Omeros (OMER) Stock Rallies 149% on $2 Billion Novo Nordisk Deal

TLDR

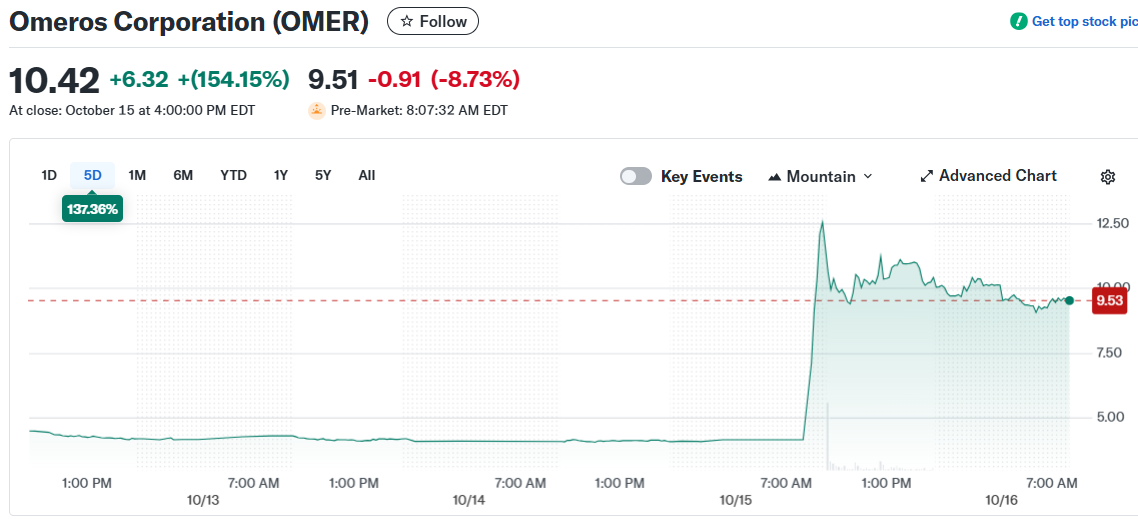

- Omeros Corporation stock jumped 149% to $10.19 after signing a $2.1 billion licensing deal with Novo Nordisk for its MASP-3 inhibitor drug zaltenibart.

- Novo Nordisk will pay $340 million upfront and near-term payments, with potential milestone payments reaching $2.1 billion total.

- Trading volume exploded to 77.9 million shares compared to the typical 1.2 million daily average.

- Omeros had only $28.7 million in cash at the end of June after burning through $58.9 million in the first half of 2025.

- The company’s lead drug candidate narsoplimab is awaiting FDA decision by December 26, 2025, after a previous rejection in 2021.

Omeros Corporation stock closed at $10.19 on October 15, up $6.09 from the previous day’s close of $4.10. The jump represented a 149% gain in a single trading session.

Omeros Corporation (OMER)

Omeros Corporation (OMER)

The move came after Omeros announced a licensing and asset purchase agreement with Novo Nordisk. The deal centers on zaltenibart, a MASP-3 inhibitor drug candidate formerly called OMS906.

Novo Nordisk will get exclusive worldwide rights to develop and commercialize the drug. The Danish pharmaceutical company will focus on rare blood and kidney disorders.

Omeros opened trading at $11.53 on October 15. The stock hit an intraday high of $12.77 and a low of $4.33.

Trading volume reached 77.9 million shares. That’s a massive increase from the average daily volume of 1.2 million shares.

The stock trades on the Nasdaq Global Select Market. Over the past 52 weeks, OMER has ranged between $0.92 and $12.87.

Deal Terms and Payment Structure

The agreement includes $340 million in upfront and near-term payments to Omeros. The company could receive up to $2.1 billion total if certain milestones are met.

These milestone payments depend on development progress and commercial success. Omeros will also receive royalties on future sales if zaltenibart reaches the market.

At midday on October 15, Omeros had a market cap just under $700 million. That’s despite the incoming $340 million payment.

Omeros signaled in August that a deal was coming. Management said during second-quarter earnings that zaltenibart negotiations were the most advanced of several asset sale discussions.

Company Financial Position

Omeros finished June with just $28.7 million in cash and short-term investments. The company burned through $58.9 million during the first half of 2025.

The Novo Nordisk payment will help Omeros pay down debts. It should also keep operations running for more than a year.

Omeros has no product sales currently. The company operates at a chronic loss.

Zaltenibart is not Omeros’ most advanced drug candidate. That distinction belongs to narsoplimab, a MASP-2 inhibitor.

Narsoplimab is under FDA review for treating stem cell transplant-associated thrombotic microangiopathy. The condition is known as HSCT-TMA.

The FDA rejected Omeros’ first application in 2021. The agency said it had difficulty estimating the treatment effect and requested more data.

Omeros submitted additional data in December. The FDA initially set a decision date of September 25, 2025.

In August, the agency pushed back the decision date to December 26, 2025. The delay extends the uncertainty around narsoplimab’s commercial prospects.

The FDA likely wanted a new randomized controlled trial back in 2021. Instead, Omeros compared 28 patients treated with narsoplimab against similar patients who weren’t in the trial.

Narsoplimab failed a different pivotal trial in 2023. That trial tested the drug for kidney damage in patients with a different autoimmune disorder.

The post Omeros (OMER) Stock Rallies 149% on $2 Billion Novo Nordisk Deal appeared first on Blockonomi.

You May Also Like

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus

Trump's border chief insists Americans support ICE – and is shut down by host: 'Come on!'