Aster App Launches on iOS as Market Targets Possible Move Toward $3

- Aster App is now available on iOS, increasing accessibility and mobile trading convenience for users.

- ASTER shows potential to move toward the $3 level after strengthening price structure and market momentum.

The official Aster DEX app, the Aster App, is finally available on the iOS App Store. Previously, the app was available for download through the Google Play Store, allowing users to open, monitor, and trade directly from their mobile devices at any time.

Concurrently, discussions regarding the potential price of the ASTER token have also resurfaced. Price movements over the past few days have shown relatively stable performance.

As of press time, ASTER is changing hands at about $1.1723, up 1.20% in the last 4 hours and 3.54% in the last 24 hours. Intraday spot volume reached $147.08 million, while its market cap stood at $2.37 billion.

Furthermore, open interest reached $512.18 million, indicating strong interest in the derivatives market. Simply put, both short-term and long-term traders appear to be keeping a close eye on this token.

Aster DEX Growth Fueled by New Integrations and Listings

The Aster App’s entry into iOS has boosted community conversations. Users can now connect to Aster DEX more easily without relying on browsers or complicated access methods.

Furthermore, Aster also appears to be continuously adding new tokens to its platform, providing traders with more market choices.

A few days ago, CNF reported that Aster DEX introduced Rocket Launch, a liquidity support mechanism for early-stage crypto projects.

The inaugural campaign partnered with APRO Oracle, which included a reward pool that users could join to increase their participation. This model typically attracts community attention, as it provides new projects with a platform to gain exposure and early support.

Furthermore, the integration of Trust Wallet last September expanded Aster’s use for traders accustomed to using mobile wallets. Through this integration, users can perform perpetual trading with up to 100x leverage on over 100 markets.

Aster DEX also supports multi-chain, hidden orders, and various advanced trading tools. So, for those looking to remain in the decentralized space without sacrificing flexibility, this platform offers quite a lot of features.

Potential Breakout Targets Gain Attention from Traders

In addition to ecosystem developments, ASTER price projections have also emerged.

Analysis from VentureBurn predicts that if macroeconomic conditions are favorable, particularly regarding the potential interest rate cut by the Federal Reserve, crypto assets like ASTER could receive additional capital inflows.

However, the predictions are not just empty optimism. The report predicts ASTER to be around $1.18 in October 2025, rising to $1.58 in November, and $1.88 in December 2025.

In the first quarter of 2026, the potential price is said to be around $2.03, then $2.32 in the second quarter of 2026.

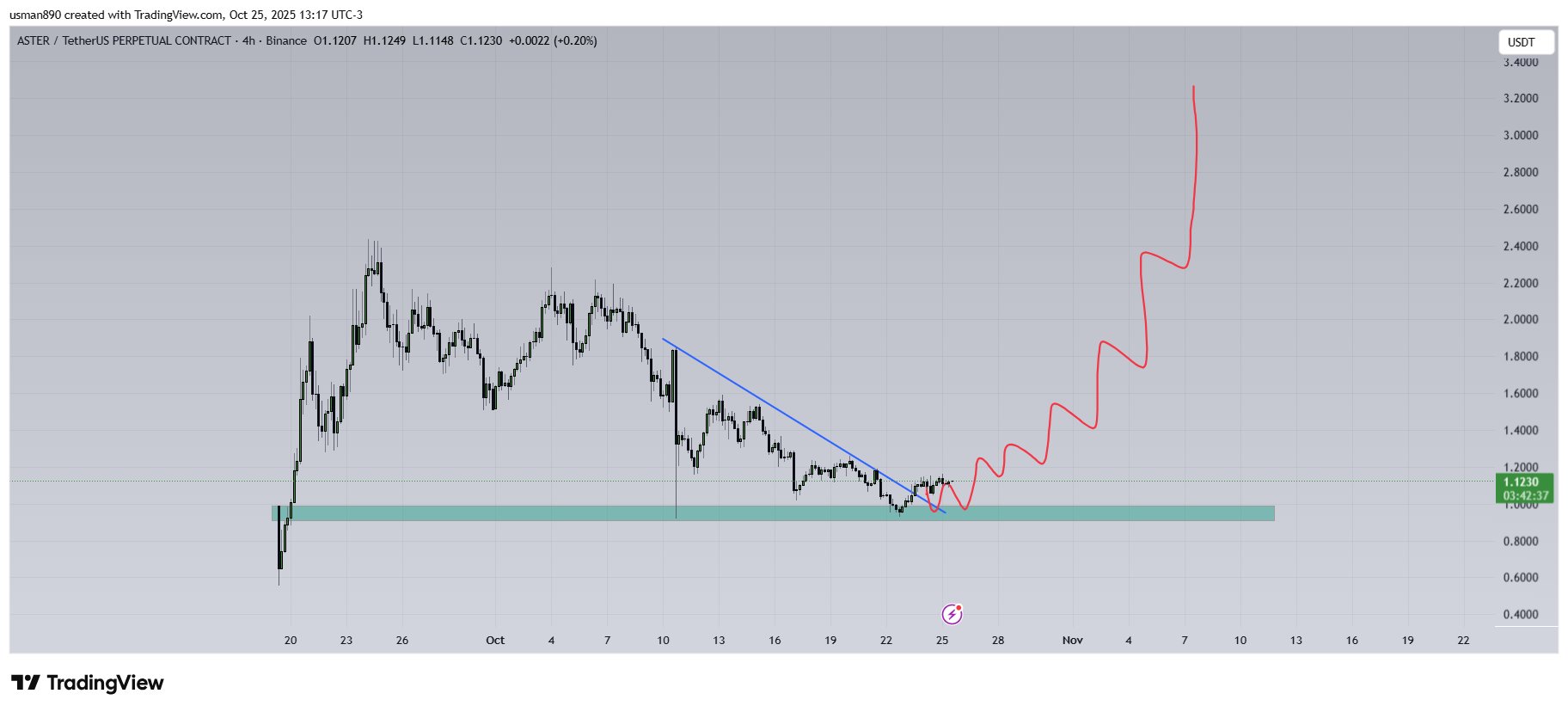

Furthermore, popular analyst KNIGHT observes that ASTER has bounced off a key support area and broken through a downtrend line. If this momentum is not broken, he believes ASTER has a chance to surpass the $3 level and set a new ATH.

Source: KNIGHT on X ]]>

Source: KNIGHT on X ]]>You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

Kraken's Big Hint: Pi Coin Set for Exchange Listing In 2026