BlackRock’s IB1T Goes Live in London — First-Hour Volume Hints at Growing UK Bitcoin Appetite

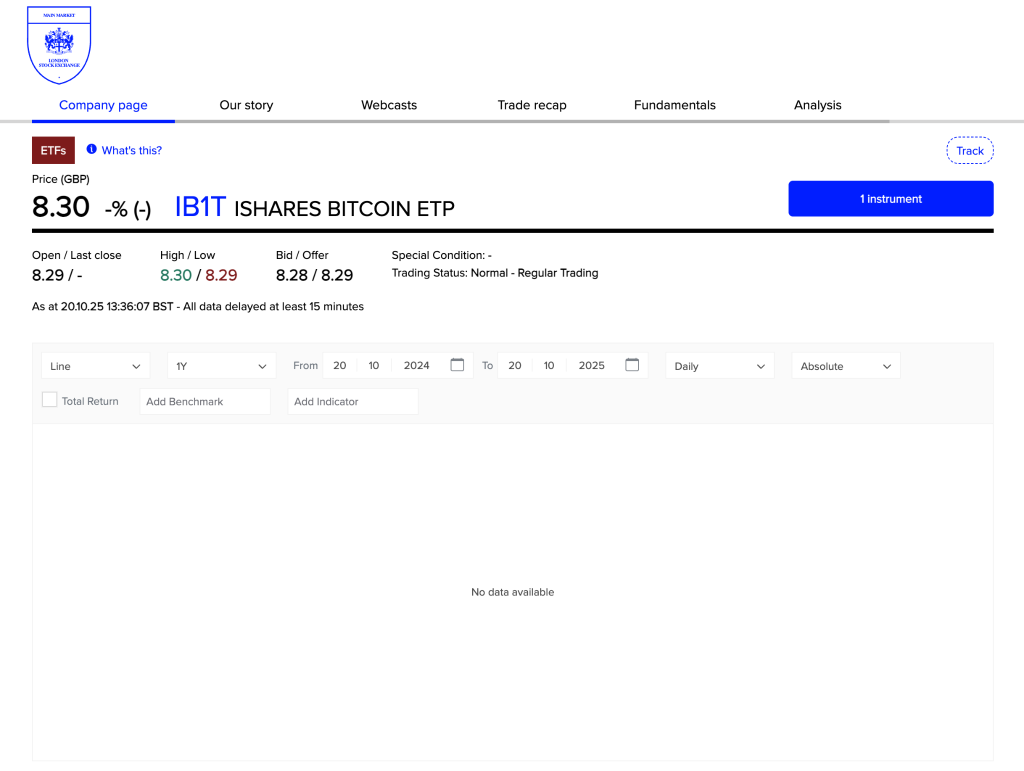

BlackRock’s long-awaited iShares Bitcoin ETP (IB1T) made its debut on the London Stock Exchange (LSE) on Monday, allowing the United Kingdom users to be exposed to retail assets.

Source: LSE

Source: LSE

The product allows retail investors to gain regulated exposure to Bitcoin without directly holding the asset. Notably, this is made possible by the Financial Conduct Authority’s (FCA) recent decision to lift its multi-year ban on crypto-based exchange-traded products.

Within its first hour of trading, the physically backed product custodied by Coinbase saw over 1,000 shares change hands, indicating a cautious but growing interest among UK investors in regulated Bitcoin exposure.

The launch comes amid institutional adoption for ETFs surging globally following the success of U.S. spot Bitcoin ETFs, which have collectively drawn billions in inflows since approval earlier this year.

The FCA’s August policy reversal effectively reopened the UK’s retail crypto investment market, which had been closed since 2021. For BlackRock, the world’s largest asset manager, the move shows confidence that British investors are ready for mainstream digital asset products.

BlackRock Surpasses $245M in Annual Fees as it Expands Bitcoin ETP Footprint with UK Launch

While early trading volume remains modest compared to U.S. figures, analysts say the launch is symbolically important. It positions London, which was once cautious toward digital assets, as a re-emerging hub for regulated crypto finance.

“IB1T’s debut is more than just another Bitcoin product,” said one market strategist. “It’s a signal that the UK is warming up to digital assets again, bridging traditional finance with the next generation of investment demand.”

With global spot Bitcoin ETF inflows surging and regulatory clarity improving, BlackRock’s London listing may mark the beginning of a new chapter for crypto participation in the UK, while also extending its footprint globally.

Notably, BlackRock’s iShares Bitcoin ETP (IB1T), which officially debuted today, was already listed across several European markets, including Germany’s Xetra, Euronext Amsterdam, and Euronext Paris, before making its UK debut.

While the IB1T launch is significant for both the UK crypto community and BlackRock itself, the launch comes as part of BlackRock’s broader global strategy to expand its digital asset offerings.

The firm, which manages over $13 trillion in assets, has enjoyed strong momentum in crypto markets since the success of its U.S.-listed iShares Bitcoin Trust (IBIT).

That fund, launched in early 2024, now holds $85.5 billion in net assets, making it the largest spot bitcoin ETF in the world, and has generated nearly $245 million in annual fees, surpassing long-established funds such as the iShares Russell 1000 Growth ETF and the iShares MSCI EAFE ETF.

According to Bloomberg ETF analyst Eric Balchunas, IBIT is on pace to become the fastest ETF in history to reach $100 billion in assets, potentially surpassing Vanguard’s S&P 500 index fund.

The momentum around IB1T’s London debut also reflects the growing institutional acceptance of Bitcoin as an asset class.

According to Bitbo data, Bitcoin ETPs now hold more than 1.35 million BTC, representing 6.47% of the cryptocurrency’s total supply.

UK Retail Investors Finally Get a Bitcoin ETP After FCA Lifts 3-Year Ban — More to Launch Soon?

The introduction of IB1T in London extends that momentum to Europe’s financial hub, arriving less than two weeks after the FCA formally lifted its ban on crypto exchange-traded notes (ETNs) and ETPs for retail investors.

The move ended restrictions imposed in 2021 when the regulator barred such products over concerns about volatility and fraud.

The FCA’s reversal, effective October 8, has been widely seen as a turning point for UK crypto policy. After years of caution, the regulator accelerated its review process this year, cutting approval times by nearly two-thirds.

The rollout of crypto ETPs on the LSE had faced short delays as the FCA and exchange finalized operational procedures, including discussions over whether to introduce a dedicated segment for retail-eligible crypto products.

With those issues now resolved, the arrival of IB1T marks the first time UK retail investors can access a regulated bitcoin ETP through the domestic exchange.

So what: The debut of IB1T indicates a shift in UK financial policy that could normalize crypto exposure within traditional portfolios and attract a new wave of institutional and retail interest.

Analysts say the move could pave the way for more issuers to enter the market, with London now positioning itself as Europe’s next crypto-financial hub.

Notably, other rivals like 21Shares and WisdomTree also launched similar bitcoin and ether ETPs for British clients, suggesting that competition and liquidity are about to heat up fast.

You May Also Like

The US dollar's share of global foreign exchange reserves has fallen below 60%.

Younger Americans Back Crypto Survey: Why Digitap ($TAP) is the Best Crypto Presale for the Next Generation