Bitcoin Price Jumps Near $94,000 After Sub-$90,000 Dip

Bitcoin Magazine

Bitcoin Price Jumps Near $94,000 After Sub-$90,000 Dip

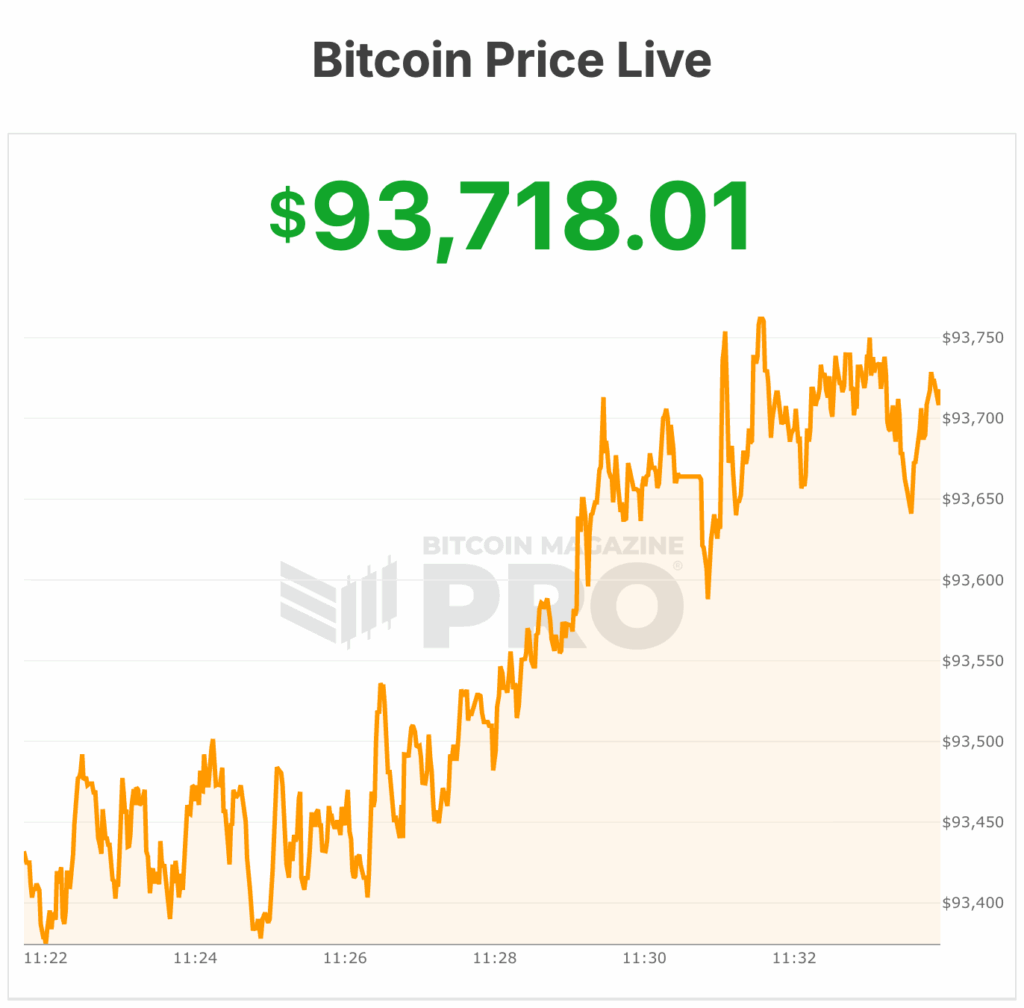

Bitcoin price briefly dipped below $90,000 overnight on Tuesday, its lowest level since April 22, before recovering to trade above $93,500 this morning.

Currently, the Bitcoin price is trading at $93,794, semi-unchanged in the past 24 hours, with a $124 billion trading volume. It sits 1% below its 7-day high of $94,212 and 5% above its 7-day low of $89,188, with a market cap of $1.86 trillion, according to Bitcoin Magazine Pro data.

Over 19.95 million BTC have now been mined, exceeding 95% of the 21 million maximum supply, and new coins are issued through mining, which slows over time due to halving events every four years. The final fractions of Bitcoin are expected to be mined around 2140, completing its fixed supply.

Earlier in the session, the bitcoin price briefly touched $89,180. For 2025, the cryptocurrency is now down about 2%.

Bitcoin price’s dubious future

Bitcoin price has fallen sharply below key support levels according to Bitcoin Magazine analysis, closing below $94,290 and erasing gains for 2025. The drops below the $96,000 weekly support signaled strong bearish sentiment, with bears firmly in control and the potential for further downside.

Immediate support lies near the 0.382 Fibonacci retracement and the $83,000–$84,000 high-volume node, followed by the 2024 consolidation zone around $69,000–$72,000.

Resistance for the bitcoin price is now thick above $94,000, with key levels at $98,000, $101,000, $106,000–$109,000, and $114,000–$116,000, making any sustained rally really challenging.

Technical patterns, including the broadening wedge, offer minimal hope for bulls. Even if a short-term bounce occurs, it is likely to stall below $106,000 and eventually roll over to new lows. Bitcoin has declined over 25% from October highs, and the four-year cycle high appears to have already passed.

While a late cycle peak in early 2026 is possible, current market weakness and strong overhead resistance make a meaningful rally improbable, according to Bitcoin Magazine Pro analysis.

Overall, with major support broken, multiple resistance levels overhead, and bearish momentum prevailing, Bitcoin price’s near-term outlook remains extremely negative, and any price recovery is likely to be limited and short-lived.

Tech and stock sell-offs

Tech investors’ sell-offs have closely mirrored crypto declines. The Nasdaq-100, heavily weighted toward large tech companies, is down roughly 4% this month.

Mike O’Rourke, chief market strategist at Jones Trading, called the correlation between Bitcoin and tech-stock losses “undeniable,” noting that the $1.8 trillion crypto market has been influencing the $32 trillion equity market.

Companies tied to crypto have also suffered. Strategy (MSTR), which leverages Bitcoin, is down roughly 27% for November. MSTR is up 8% today.

Shares of Robinhood Markets, buoyed earlier by crypto trading, have fallen 21%, while Coinbase Global has dropped roughly 23%.

Global stock markets are reflecting similar caution. The S&P 500 has slid nearly 3%, Germany’s DAX is down almost the same, and Japan’s Nikkei 225 has fallen 7%. Europe’s Stoxx 600 lost 1.2%, while the UK’s FTSE 100 fell 1.2% for a fourth consecutive day.

The AI sector, a driver of tech enthusiasm, has also rattled investors. Nvidia, the poster child for AI hype, dropped 9% after reaching a $4 trillion market valuation earlier this year.

Alphabet CEO Sundar Pichai warned of “irrationality” in AI markets and cautioned that no company would be immune if the AI bubble bursts. Klarna CEO Sebastian Siemiatkowski voiced concerns about the scale of investments in computing infrastructure and datacenters, noting that huge amounts of money are being allocated to AI without careful consideration.

Despite the market dip, El Salvador kept aggressively accumulating Bitcoin. The country purchased 1,091 BTC recently, bringing its total holdings to 7,474.37 BTC valued at around $688 million.

At the time of writing, the Bitcoin price is $93,718.

This post Bitcoin Price Jumps Near $94,000 After Sub-$90,000 Dip first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Michigan’s Stalled Reserve Bill Advances After 7 Months

DeFi Leaders Raise Alarm Over Market Structure Bill’s Shaky Future