PEPE coin price weakens as head and shoulders pattern emerges

PEPE coin price has dropped nearly 40% from its September highs as it approaches a potential breakdown from a bearish head and shoulders pattern, which could spell more pain for holders in the days ahead.

- PEPE price continued to extend losses on the weekly timeframe.

- Whales and smart money holders have started exiting positions.

- A bearish head and shoulder pattern is forming on the PEPE/USDT weekly chart.

According to data from crypto.news, Pepe (PEPE) coin dropped to a 6-month low of $0.0000063 on Friday, Oct. 17, before managing a slight recovery to $0.0000072 at the time of writing. At this price, the altcoin is down 40% from its September peak and has plunged nearly 66% from its highest point earlier this year.

Pepe coin price dropped 33% to $0.0000062 on Oct. 11 after U.S. President Donald Trump announced new tariffs on Chinese exports, reigniting trade war fears between the two major economies.

The back-and-forth between Washington and Beijing has continued to unsettle global risk markets, including crypto, with several major cryptocurrencies shedding over 20% from their monthly gains as investors turned risk-averse.

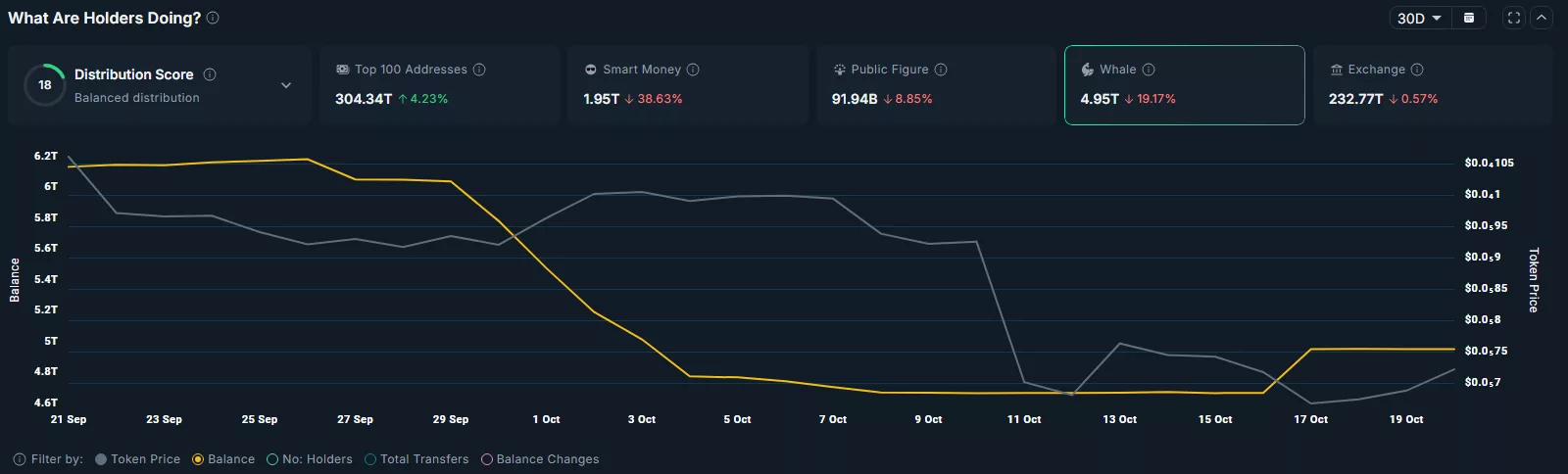

Data from Blockchain analytics platform Nansen suggests Pepe’s price decline has been amplified by a steady exit of smart money and whale investors. Over the past 30 days, the total number of tokens held by smart money wallets has dropped by 38.6% to 1.95 trillion. At the same time, whale holdings have fallen from 6.13 trillion to 4.95 trillion during the same period.

Such large-scale exits typically signal a market that is still in a state of uncertainty. Investors appear to be taking a wait-and-watch approach, probably holding out for clearer signs of stability before considering a possible reentry.

If the selling continues, it could begin to weigh on retail investor sentiment as well, potentially triggering a broader wave of panic selling driven by fear rather than fundamentals.

Pepe price analysis

On the weekly chart, Pepe coin price has formed a textbook multi-year head and shoulders pattern, with the neckline hovering near $0.0000070 and the head topping out around $0.000028. This structure is often viewed as a strong bearish reversal signal, especially if the price breaks below the neckline with confirmation from other indicators.

PEPE’s MACD line had crossed below the signal line when writing, which is a telltale sign that bearish momentum was gaining strength. Sellers assessing charts based on this signal may continue to apply pressure in the coming sessions.

Meanwhile, the RSI on the weekly timeframe was also heading downwards and had breached the neutral mark at 50, further reinforcing the bearish outlook among traders.

For now, the key support level to watch is at $0.0000070, which aligns with the 23.6% Fibonacci retracement. It stands 44% below the current price.

A clear break below this level, supported by rising trading volume, could open the doors for a deeper decline toward $0.0000040, particularly if overall market sentiment remains negative.

On the flip side, if bulls manage to defend the neckline and push prices higher, the first major resistance sits at $0.0000090. Decisively reclaiming that level could mark the end of the current downtrend and potentially signal an early shift in momentum in favor of buyers.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

Russian Central Bank Proposes Allowing Banks and Brokers to Obtain Crypto Licenses