Brian Armstrong: Senate Close to Passing Crypto Market Structure Laws

- U.S. Senate is making significant strides toward passing cryptocurrency market structure legislation by Thanksgiving, with broad agreement on most issues.

- Legislators are narrowing their focus to matters like decentralized finance (DeFi) regulation and stablecoin consumer protections.

- Coinbase CEO Brian Armstrong emphasizes the importance of regulating centralized intermediaries, not the protocols themselves.

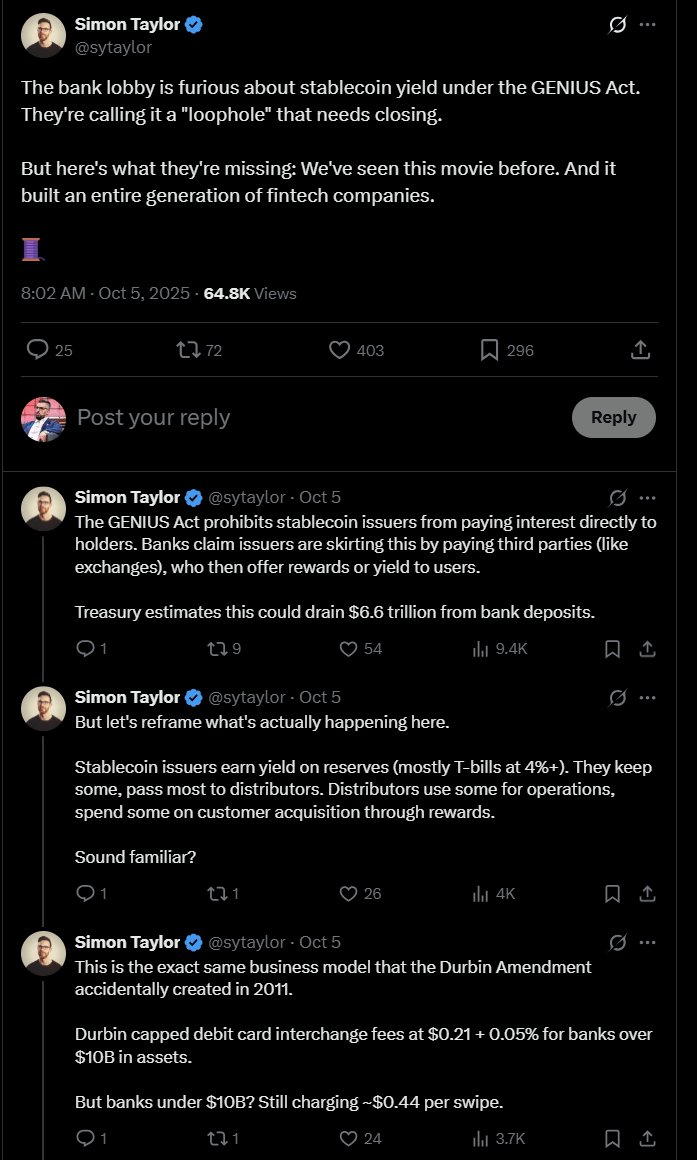

- Banking industry lobbyists oppose parts of the GENIUS Act, raising concerns over potential loopholes enabling interest payments to stablecoin users.

- Cryptocurrency advocates see stablecoins as a threat to traditional banking models, fueling ongoing regulatory debates.

Progress in U.S. Crypto Legislation as Senate Nears Consensus

Coinbase CEO Brian Armstrong has expressed confidence that U.S. lawmakers are nearing the passage of crucial cryptocurrency market legislation, targeting bipartisan support by Thanksgiving. Despite the federal government shutdown, the Senate continues to prioritize advancing blockchain and digital assets regulation, with approximately 90% of the framework already agreed upon. The remaining issues primarily concern decentralized finance, or DeFi, which policymakers aim to regulate without stifling innovation.

Armstrong highlighted that the focus now is to safeguard innovations like stablecoins, ensuring that centralized entities such as Coinbase are regulated, while protocols remain unencumbered. This approach aims to strike a balance between fostering growth and imposing consumer protections, an effort reflected in recent policies like the GENIUS Act, which set federal standards for stablecoins’ reserves and transparency.

“The government is working diligently on market structure legislation, even amidst broader shutdowns,” Armstrong said in a video on X. “Most of the details are settled, with only minor issues left. We expect progress soon.”

Banking Lobby Pushback and Stablecoin Regulation Concerns

While legislative progress is promising, resistance remains from the traditional banking sector. Lobbyists oppose parts of the GENIUS Act, especially the loophole that allows interest payments to stablecoin holders via exchanges, despite the act’s prohibition on stablecoins offering yields directly. The Bank Policy Institute (BPI) notes this gap allows crypto exchanges like Coinbase to effectively bypass the restrictions.

Source: Simon Taylor

Source: Simon Taylor

Industry insiders and academics, including New York University professor Austin Campbell, warn that banks are increasingly anxious about stablecoins offering yields, which could undermine the low-interest bank deposit model. This concern underscores ongoing debates over how best to regulate stablecoins within an evolving crypto financial ecosystem that is gaining ground.

As regulatory discussions intensify, the cryptocurrency sector remains vigilant, balancing innovation against traditional financial interests and the need for clear legal standards to foster sustainable growth in the digital asset markets.

This article was originally published as Brian Armstrong: Senate Close to Passing Crypto Market Structure Laws on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

White House Post Sends Solana Memecoin PENGUIN From $387K to $94M