What a violent rollercoaster of a day has been for BTC.What a violent rollercoaster of a day has been for BTC.

BTC Rebounds $3K in a Flash Thanks to Fresh Fed Rate Cut Optimism

The massive volatility in the cryptocurrency markets continues, as bitcoin rebounded by over three grand after plunging below $81,000 to mark a new seven-month low just an hour ago.

The most evident reason behind this immediate increase is related to the US Federal Reserve. The President of the New York branch, John Williams, brought some hope back on the rate cut horizon, indicating that the central bank can indeed lower them “in the near term.”

Although he admitted that inflation progress has “temporarily stalled,” he believes there’s a way for the Fed to lower the rates again soon and also aim for the 2% long-term goal.

His remarks came after reports claiming that the central bank might not lower the rates during its December meeting, due to the delayed economic data for October and November.

US Fed Rate Decision on Polymarket

US Fed Rate Decision on Polymarket

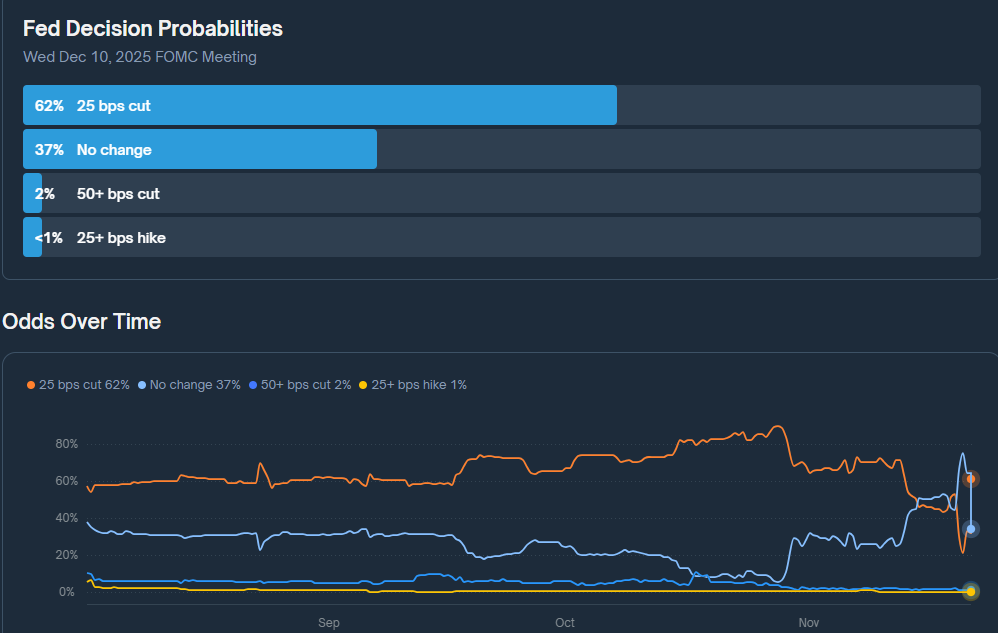

The odds on Polymarket also displayed the recent changes, as the no-rate-cut option had skyrocketed to over 60% in the past few days. However, the roles reversed after Williams’ speech, and now the 25 bps cut option is up to 62%.

Bitcoin also priced in his words immediately, going from its multi-month low of $80,600 to $84,000 in minutes, where it faced some resistance. Nevertheless, the asset has been falling hard for the past few weeks, going from over $107,000 on November 11 to the aforementioned low of under $81,000.

The post BTC Rebounds $3K in a Flash Thanks to Fresh Fed Rate Cut Optimism appeared first on CryptoPotato.

Market Opportunity

Bitcoin Price(BTC)

$95,449.46

$95,449.46$95,449.46

USD

Bitcoin (BTC) Live Price Chart

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

ASML Stock Gains 7% After BofA Raises Price Target on Intel Partnership News

TLDR BofA Securities raised ASML price target to €941 from €724 with Buy rating after Nvidia announced $5 billion Intel partnership ASML stock gained 7% as investors see the Nvidia-Intel deal boosting demand for semiconductor manufacturing equipment Bank of America believes a more competitive Intel will drive positive results for semiconductor equipment companies like ASML [...] The post ASML Stock Gains 7% After BofA Raises Price Target on Intel Partnership News appeared first on CoinCentral.

Share

Coincentral2025/09/21 20:47

Saylor Defends Bitcoin Treasury Firms Amid Rising Criticism

Strategy chairman Michael Saylor pushed back on critics who say companies that hold Bitcoin are reckless. He told a podcast that buying Bitcoin should be seen as

Share

NewsBTC2026/01/18 00:30

October Leverage Reset No Longer Pressures Crypto Prices, Grayscale Says

Crypto markets appear to have moved past the leverage-driven stress seen in October, according to asset manager Grayscale. Recent research shared by the firm suggests

Share

Coinstats2026/01/18 00:05