Bitcoin (BTC) Price: Supply Drops to Six-Year Low as $4.8 Billion Leaves Exchanges

TLDR

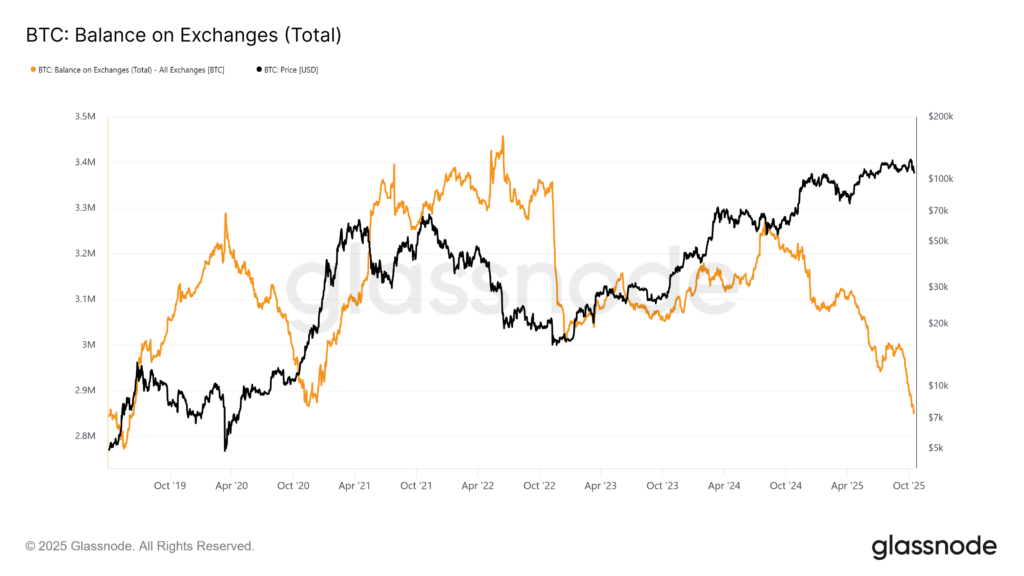

- Bitcoin exchange supply has dropped to a six-year low with over 45,000 BTC worth $4.8 billion withdrawn since early October

- BTC is trading at $110,544 on Monday morning, up 3.16% in 24 hours after spending four days below $110,000

- Long-term holders are accumulating coins and moving them to cold storage rather than keeping them available for trading

- Analysts expect a potential interest rate cut in October with 98.9% probability according to CME FedWatch Tool

- Key resistance level stands at $111,000 where a breakout could trigger accelerated upward movement

Bitcoin exchange balances have fallen to their lowest level since 2019. The drop comes as investors continue removing coins from centralized trading platforms.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Over 45,000 BTC has left exchanges since early October. The total value of withdrawn coins reaches nearly $4.8 billion.

Lower exchange balances typically mean fewer coins are available for immediate sale. This reduces the supply available to traders on the market.

Source; Glassnode

Source; Glassnode

Bitcoin is currently trading at $110,544 as of Monday morning. The price represents a 3.16% increase over the past 24 hours.

The cryptocurrency spent the previous four days trading below the $110,000 threshold. The weekend rebound brought prices back above this level.

Ether rose 3.6% to $4,036 during the same period. Other major cryptocurrencies including BNB, XRP and Solana also posted gains between 2.68% and 3.91%.

Rate Cut Expectations Drive Recovery

The recent price movement follows improved macroeconomic conditions. Traders are factoring in a potential interest rate cut for October.

The CME Group’s FedWatch Tool shows a 98.9% probability of a 25 basis point rate reduction. The next Federal Reserve meeting will determine if this occurs.

Federal Reserve Chair Jerome Powell acknowledged that labor market softness persists. This statement has eased bond yields and improved conditions for risk assets.

Spot crypto ETFs have seen renewed demand in recent days. Market participants treated the recent sell-off as a buying opportunity.

Rachael Lucas from BTC Markets noted that institutional inflows contributed to the rebound. The combination of these inflows and macro conditions supported the recovery.

Supply Squeeze Intensifies

The withdrawal pattern indicates investors are moving assets into cold storage. This behavior differs from periods of uncertainty when traders typically seek liquidity.

Bitcoin’s circulating supply stands at 19.93 million coins. Fewer than 1.1 million coins remain to be mined before reaching the 21 million hard cap.

The 30-day Market Value to Realized Value ratio sits at -7.56%. This reading suggests recent buyers are holding small unrealized losses.

Negative MVRV readings have historically marked accumulation phases in previous cycles. These periods often preceded price recoveries as selling pressure decreased.

Leveraged positions are currently at multi-year lows. This reduces the risk of forced liquidations in the derivatives market.

Key Resistance Levels Ahead

Vincent Liu from Kronos Research identified $107,000 and $110,000 as critical support levels. A break below $107,000 could trigger liquidations and shift market sentiment.

Source: TradingView

Source: TradingView

Lucas pointed to resistance between $111,700 and $115,500. A break above $111,000 could result in a short squeeze.

The symmetrical triangle pattern on shorter timeframes suggests a potential breakout. The price is testing resistance at $108,500 while maintaining higher lows since October 17.

The RSI indicator has climbed from 35 to 59. This shows improving momentum without entering overbought conditions.

A breakout above $110,850 could open movement toward $113,500 and $115,960. These represent key resistance zones from the previous price channel.

Failure to hold above $107,400 could trigger a pullback to $104,550 or $102,000. These levels would mark support zones on further downside movement.

Bitcoin’s total market capitalization stands at $2.16 trillion. Sustained buying pressure above $111,000 could extend the current momentum and allow for further upward movement.

The post Bitcoin (BTC) Price: Supply Drops to Six-Year Low as $4.8 Billion Leaves Exchanges appeared first on CoinCentral.

You May Also Like

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

US Prosecutors Seek $327K Crypto Forfeiture Over Romance Scam