Signal to Adopt Bitcoin Payments in Move that Could Push $HYPER to 10x This Year

Takeaways:

- Jack Dorsey calls for Signal to integrate native Bitcoin payments.

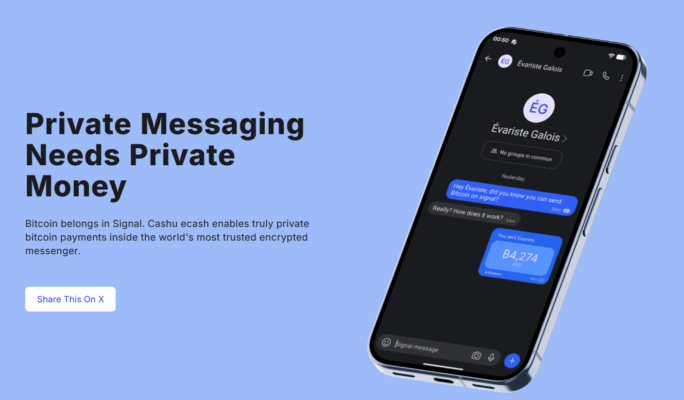

- The Bitcoin for Signal campaign plans to use the Cashu protocol to bring microtransactions to Signal.

- Bitcoin Hyper addresses the same problem beyond Signal, making fast and cheap transactions possible with Bitcoin.

Around 100M people use Signal’s secure messaging service every month.

Now, major figures like Jack Dorsey and Peter Todd are advocating for Signal to integrate Bitcoin payments, thereby strengthening Signal’s independence and boosting crypto adoption.

However, anytime there’s a conversation about integrating Bitcoin with social media, a related discussion about security and privacy concerns inevitably arises.

Signal’s potential integration could catalyze further growth for Bitcoin, attracting millions of new users. However, the inherent limitations of Bitcoin also highlight the utility of groundbreaking projects like Bitcoin Hyper ($HYPER), which unlocks fast and cheap Bitcoin transactions.

The Push for Bitcoin in Signal

The sales pitch for Bitcoin in Signal is simple:

The initiative proposes embedding Bitcoin sending and receiving features in Signal via the Cashu protocol, particularly its Chaumian Ecash design. While there is native blockchain integration with Signal through the MobileCoin token, $MOB’s $37M market cap is a drop in the bucket compared to Bitcoin’s $2T+.

Jack Dorsey retweeted the concept:

Support also came from Bitcoin developer Peter Todd and Pavol Rusnak of Satoshi Labs.

Advocates argue that integrating $BTC would align with Signal’s privacy ethos, enable private peer-to-peer payments without intermediaries, and help Signal break free from reliance on donations or external funding.

The Cashu approach aims to thread the needle by decoupling actual payment operations from the public ledger; however, the approach is relatively untested.

Interestingly, Cashu’s technique – which relies on depositing $BTC into a specific address and receiving a different currency in return – bears a close similarity to Bitcoin Hyper’s approach. Both protocols recognise inherent weaknesses in the way Bitcoin operates and rely on different architectures to try to overcome them.

Bitcoin Hyper ($HYPER) – Scalability and Flexibility Come to Bitcoin Through Fast, Cheap Layer 2

Bitcoin dominates crypto in part because there’s simply no other token as reliable, well-known, secure, and stable as $BTC.

But those features come at a price. The original vision for Bitcoin was a peer-to-peer digital cash network; however, payments on Bitcoin suffer from comparatively high fees and low network throughput. That makes microtransactions, such as those on Signal, unrealistic with Bitcoin’s current architecture.

In this case, the address is a Bitcoin Canonical Bridge, a cross-chain bridge that uses the Solana Virtual Machine to create wrapped $BTC on the Bitcoin Hyper Layer 2.

Hyper’s approach is simple but efficient. Final settlement is reserved for Bitcoin’s Layer 1, preserving the stability and security for which Bitcoin Hyper is famous. However, on the Hyper Layer 2, wrapped $BTC can be traded and swapped at thousands of transactions per second, with minimal fees.

The result is a Bitcoin transaction network that actually makes sense and hearkens back to the original whitepaper.

Over $23.9M has poured into the project’s presale, with major whale purchases of $379K and $274K. It’s a clear sign that there’s an appetite for Bitcoin microtransactions and for utility beyond simply a store of value.

Research and learn more about the project at the Bitcoin Hyper presale page.

If so, both $BTC and $HYPER could be set for major gains. Hyper could 10x from its current $0.013125, while $BTC could set its sights on $250K or higher. Put another way – if Signal successfully adopts Bitcoin payments, the sky is the limit for both Bitcoin and Bitcoin Hyper.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Signal to Adopt Bitcoin Payments in Move that Could Push $HYPER to 10x This Year appeared first on Coindoo.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

XRP Price News: Elon Musk Confirms X Money Crypto Plans as Pepeto’s Three Products Approach Launch and the 537x Window Stays Open