Gold Reaches Record High Above $4,300 as US Credit Concerns Mount

TLDR

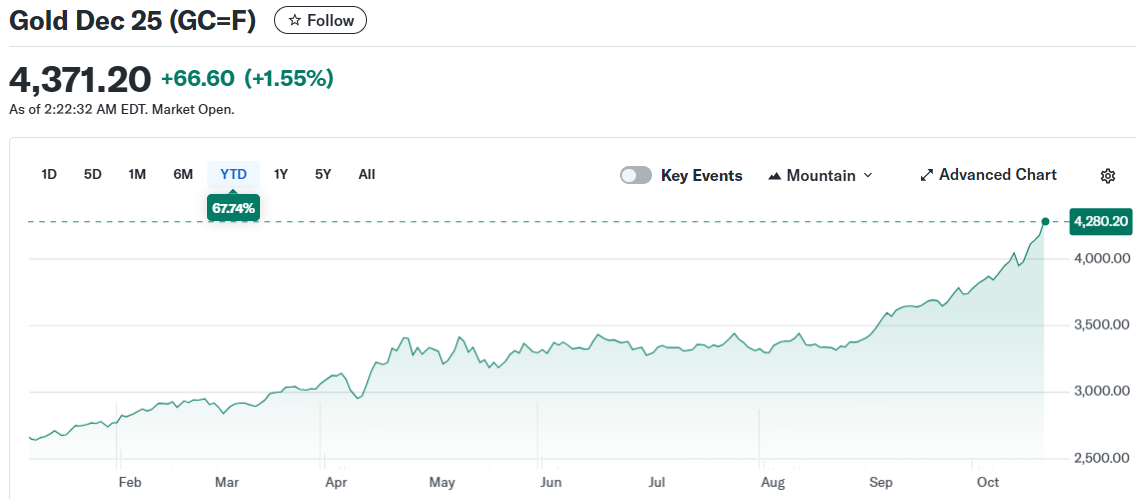

- Gold reached a new all-time high near $4,380 per ounce on Friday, marking its biggest weekly gain since March 2020 with an 8% increase

- US stock futures fell sharply with Dow down 0.8%, S&P 500 down 1.1%, and Nasdaq down 1.3% before Friday’s opening bell

- Two US regional banks disclosed loan problems allegedly linked to fraud, following JPMorgan CEO Jamie Dimon’s warning about credit quality issues

- Silver broke through its 1980 peak and surged over 85% this year, hitting $54.50 per ounce before pulling back slightly

- The 10-year Treasury yield dropped below 4% as investors moved money into safer assets like bonds and gold

US stock markets faced heavy selling pressure on Friday as investors rushed to safe haven assets following new concerns about credit quality in the American banking system. Two regional lenders revealed problems with loans that may be connected to fraud. This news came after JPMorgan CEO Jamie Dimon made his “cockroach” warning about potential issues with US borrower creditworthiness.

Gold Dec 25 (GC=F)

Gold Dec 25 (GC=F)

Gold prices responded by climbing to record levels above $4,380 per ounce during Friday trading. The precious metal gained roughly 8% over the week, representing more than $300 in increases. This marks gold’s largest weekly gain since March 2020 when pandemic fears first gripped global markets.

The flight to safety extended beyond gold as investors pulled money from stocks and moved into Treasury bonds. The 10-year Treasury yield fell below the 4% threshold as bond prices rose. Stock index futures showed steep declines with the Nasdaq 100 leading losses at 1.3% before the market opened.

E-Mini S&P 500 Dec 25 (ES=F)

E-Mini S&P 500 Dec 25 (ES=F)

Silver also participated in the precious metals rally, breaking through a price peak that was set in 1980. The white metal hit a fresh high near $54.50 per ounce on Friday morning before giving up some gains. Silver prices have climbed more than 85% so far this year.

The London silver market experienced unusual tightness over the past two weeks. This squeeze pushed London silver prices well above New York futures contracts. Traders responded by flying physical silver across the Atlantic Ocean to meet demand.

Supply Dynamics in Silver Markets

More than 15 million ounces of silver were withdrawn from warehouses linked to the Comex futures exchange in New York over the past week. Most of this metal is believed to be heading to London where tight supplies have pushed borrowing costs to around 20% on an annualized basis. Silver-backed exchange-traded funds saw a large 10 million ounce outflow on Thursday.

The price gap between London and New York silver trading remained at $1.20 per ounce on Friday. This spread has narrowed from a peak of $3 last week but remains unusually wide by historical standards. Silver ended Friday trading at $54.07 per ounce, up 7% for the week despite a slight 0.3% decline during the day.

Banking Sector Concerns Mount

The stock market selloff came as the second day of losses for major US indices. Regional bank troubles have revived memories of last year’s banking crisis. JPMorgan’s Dimon used the term “cockroach” to suggest that visible credit problems may indicate larger hidden issues in the financial system.

US-China trade tensions added to market stress during the week. China announced fresh export controls and sanctions as President Trump threatened new tariffs. The White House did offer one positive development by preparing to ease tariffs on the auto industry.

The federal government shutdown continued to drag on with no clear end in sight. Some lawmakers expressed worry that the stoppage could extend into November or past Thanksgiving. Federal workers have not received paychecks as the shutdown persists.

Gold’s rise this year has been supported by central bank purchases and inflows to exchange-traded funds. Traders are betting on at least one large US interest rate cut before the end of the year. Lower interest rates typically benefit gold and silver because these metals do not pay interest to holders.

Platinum and palladium prices moved lower on Friday as investors focused their safe haven buying on gold and silver.

The post Gold Reaches Record High Above $4,300 as US Credit Concerns Mount appeared first on Blockonomi.

You May Also Like

SharpLink Earns Nearly 15,000 ETH in Staking Rewards After Launching Ethereum Treasury

Palantir (PLTR) Stock Partners with Polymarket to Monitor Sports Betting Fraud