complex, with legal debates and policy uncertainties likely to shape the industry’s future trajectory.

This article was originally published as Peter Thiel’s Erebor Gains Behind-the-Scenes Backing as New Silicon Valley Bank Rival Debuts on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

US SEC approves options tied to Grayscale Digital Large Cap Fund and Cboe Bitcoin US ETF Index

Kast Stablecoin Firm Hits $600M Valuation after $80M Raise: Report