Bitcoin Back at $115K: Technical Indicators Hint at Reversal, But Caution Persists

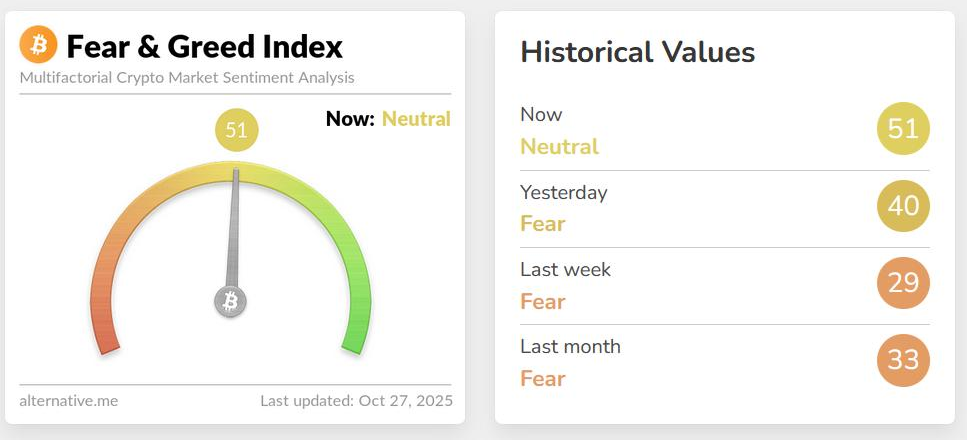

As Bitcoin's price surged back up to around $115,000 over the weekend, the Bitcoin Fear & Greed Index finally moved out of the "fear" zone and into neutral territory, marking the first change in the index in more than two weeks.

With a score of 51 out of 100, the Bitcoin Fear & Greed Index is currently situated in the "neutral" zone, indicating market mood.

There has been a marked change in attitude over the previous several days, as the score has climbed by 11 points from Saturday's cautious level of 40 and by over 20 points since last week.

Source: alternative.me

Source: alternative.me

Following Trump's announcement of 100 percent additional tariffs on China on October 10, the index experienced a decline from 71 to 24, reflecting a "greed" score, as a record $19 billion in crypto leveraged positions were liquidated.

According to data from analytics platform Glassnode, there has been a change in market sentiment recently, which has coincided with a significant drop in the selling pressure for Bitcoin (BTC).

As selling pressure and negative sentiment seem to have reached their pinnacle, Glassnode speculated in a recent X post that a trend reversal may be imminent.

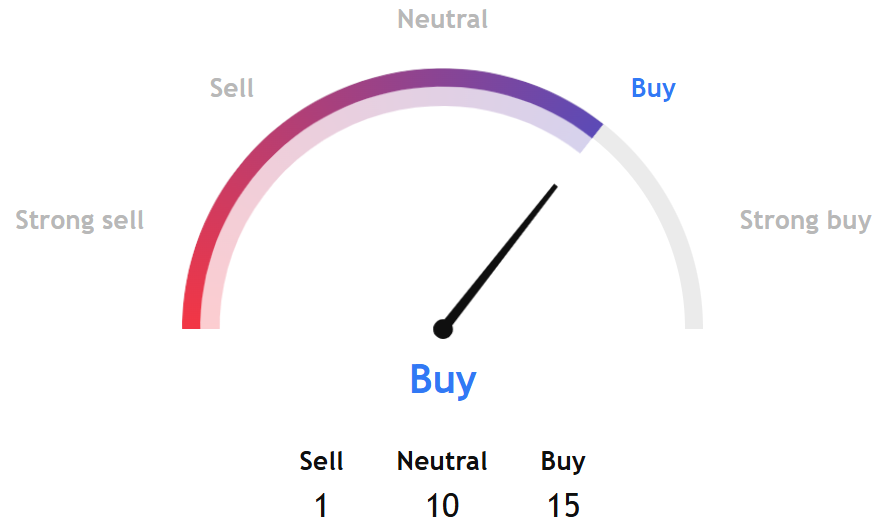

Separately, TradingView's Bitcoin technical gauge based on the summary of the most popular indicators, such as moving averages, oscillators, and pivots, gave a buy signal for the week ahead.

Source: TradingView

Source: TradingView

The trend of being neutral in the short term and a strong buy signal continued for the week ahead, according to the sub-technical indicators.

Source: TradingView

Source: TradingView

Can Bitcoin Run Up Further?

There have been a number of signs that have helped pinpoint when the Bitcoin bull market peaked throughout the years.

In previous cycles, when these indications have been active, it has been wise to get out of the market before a new bear market started.

However, even if Bitcoin's price reached multiple new all-time highs this time, the market peak has not been reached yet because none of the cycle peak indications have activated.

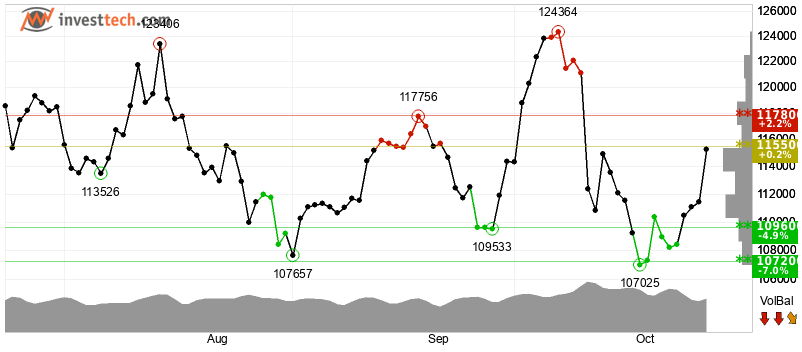

InvestTech's Algorithmic Overall Analysis gave a hold signal for Bitcoin.

The recommendation for one to six weeks was negative, according to InvestTech.

Source: InvestTech

Source: InvestTech

The firm said, "Bitcoin is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal."

InvestTech added: "The token is testing resistance at points $115,500. This could give a negative reaction, but an upward breakthrough above $115,500 means a positive signal. Negative volume balance weakens the currency in the short term. The currency is overall assessed as technically negative for the short term."

That was reflected in SoSoValue's data, which showed the Daily Total Net OI (Delta) was -$1.49 billion as of Oct 22.

You May Also Like

Tom Lee’s BitMine Hits 7-Month Stock Low as Ethereum Paper Losses Reach $8 Billion

Headwind Helps Best Wallet Token