Why 2026 Could Be the Year of AI‑Powered Crypto Projects

Let’s pull up a chair and chat frankly about a theme that’s gaining serious steam: the intersection of artificial intelligence (AI) and crypto. If you’re in the digital assets space – or if you’re simply curious about where things are headed – this one’s worth your attention. Because, in my view, 2026 could very well be the breakout year for AI‑powered crypto projects.

What’s changing?

1. The market is shifting from hype to utility

The past few years in crypto have been wild – hype, narratives, moonshots. But 2026 looks set to mark a shift toward substance over spectacle. Investors and analysts are now focusing on projects that deliver real-world utility, strong technology, and sustainable growth, rather than just riding speculative waves. This change signals a new phase where fundamentals finally take center stage in the crypto market.

That matters for AI crypto because AI + blockchain isn’t just flashy – it can deliver tangible solutions: better data, smarter networks, more efficient markets.

2. AI meets blockchain – for real

We’re no longer just talking about “AI this” or “blockchain that” as buzzwords. There is real momentum:

- Reports highlight a growing “AI crypto” sector, with tokens such as Fetch.ai (FET), Ocean Protocol (OCEAN), and Render Token (RENDER) already leading in this space.

- One analysis points out that the “AI‑driven blockchain sector grows to $25 billion market cap by mid‑2025… supported by institutional adoption and ethical AI clarity.”

- Additionally, 2026 predictions emphasise deeper integration of crypto with AI, IoT, infrastructure, and new asset classes (like real‑world assets) that lean on intelligent systems.

Even mainstream presale analyses note that early AI and crypto integrations are being watched closely: Another Presale Bubble? Not if You’re Watching IPO Genie

In short, the building blocks are in place. The question is: will 2026 be when it all starts to click?

Why the “AI crypto” wave could crest in 2026

Let’s zoom in on three big reasons why this specific year might mark an inflection point.

Theme 1: Scalability & infrastructure readiness

Until now, one of the hurdles for blockchain + AI has been infrastructure: lots of data, heavy computing, and decentralisation challenges. But that is changing:

- Decentralised compute models (e.g., tokenised GPU sharing) are gaining traction. Render Token is one example of a project bridging GPU resources with blockchain.

- Data marketplaces (e.g., Ocean Protocol) are making datasets accessible and monetisable – a key component for AI systems.

- Trend analysis highlights that 2026 may finally see “advanced security measures, including AI‑driven threat detection and multi‑party computation” become mainstream in crypto.

All of this means: the tech seams are being sewn. The foundation is getting stronger. In 2026, that may translate to more deployment, not just prototypes.

Theme 2: Real‑world use cases & token utility

Here’s where things get persuasive: the projects that survive and thrive tend to solve real problems. In the “ai crypto” space, the opportunity is huge:

- Automated agents trading, optimising, learning (thanks to AI), and settled on blockchain rails.

- Decentralised networks of compute and data where tokens have meaningful utility (e.g., paying for a service, staking, governance, sharing value).

- Projects already highlighted for 2026 are evaluated on factors such as technology & use case, market adoption, token utility, and team/partnerships.

When utility meets demand (especially enterprise demand), that’s when crypto exits “niche experiment” mode and enters “industry tool” mode.

Theme 3: Narrative & investor rotation

Investors follow stories, and stories help capital flow. We may be entering a narrative shift:

- From “degen memecoins” to “AI‑driven blockchain infrastructure.”

- From “get rich quick” to “build sustainable systems.”

- From “hype first” to “functionality matters.”

Some coverage argues that 2026 will be the year where crypto’s narrative is no longer just about speculative price moves, but a value proposition. If AI‑crypto becomes the narrative of that moment, capital may rotate into that theme strongly, meaning early movers who are credible could benefit.

What this means for you (and me)

So, you might be thinking: “Great, but what do I do with this?” Here are some conversational takeaways.

For the investor/watcher

- Do your homework: Not every token with “AI” in the name is meaningful. Fundamentals still count. Check: real use case, real team, token utility, ecosystem traction.

- Time horizon matters: 2026 isn’t “tomorrow morning,” but it’s close. If you’re trying to squeeze quick wins without risk, that’s tough. If you’re willing to position for the next wave, that’s where opportunity lies.

- Risk remains high: Technology adoption globally, regulatory frameworks, token economics – all of these can trip even the best “AI crypto” story.

- Narrative change is powerful: If you believe that money will chase AI + blockchain as the next big theme, then being early is meaningful. But keep sober: the story must match substance.

For the project or founder

If you’re building (or considering building) something in this space, here’s what I’d emphasise:

- Lean into AI + blockchain synergy: Show how you combine data / compute / decentralised network aspects.

- Focus on token utility: Use case, governance, incentives – tokens must have logic, not just “we’re launching a token.”

- Demonstrate partnerships & traction: Enterprise adoption, developer ecosystem, measurable metrics.

- Prepare for 2026: The next wave may reward those ready. Don’t wait until everyone else is already flying.

Common questions & caveats

- Is AI crypto just hype? Sure, some projects are riding branding. But there are real examples with substance (see Fetch.ai, Ocean Protocol, Render, and IPO Genie). The key is filtering the signal from the noise.

- Will everything labelled “AI crypto” succeed? Absolutely not. This is still a high-risk space. Execution matters.

- What about regulation & security? These are important. AI + blockchain introduces complexity. Security and privacy (AI-driven) are big themes in 2026.

- What if we don’t hit 2026 as a landmark year? Even if it doesn’t pop in 2026, the groundwork suggests the mid‑2020s are a meaningful window for AI‑crypto growth.

The take‑home: Why 2026 feels different

Put simply: if you believe that AI is the next major technological wave, and that blockchain is increasingly capable of supporting serious infrastructure, then the confluence of both creates a compelling narrative. Couple that with market context (institutional flows, narrative shifts, infrastructure maturing) and you get a setting where 2026 becomes the stage for AI‑crypto to step into the spotlight.

If I were to summarise in one line:

2026 might be the year when “AI crypto” moves from niche experiment to real‑world tool – and the projects ready for that shift could lead the next growth wave.

Disclaimer: This article is for informational purposes only. Cryptocurrency investments carry risk. Always verify project details through official sources before joining any presale.

FAQs:

1. What makes 2026 the year for AI-powered crypto projects?

Think of it as a perfect storm. This is the time of Technology – Decentralized Computing, AI-fueled Networks & Tokenized Data Marketplaces. There is a movement among investors and institutions from speculative bets to work that has utility and is sustainable. 2026 might be the tipping point that takes AI crypto from niche experiments to real-world adoption. If you haven’t been waiting for another reason to pay attention, it might be it.

2. How do I know which AI crypto projects are worth my time?

Not every token that contains “AI” in its name is a winner-far from it. The key is for you to prioritize fundamentals:

- Real use case – Is the project tackling a real problem?

- Token utility – Is the token actually used for staking, governance, or accessing services?

- Ecosystem traction – Are developers, partners, and users actively engaging?

It will be those projects that meet these criteria that are expected to ride the AI + blockchain wave in 2026 rather than fizzling out like so many past hype coins.

3. Isn’t AI crypto still risky?

Of course – it’s no sugarcoating it. Outcomes vary by regulatory shifts, tech adoption, and market sentiment. But here’s the thing: high risk is frequently accompanied by high opportunity. When handled with the right research, patience, and focus on credible projects, you could take advantage of the next trend in crypto investing. Think of it as early access to a market with potential for major transformation, as opposed to a gamble on a viral meme coin.

The post Why 2026 Could Be the Year of AI‑Powered Crypto Projects appeared first on Blockonomi.

You May Also Like

The author of "Rich Dad Poor Dad" responds to criticism: He will continue to increase his holdings of Bitcoin and gold; investors should focus on asset value.

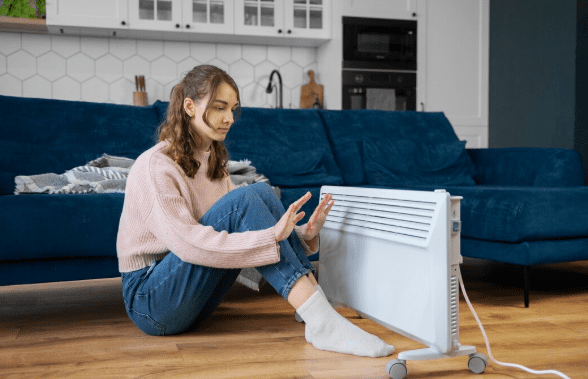

Space Heaters Explained: How They Work and When to Use Them