Monad ICO loans 160M tokens to five market makers

Coinbase published a token sales disclosure for the Monad ICO that contains detailed information about its market maker operators and how many tokens are loaned to each firm.

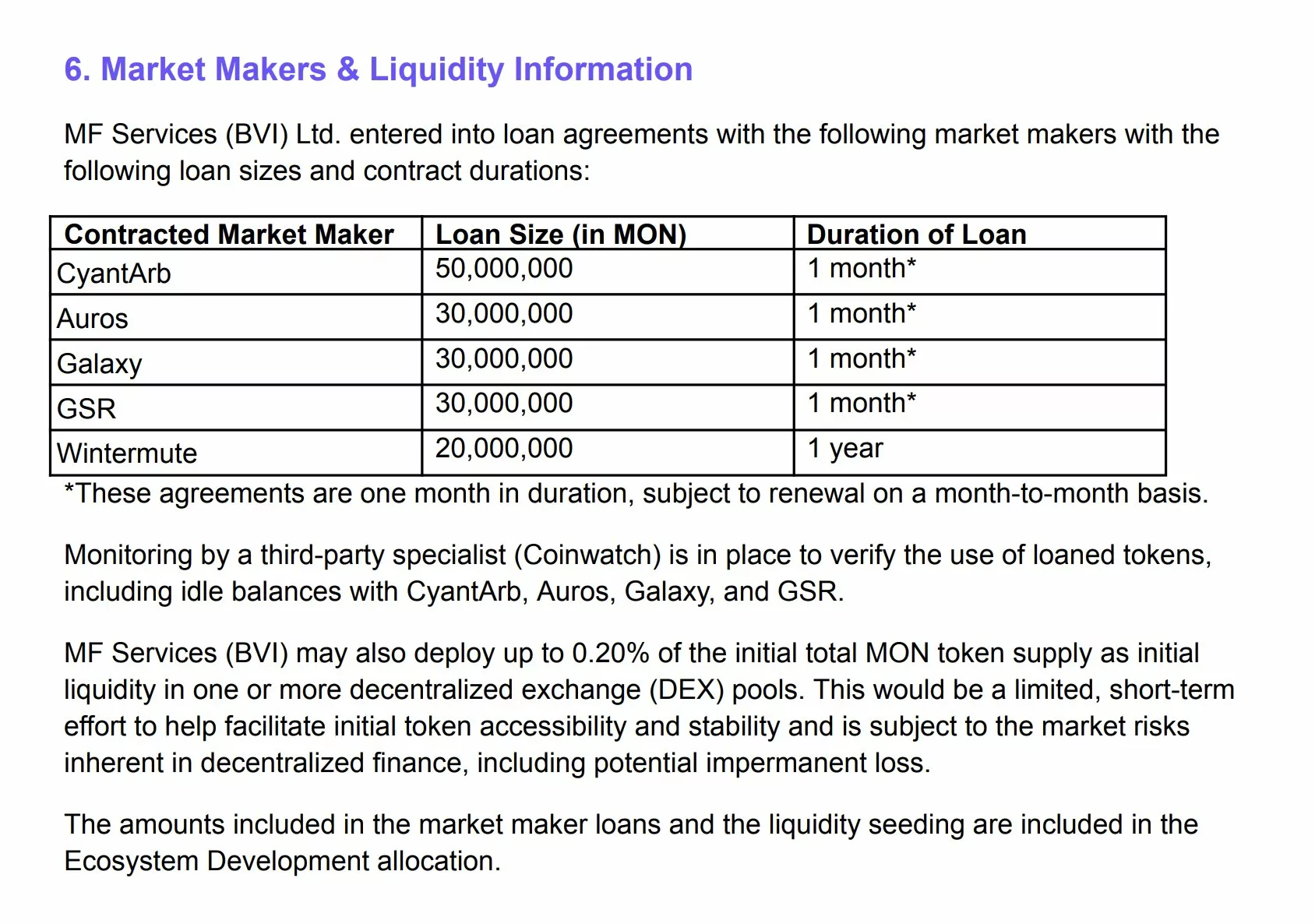

- Coinbase revealed full details about Monad’s market maker arrangements, involving Galaxy, GSR, Wintermute and others. The firms will collectively receive 160 million MON in short-term token loans.

- The Monad ICO, which takes places on Nov. 17, will offer up 7.5 billion MON at a starting price of $0.025. Around 27% of the token supply will be reserved for the team under a multi-year lockup scheme and 38.5% goes to ecosystem development.

Coinbase’s disclosure may be one of the first cases where a large institution fully discloses the list of market makers participating in the initial coin offering for Layer-1 EVM blockchain Monad. The document lays out not only the names of the five market makers involved, but also the scale of funds loaned to each firm and the duration period of each loan.

According to the document, the Monad Foundation subsidiary firm MF Services (BVI), Ltd. has signed token lending contracts with five market makers in the crypto space. The largest loan of MON tokens has been promised to CyantArb, amounting to 50 million MON which will be loaned to the firm for one month.

On the other hand, three market makers will receive a loan of 30 million MON for the duration of one month. These firms are Auros, Galaxy and GSR. Lastly, Wintermute will receive a loan of 20 million MON that it can hold for one year at most.

The total amount of tokens allocated to market makers is a combined 160 million MON, which according to its initial set market price of $0.025, will be worth around $4 million.

As stated in the document, the agreements with market makers can be renewed on a monthly basis. The contracts would be monitored by a third-party agency called Coinwatch, which will be responsible for verifying token usage and keeping track of idle balances of the five market makers listed.

In addition, MF Services plan to deploy up to 0.20% of the initial MON token supply for liquidity purposes into one or more decentralized exchange pools. Coinbase deems it a limited short-term effort to facilitate initial token access and stabilize its price in the event of increased market volatility.

Monad ICO to launch with $7.5B tokens on sale

The Monad ICO sale is scheduled to take place on Nov. 17 at 9:00 AM EST and it will end on Nov. 22 at 9:00 AM EST. In total, the project will allocate up to 7.5 billion MON for the token sale or around 7.5% of the initial total supply.

At press time, the project has determined a fixed price of $0.025 for each MON token in the Monad ICO. The market price was determined based on the implied fully diluted value of the Monad Network, which stands at $2.5 billion with an total supply of 100 billion MON tokens.

Based on the document, as much as 27% of the total token supply will be allocated to the team. Team token allocations are subject to both lock-up and vesting conditions. Individual vesting schedules last typically around 3-4 years and are tied to the date of initial involvement in the project.

The document stated that all team tokens will be locked for the first year following the launch of the Monad Public Mainnet and later released during the 1-year anniversary and over the next three years.

Meanwhile, 38.5% tokens will go to the development of the ecosystem. Unlike team tokens, this portion will be unlocked upon launch. Investors will receive up to 19.7%, while 4% will be set aside for the Category Labs treasury, formerly known as Monad Labs. Around 3.3 billion MON or around 3.3% of the initial total supply will go to the airdrop event targeting members of the Monad Community and the wider crypto community following the Monad ICO.

You May Also Like

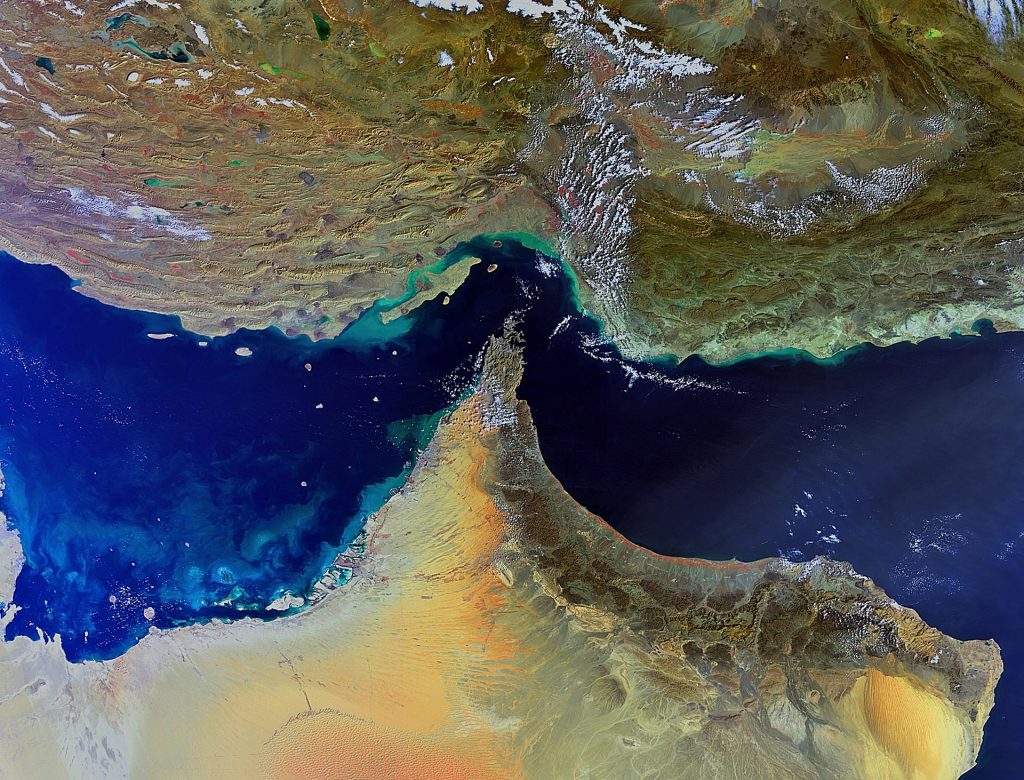

İran Hürmüz Boğazı’nı Kapatırsa Ne Olur? Verilerin Gösterdiği Tek Bir Şey Var!

TON Station Daily Combo 01 March 2026: Maximize Your $TONS Rewards Today