PEPE’s 20% Weekly Crash Gets Worse as Crucial Support Breaks Down

PEPE is trading near $0.00000485 after falling through a key support level. The token is down over 17% on the week, as it dipped to multi-month lows.

Meanwhile, the move has drawn attention from traders watching whether a deeper drop is ahead or if a base is forming.

Key Level Break Signals Pressure

Analyst Crypto Patel noted that the $0.0000059 support has broken and is now acting as resistance. He describes this shift as a warning that the larger trend still favors sellers.

Patel also points to a weekly Fair Value Gap (FVG) that remains partially filled, along with a sweep of liquidity under multi-month lows. These conditions, according to his chart, suggest that further downside could take the price toward the $0.00000178 zone. He refers to this area as a likely point of interest for longer-term buyers.

Source: Crypto Patel/X

Source: Crypto Patel/X

Moreover, Patel’s chart compares the current setup to one seen before PEPE’s last major rally. In that case, the price broke down, consolidated, then launched into a sharp move higher. The previous breakout delivered gains of over 4,600%. He notes that the same setup could return, but only if the price dips into support and then reclaims lost ground. A move back above $0.0000059 would mark a shift in structure.

As CryptoPotato reported earlier this month, PEPE also broke below neckline support, confirming a head-and-shoulders pattern, aligning with the bearish structure.

Trend Remains Weak on Indicators

The price remains below the 20-, 50-, 100-, and 200-day exponential moving averages. All of these are trending lower. That signals weakness across the daily time frame. Unless PEPE can close above those levels, the bias stays to the downside.

Source: TradingView

Source: TradingView

In addition, the MACD lines are still below the zero mark and moving sideways. There’s no sign yet of momentum turning. Volume and volatility also appear to be dropping, adding to the view that buyers are staying on the sidelines for now.

Speculation Drops as Interest Fades

Futures open interest has dropped to $193.5 million, down from over $1 billion in mid-2023, based on CoinGlass data. The sharp decline suggests fewer traders are using leverage. This can mean less volatility but also reflects a market that’s cooling off.

Spot exchange data supports the same view. Netflows have mostly been negative, showing that more tokens are leaving exchanges than coming in. This often points to holding behavior, but the steady drop in price shows demand hasn’t kept up. In recent weeks, both netflows and price action have flattened, signaling a pause in activity.

Source: CoinGlass

Source: CoinGlass

The post PEPE’s 20% Weekly Crash Gets Worse as Crucial Support Breaks Down appeared first on CryptoPotato.

You May Also Like

Yango taps Flutterwave for cashless taxi, food delivery payments in Zambia

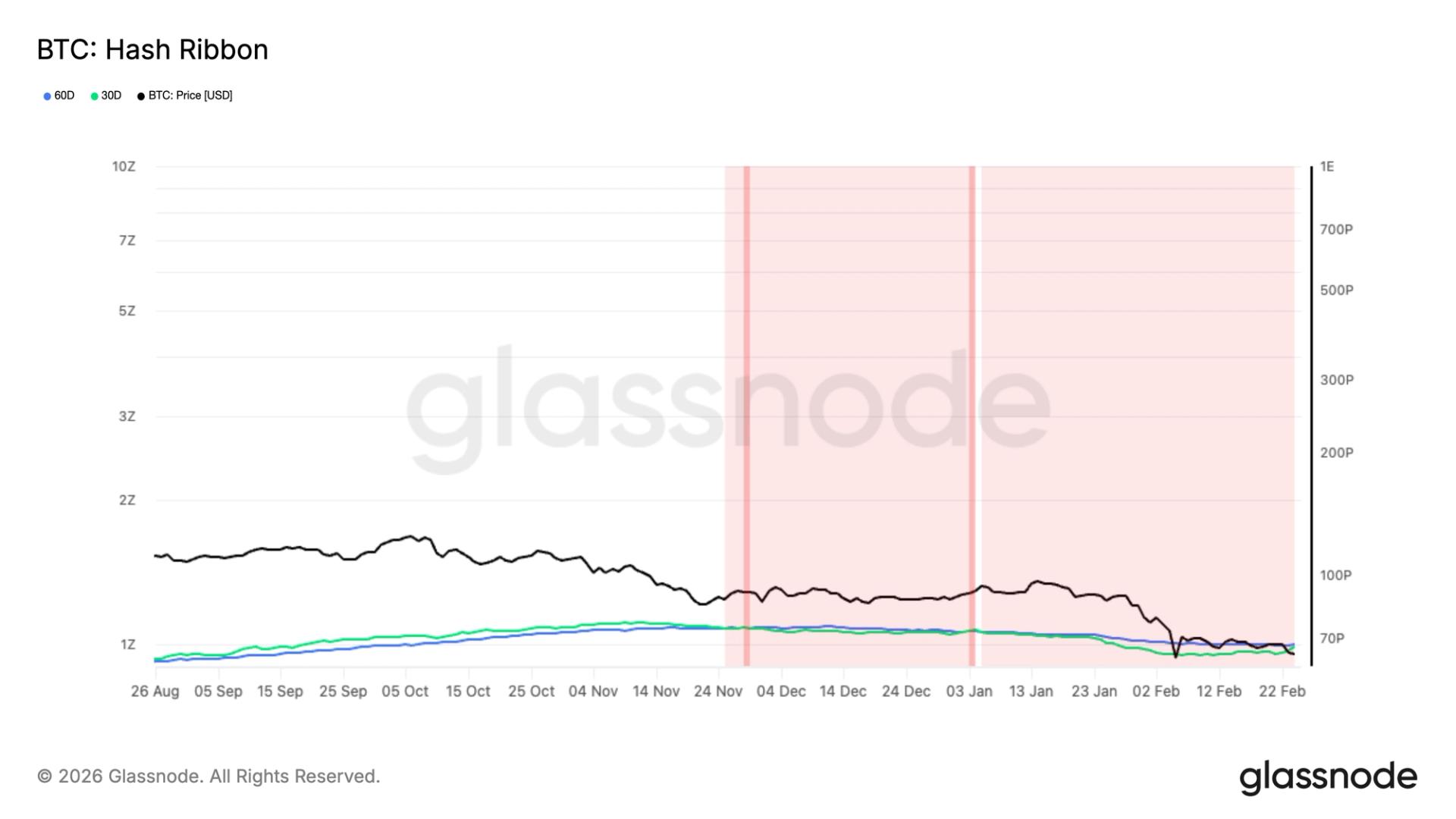

One of longest mining capitulations nears end, signaling potential BTC price bottom

Copy linkX (Twitter)LinkedInFacebookEmail